There is little information on which banks foreigners in Germany like to use and what features are most important to them.

So, we decided to do our own research. We reached out to our community with a banking survey and got 369 replies.

We wanted to confirm if the content we’ve been producing for Simple Germany since 2020 aligns with the needs of the international community in Germany.

We are happy that most of our assumptions were right. We also learned new insights that will help us do better research for our audience.

Let’s explore.

Key Takeaways from the Survey

Here is a summary of the most interesting findings of our banking survey:

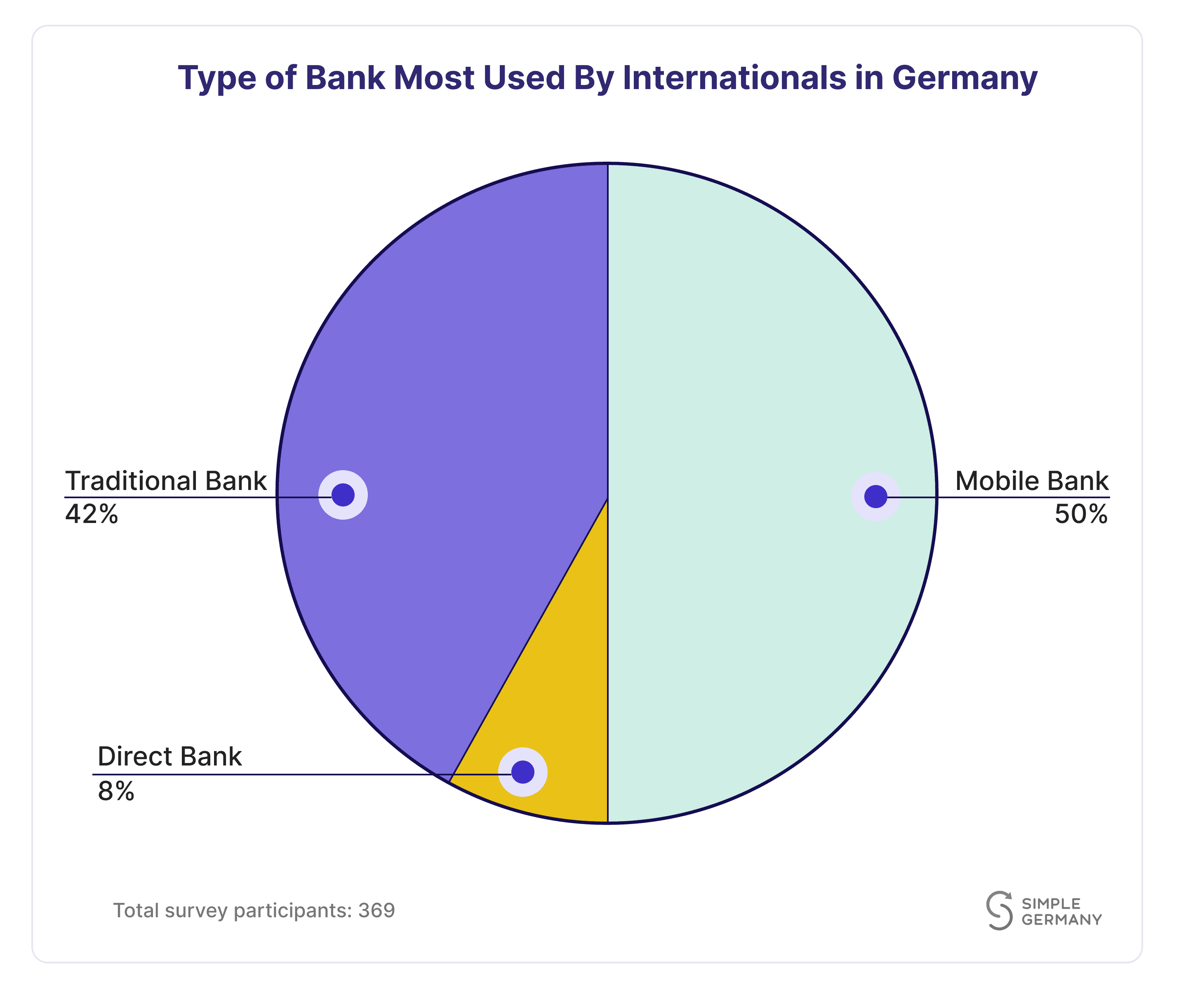

🏦 We found that only 42% of internationals have a traditional German bank account. The majority prefer to go with a mobile bank.

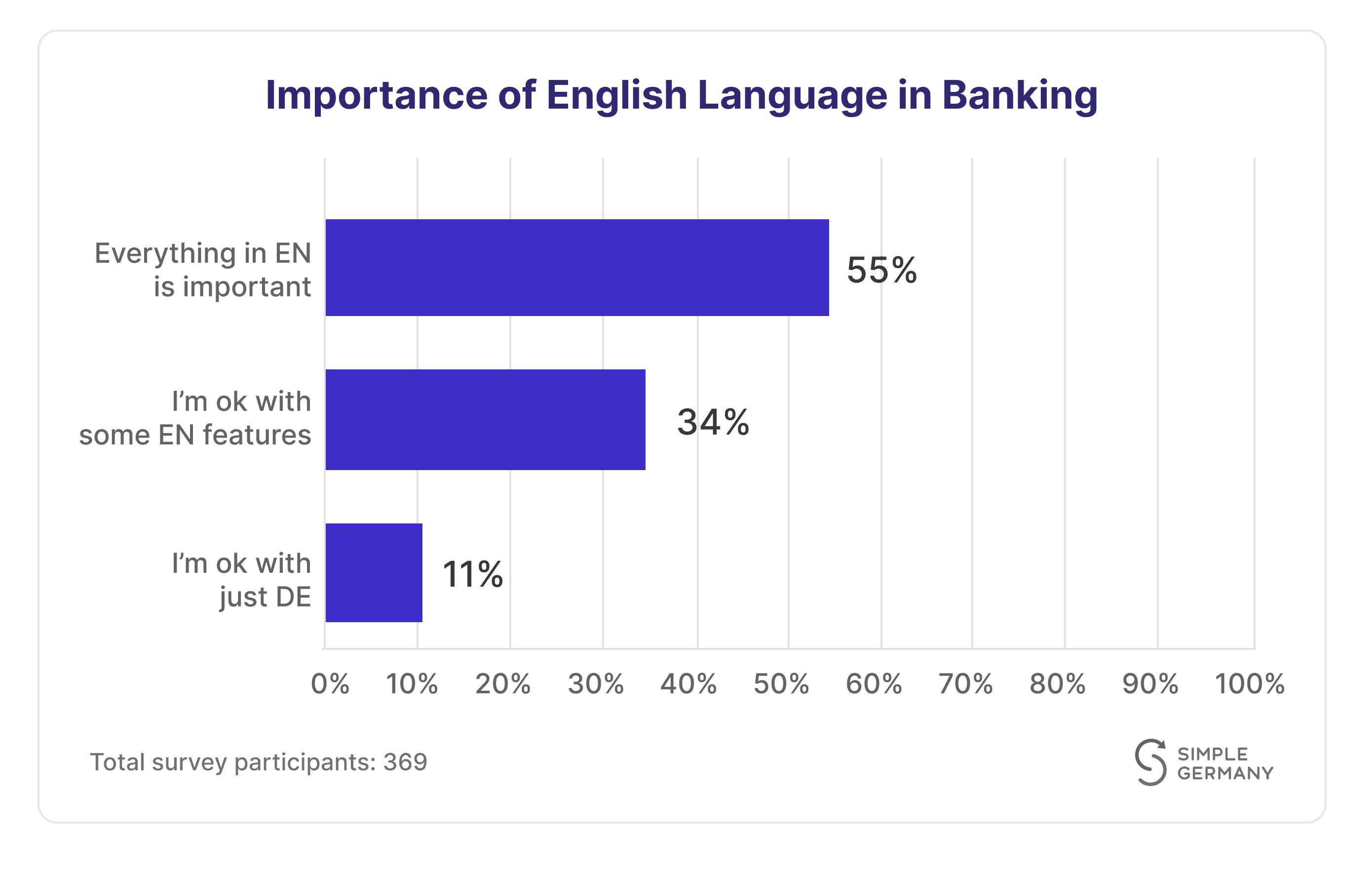

💬 90% of respondents confirmed that English is an important feature they look for in a bank. 55% said they like everything to be in English. While 35% said they are ok with having some features in English.

