Hey, welcome to my guide explaining the tax class in Germany.

I have had two different tax classes while working in Germany. For me, the tax class changed because