🇩🇪 89% of respondents have a bank account with a German IBAN.

🔥 N26 is the most popular bank amongst internationals in Germany, with 39% of our participants having an account with them. It’s no surprise since N26 is a very user-friendly mobile bank in English.

✍️ 52% of internationals only have one bank account.

💎 The majority of internationals with two bank accounts will combine the services of N26 and Commerzbank.

🙅♀️ 73% of internationals want to have a free bank account. They don’t want to pay for a monthly service fee.

💶 Cash is important in Germany; our survey showed that most internationals withdraw cash 1 to 3 times a month. 96% of the cash withdrawals are done through an ATM.

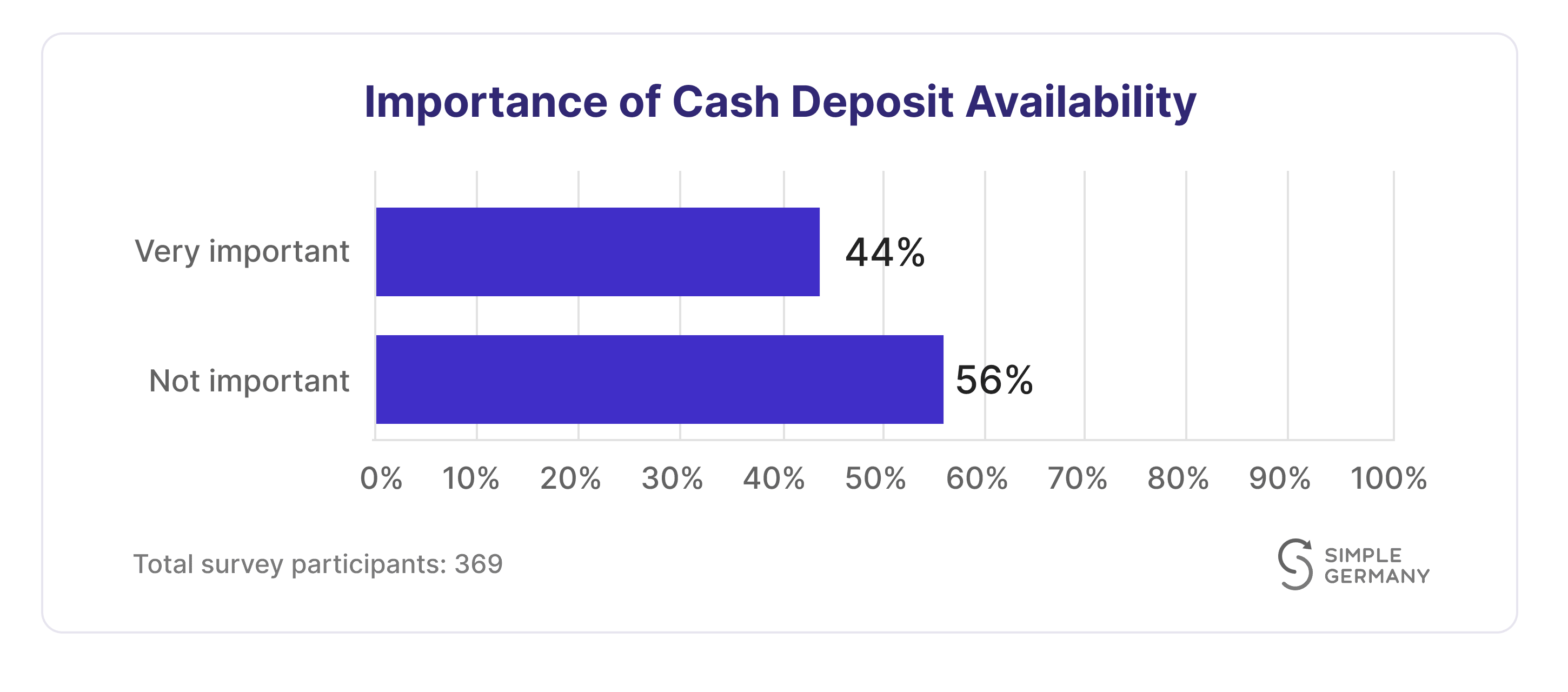

👀 We did not expect to find that 44% of internationals want the ability to deposit cash into their bank account.

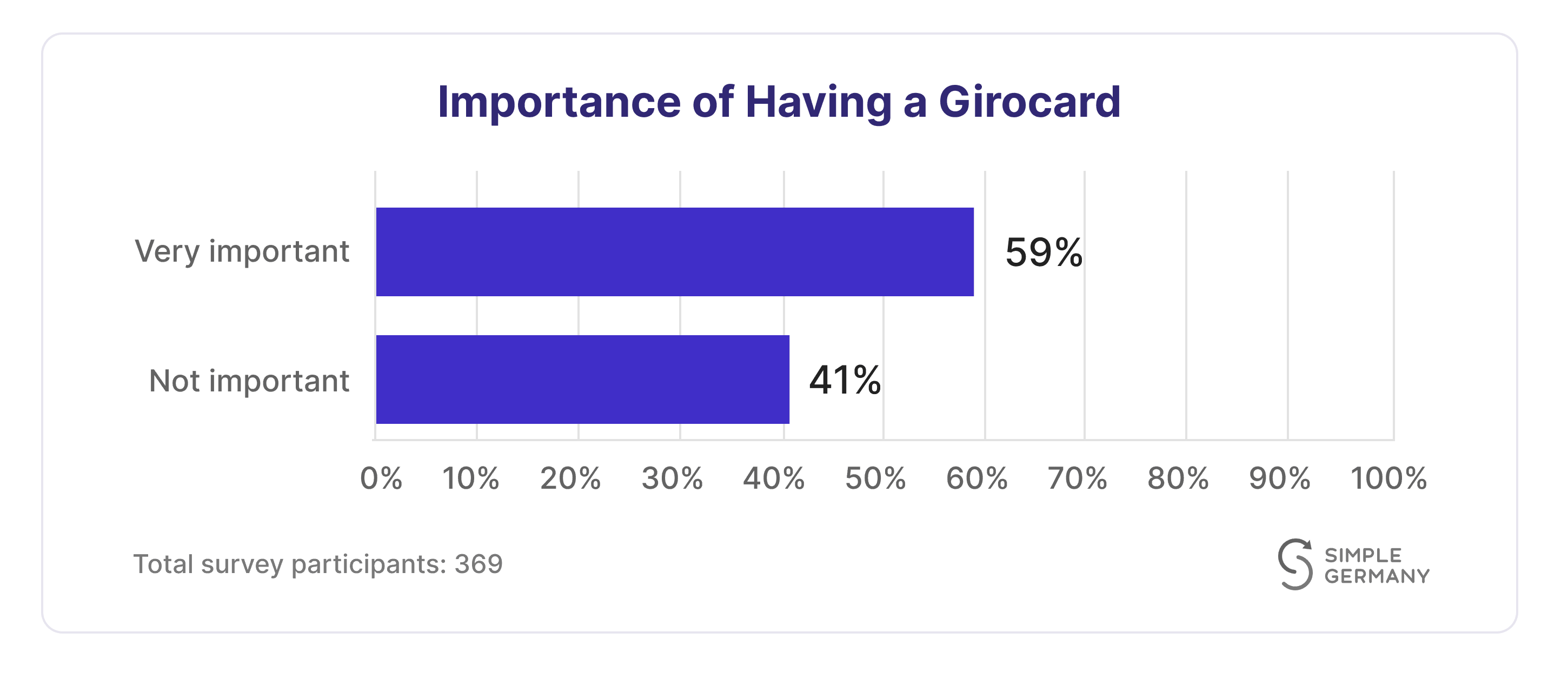

💳 59% of internationals find having a Girocard important. Surprisingly, 41% said they have been ok without one.

About this Survey

We surveyed 369 internationals living in Germany about their banking preferences. We received responses from 82 nationalities!

We sent out the survey to our confirmed newsletter subscribers.

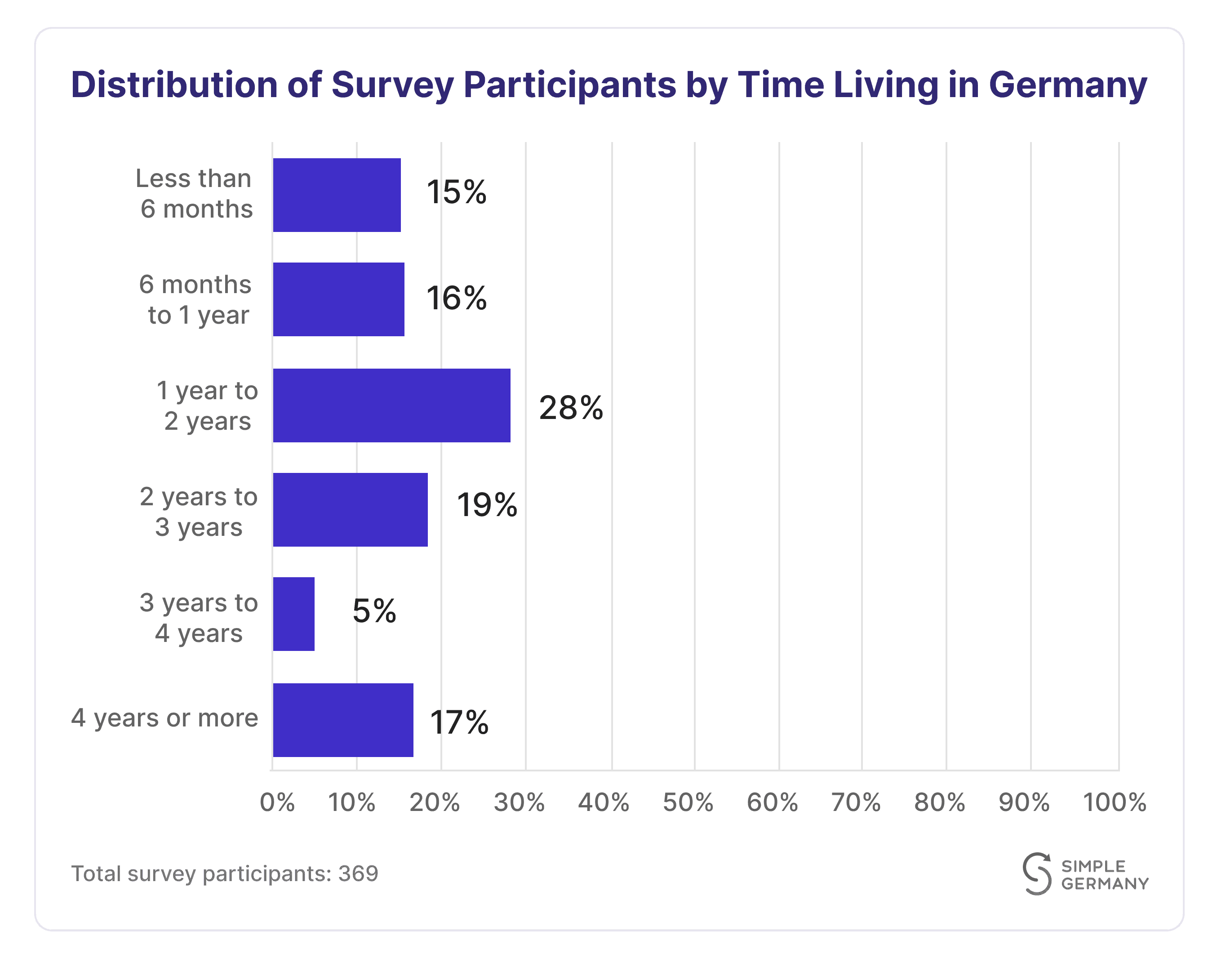

Most of our respondents have lived in Germany for 1 to 2 years.

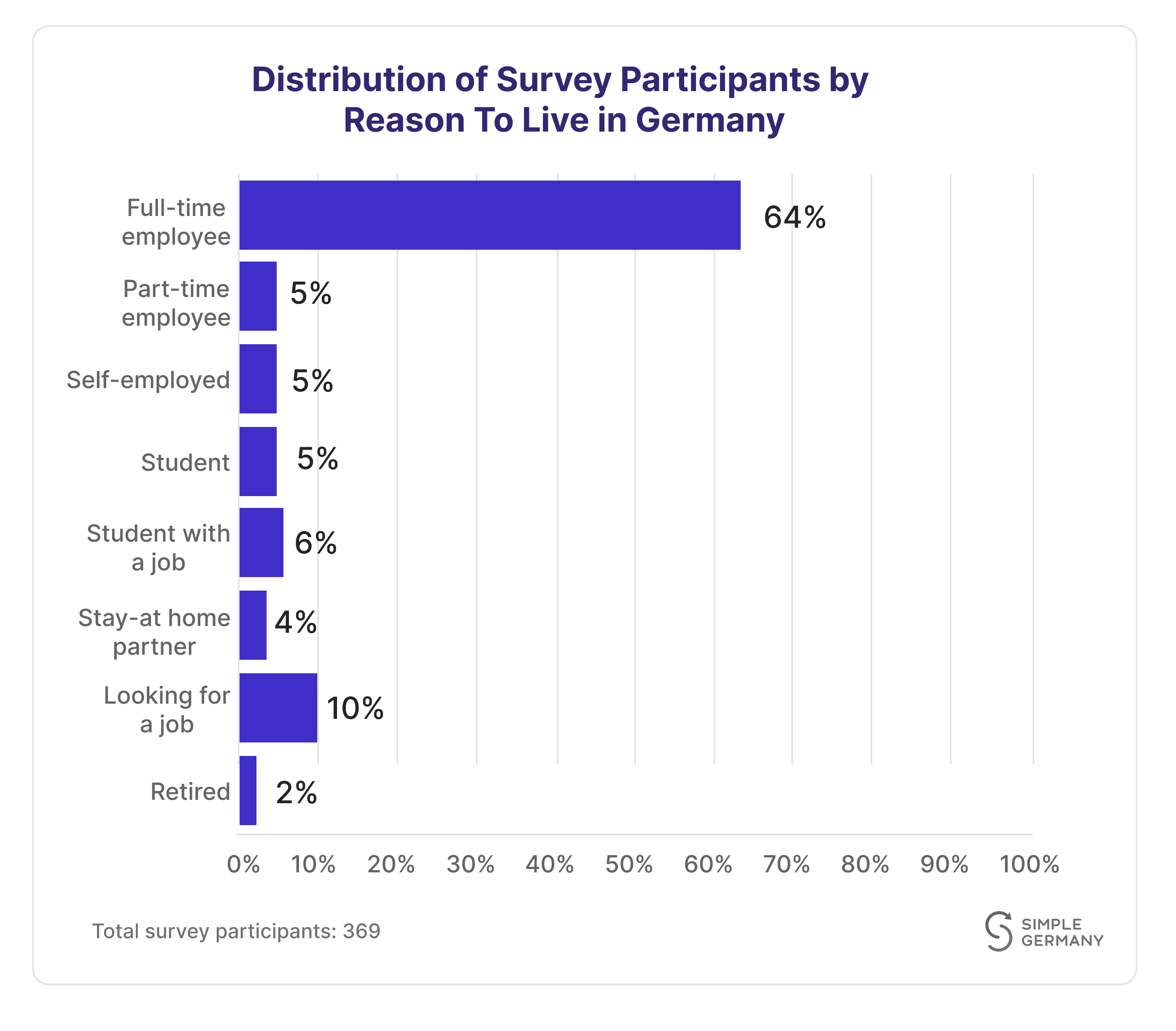

The Simple Germany audience predominantly includes full-time employees, so the results will reflect the banking preferences of international workers in Germany.

Only 42% of internationals have a traditional German bank account

In the past years, traditional banks in Germany have made an effort to offer more digitized and modern services. But, internationals prefer mobile banks like N26, Revolut, and Wise.

I think people from other countries like mobile banks because they get instant messages when they spend money, and everything is in English.

90% of internationals want their banking in English

In our survey, most people said it was important for them to have English options when choosing a bank.

55% wanted everything in English, and 35% were okay if only some things were in English.

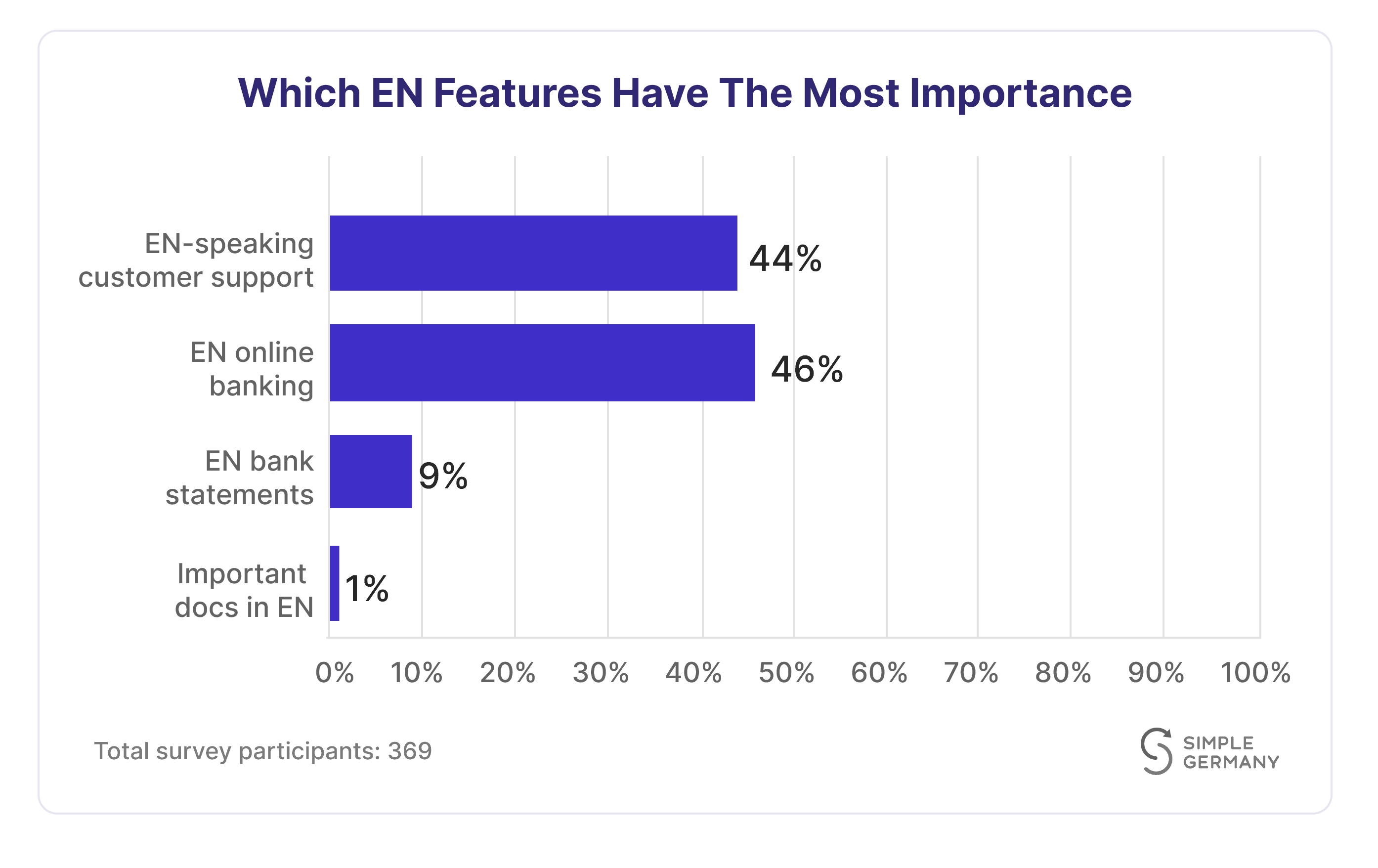

We asked those who were okay with just some English features which ones mattered most to them.

The top two desired features were having English banking (on mobile and desktop) and English-speaking customer support.

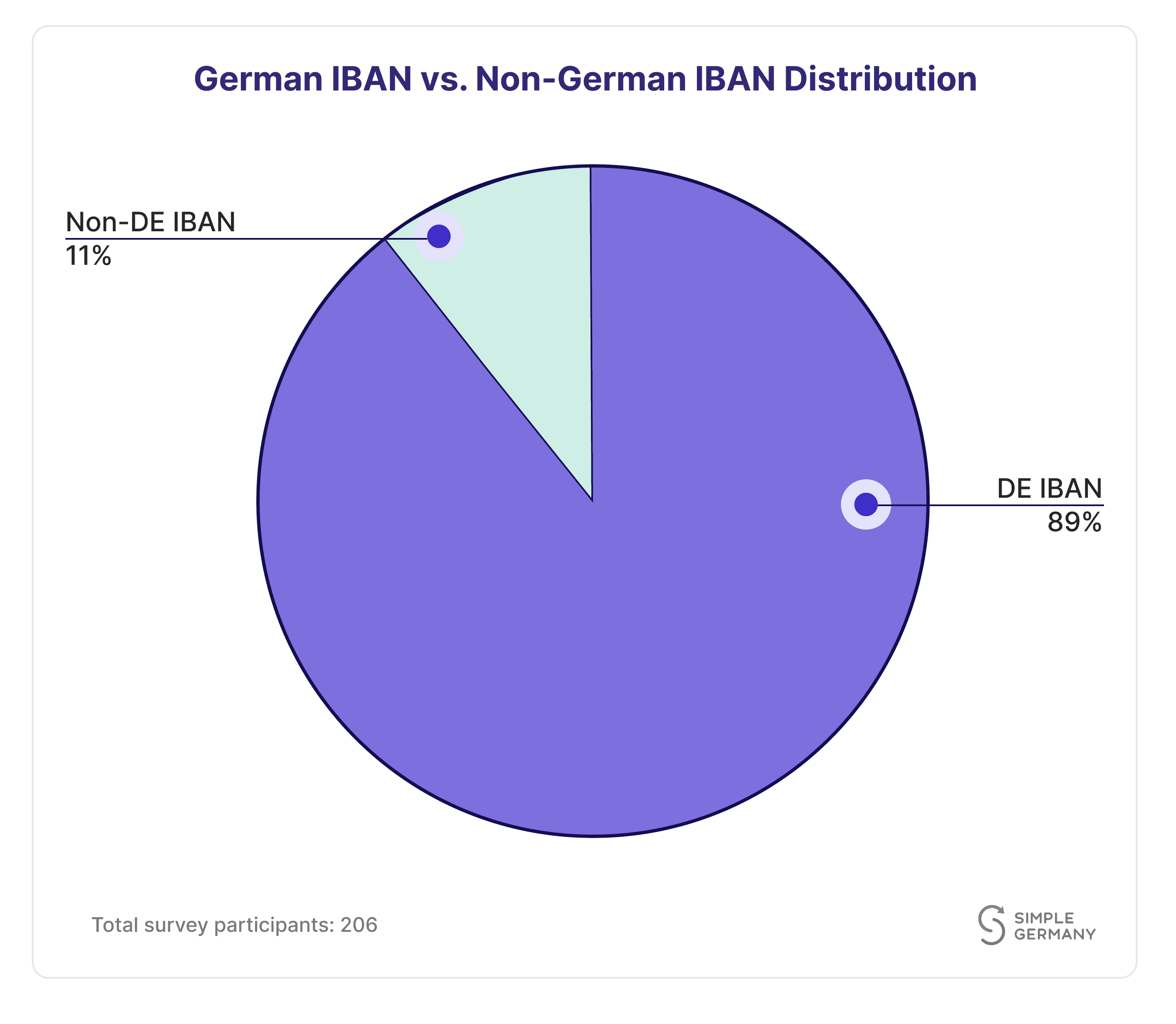

A German IBAN number is essential for internationals in Germany – 89% of respondents have one

An IBAN is a unique code used worldwide to recognize a specific bank account for sending or receiving money. In Germany, this code starts with ‘DE’.

You need a German IBAN to get paid and to pay for things in Germany. 89% of internationals who replied to our survey have a German IBAN.

This matters because some well-known mobile banks, like Revolut, give out IBANs that aren’t German. Even though it’s against the EU law to treat IBANs differently, some foreigners have told us that certain companies won’t pay their salaries into accounts without a German IBAN.

So, it’s a good idea to get a German IBAN quickly.

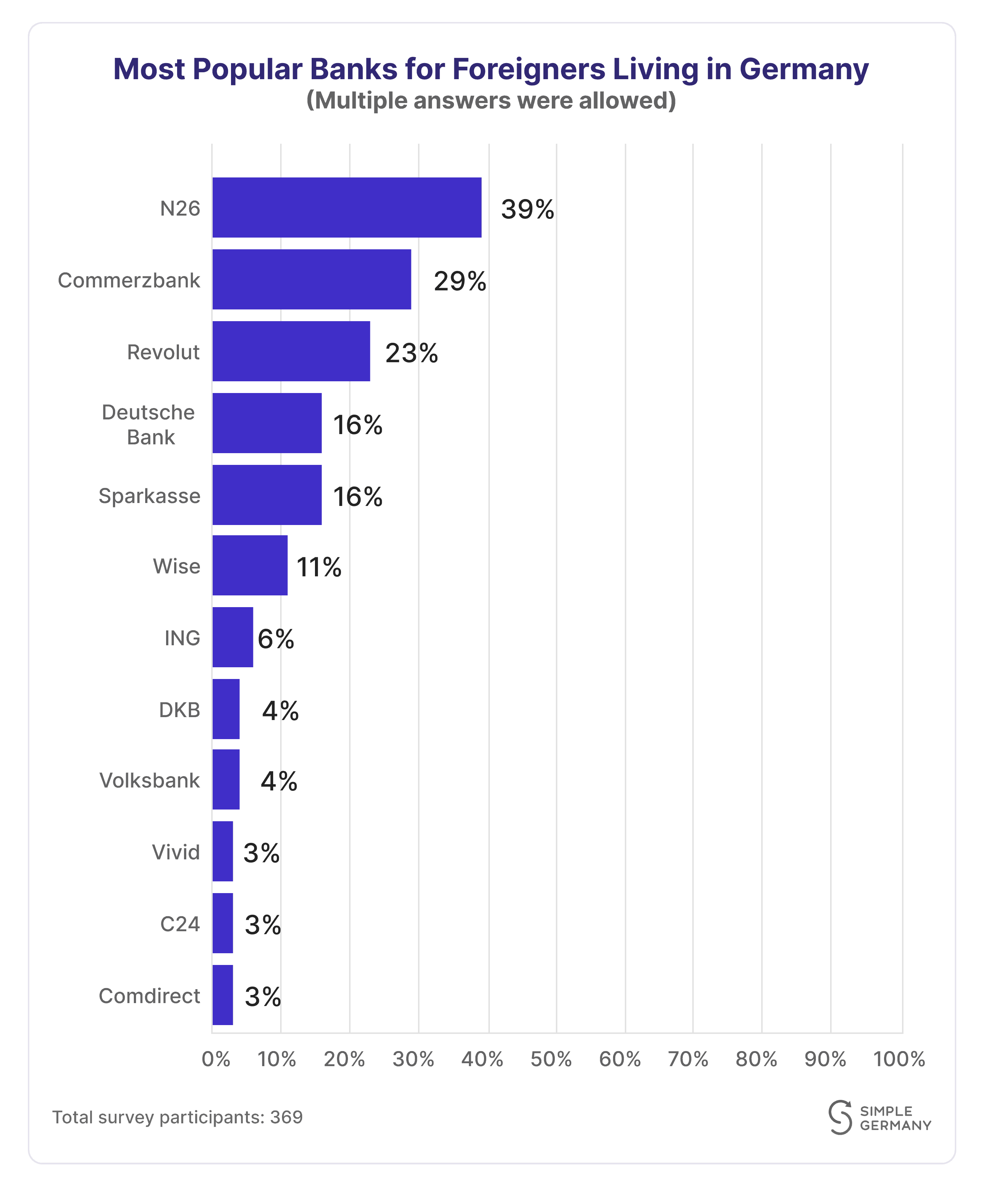

39% of respondents have an N26 bank account – making it the most popular bank for internationals in Germany

N26 was the first mobile bank in Germany. They offer all of their banking services in English. So it’s no surprise that it’s the most popular bank for internationals living in Germany.

The most used banks by foreigners in Germany after N26 are Commerzbank, Revolut, Deutsche Bank, Sparkasse, and Wise.

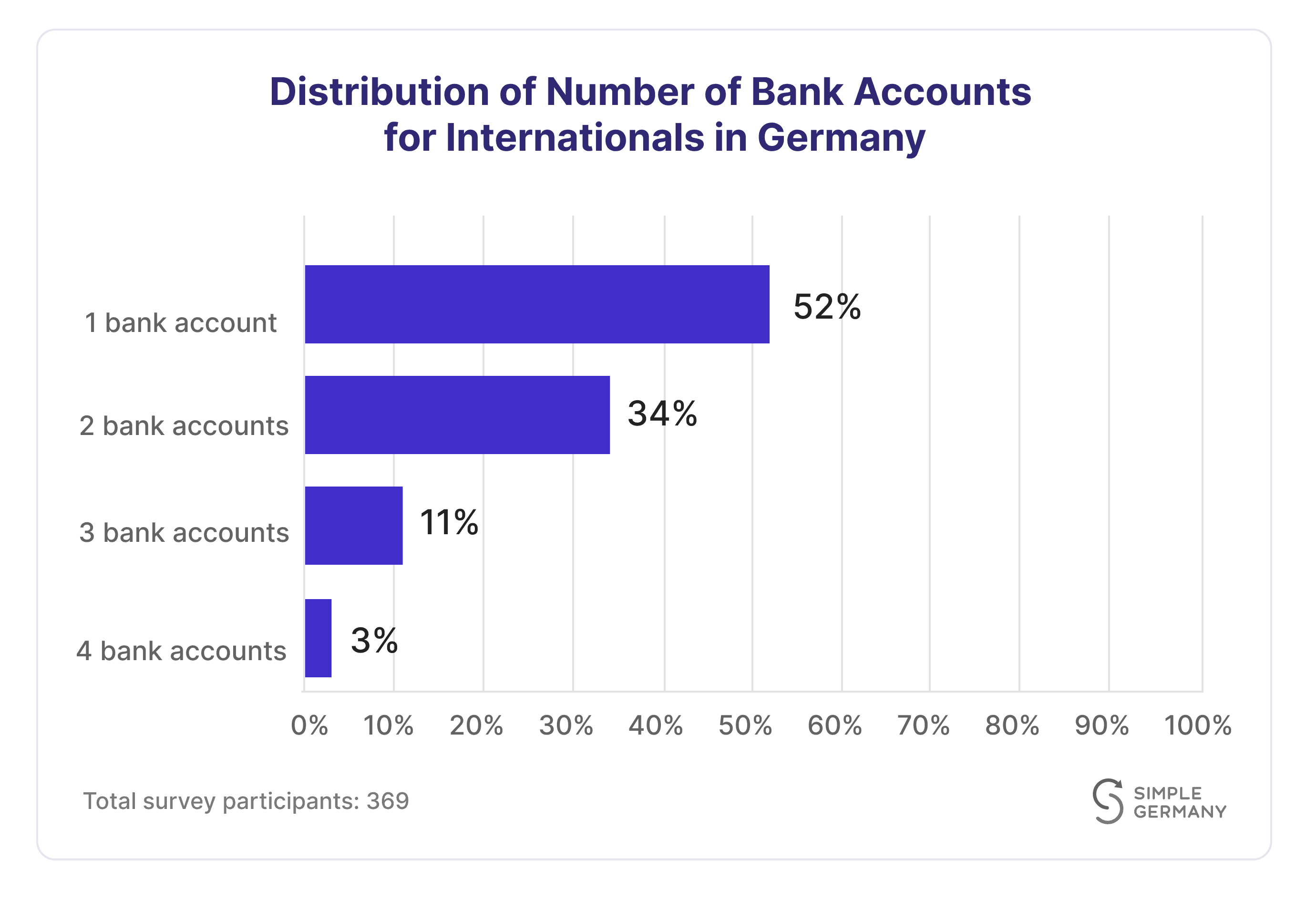

52% of internationals only have one bank account

The majority of internationals only have one bank account.

Many foreigners (34%) have two bank accounts. Having four or more bank accounts is rare for internationals living in Germany.

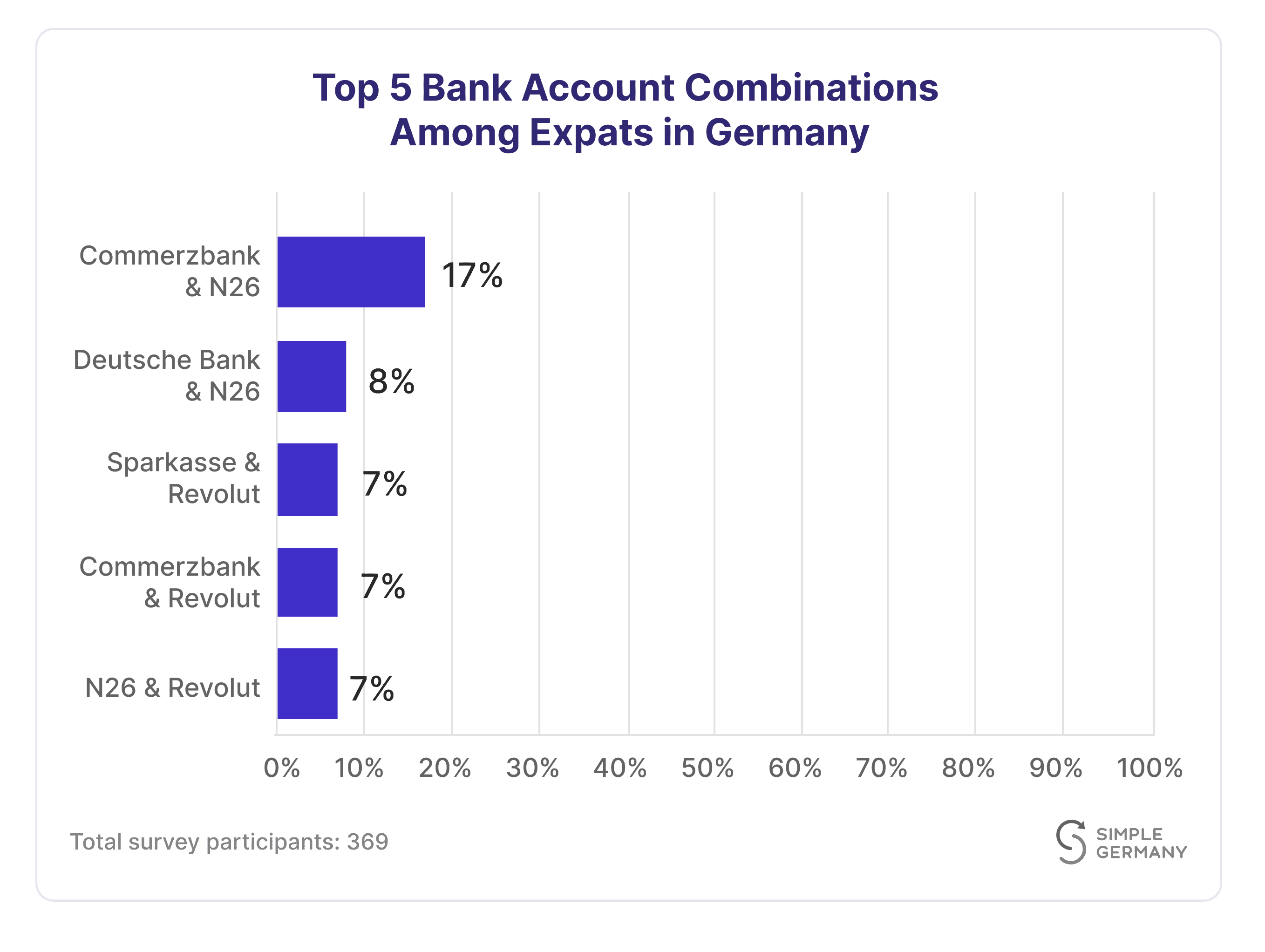

The most popular bank combination among respondents with multiple bank accounts is Commerzbank and N26

34% of internationals in our survey have two bank accounts. The most popular bank combination is Commerzbank and N26 – with 17%.

The top 4 results show a combination of a traditional and modern bank.

I believe that the best banking setup in Germany is to have a mobile and a traditional bank. The different features of each type of bank complement each other quite nicely.

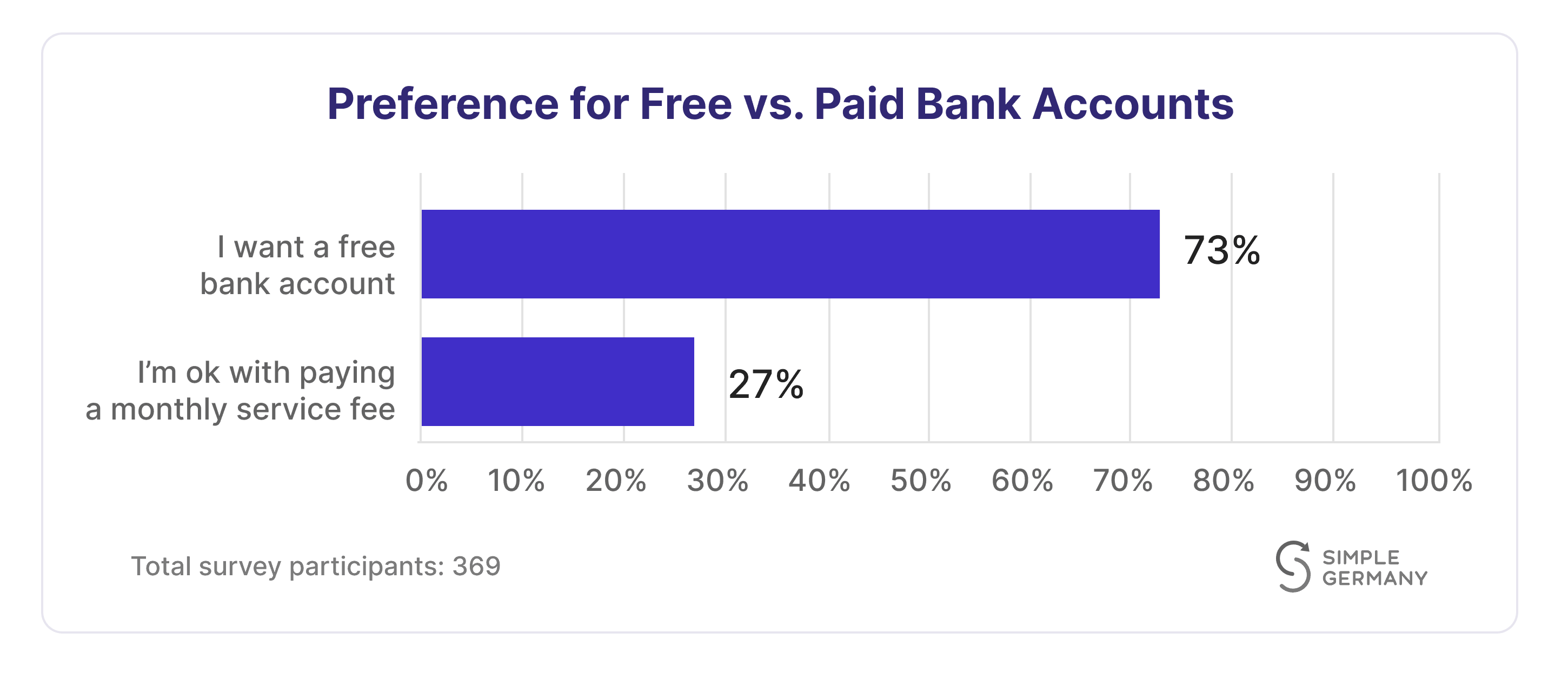

Only 27% of Internationals Are Willing to Pay for A Monthly Service Fee

We at Simple Germany believe that banking services should be free. We’re glad to find that our survey participants think so, too.

73% of respondents say they prefer a free bank account without a monthly service fee.

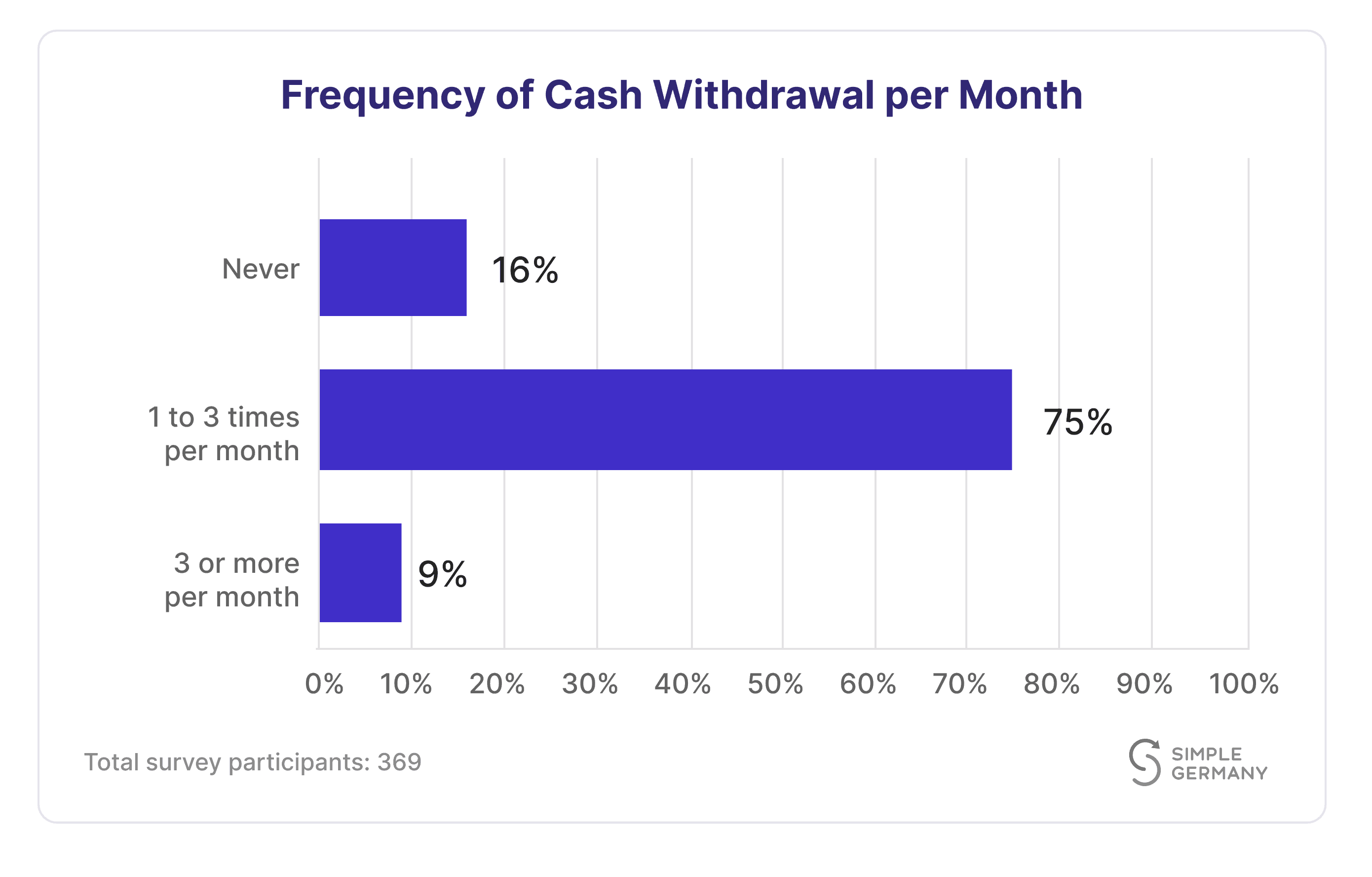

75% of Internationals withdraw Cash 1 to 3 times per month

Cash is king in Germany. Many small businesses in the country still don’t accept card payments.

Our survey confirms how vital cash is in Germany, with 75% of internationals withdrawing money 1 to 3 times a month.

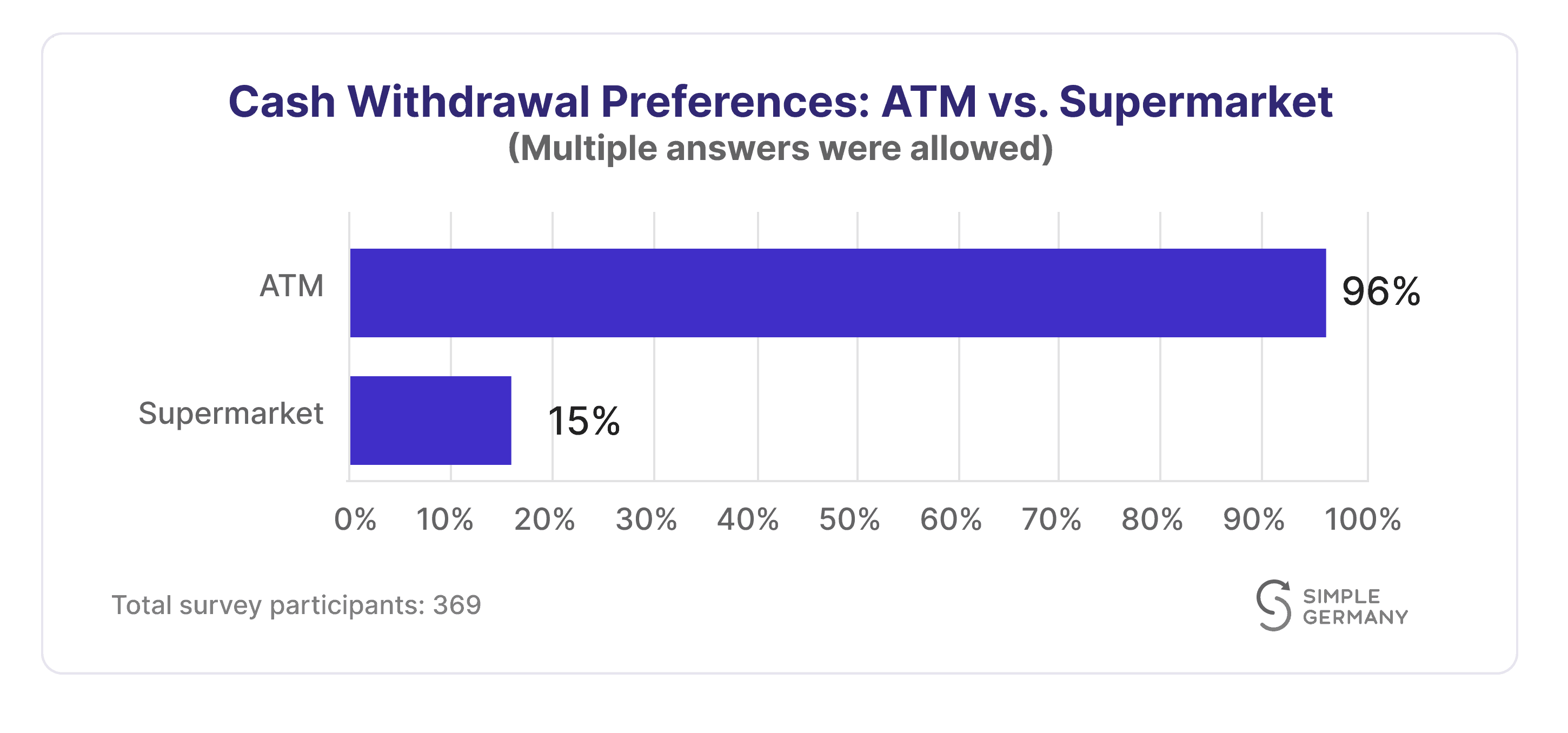

96% of cash withdrawals Are With An ATM

Yes, withdrawing cash from an ATM is nothing new. There is another option to withdraw cash in Germany – that’s with a supermarket clerk.

Our survey confirms that withdrawing cash with a supermarket clerk is unpopular among internationals. This is interesting, as most of the time, these withdrawals are free of charge and very convenient.

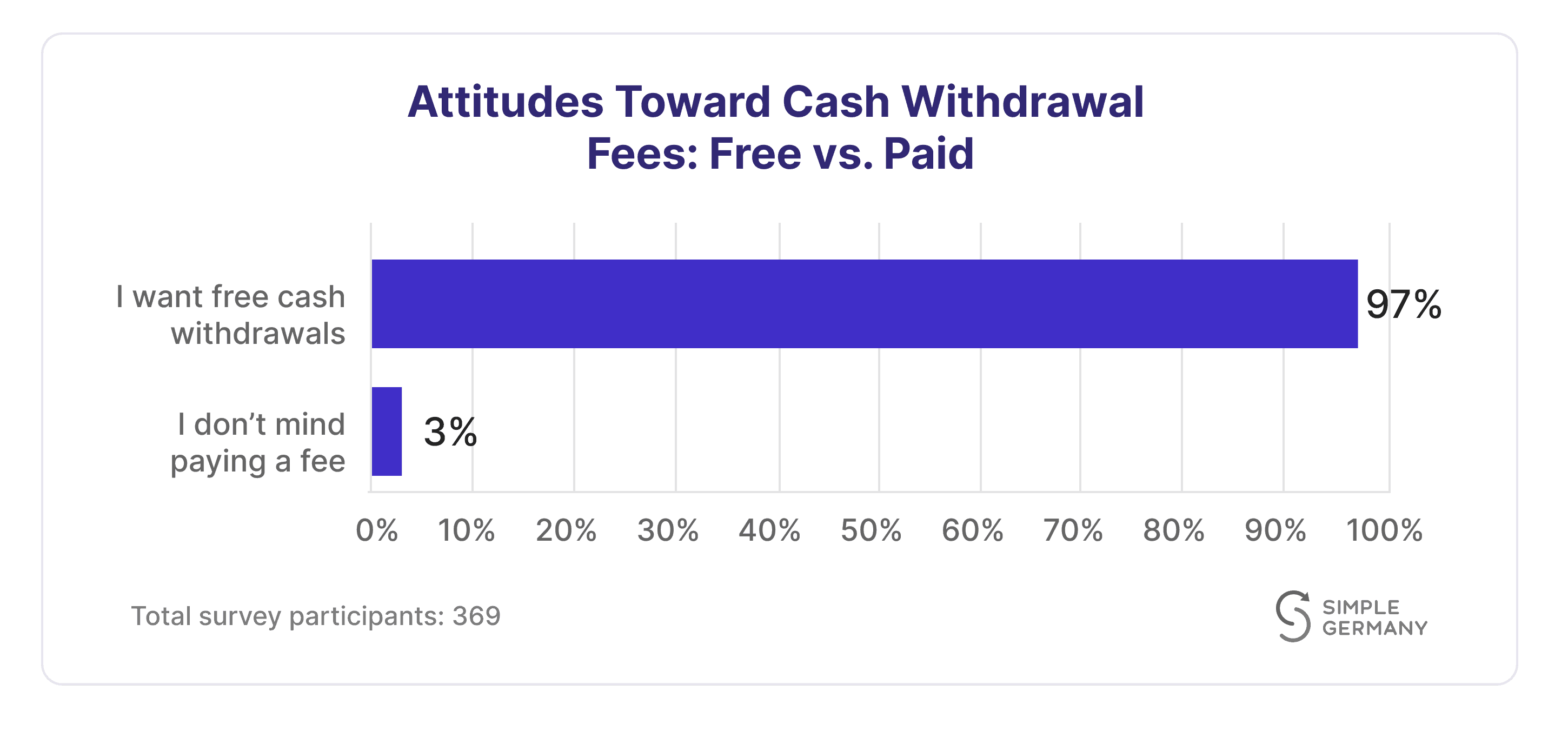

No one wants to pay for cash withdrawals

97% of our respondents shared that they want free cash withdrawals.

Many mobile banks charge fees for taking out cash. They might limit how much you can take out for free each month or cap the amount before charging fees.

As we’ve seen in our previous results, this is where a traditional bank combination is beneficial, as the majority offer unlimited free cash withdrawals per month.

44% of internationals value the availability of cash deposits

This was a surprise to us. We did not expect so many internationals to want the ability to deposit cash into their bank accounts.

This is again a benefit of a traditional German bank. The majority have special ATMs where one can deposit cash for free.

59% of internationals in Germany say having a Girocard is important to them

A Girocard is a special German debit card. Some businesses only accept this kind of debit card for electronic payments.

59% say a Girocard is a must-have in Germany. Meanwhile, 41% are fine without one. The latter group might prefer paying with cash.

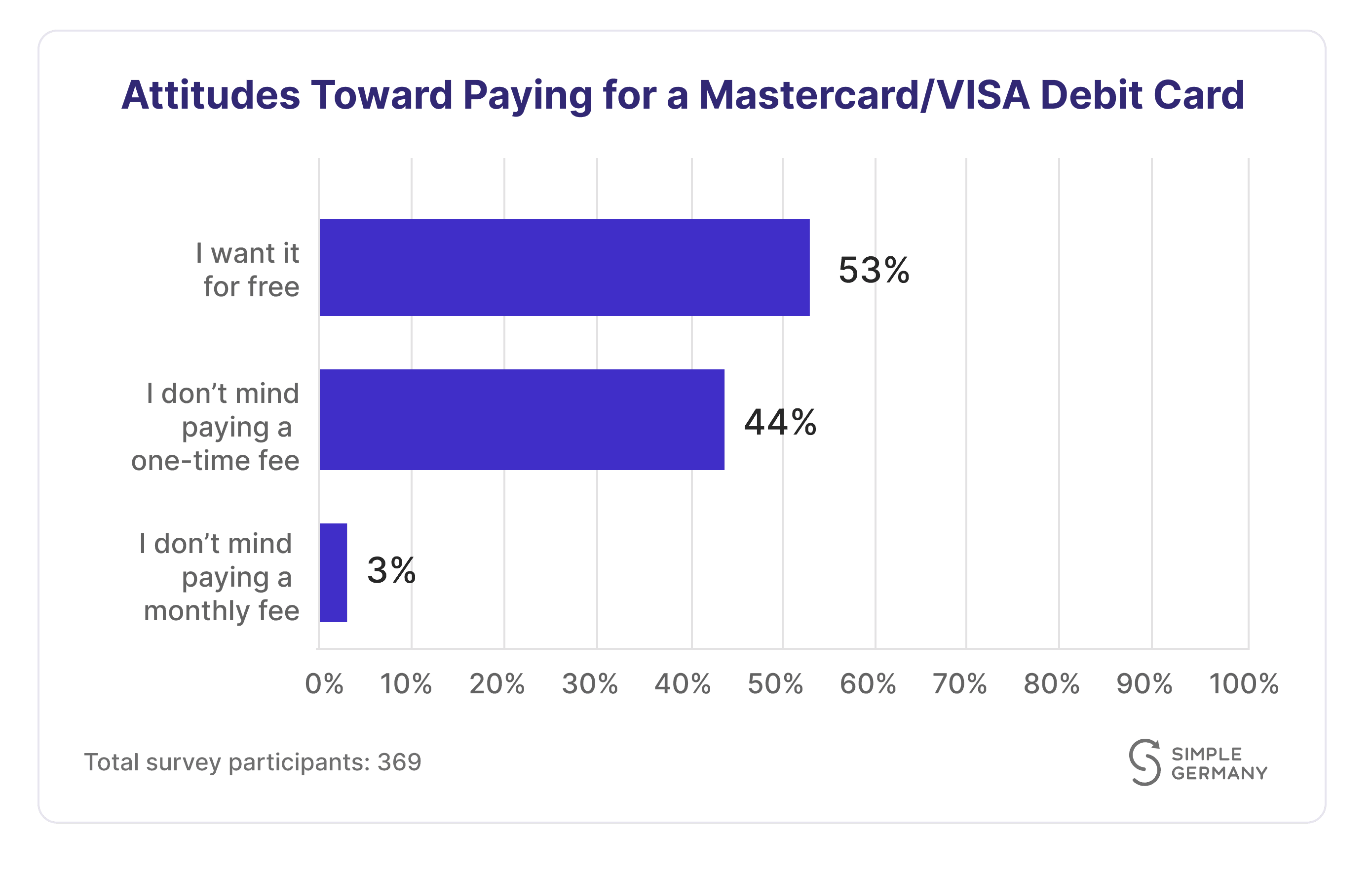

44% are willing to pay a one-time fee for a Mastercard or Visa Debit Card

Many banks in Germany, both mobile and traditional, don’t give out a free physical Mastercard or Visa debit card. You need this kind of card to buy things online, for example.

53% of people said they want this card for free. 44% said they’re okay with paying for it if it’s just a one-time fee.

My 3 Surprises From This Survey

- Only one person in the survey had a Tomorrow bank account: Tomorrow is an eco-friendly, all-digital bank in Germany that operates in English. It’s probably not very popular because it charges a monthly fee, and every cash withdrawal has a fee. As we learned from the survey, 73% of expats in Germany prefer to have a free bank account, and 97% want free cash withdrawals.

- Many value the availability of cash deposits: As an international in Germany, I’ve deposited cash in my bank account twice in the last 12 years. So, it was surprising to see how many foreigners really care about this feature in a bank account.

- Taking out cash at supermarkets isn’t common: Most foreigners use ATMs to get cash. I usually get cash from the supermarket clerk at checkout while grocery shopping. But you need a Girocard to do this. It might not be popular because people don’t have a Girocard, there’s a language problem, or maybe many just don’t know it’s an option.

Conclusion

In a nutshell, my conclusion is that an average full-time international worker who has lived for 1 to 2 years in Germany has one bank account, most likely with N26 or Commerzbank. They have a Girocard, withdraw cash 1 to 3 times a month, and would like banking services to be free.

If you’re moving to Germany and are looking for a bank account, make sure to check out our guide on the 10 best banks in Germany and our detailed comparison of the best bank accounts in Germany for English speakers.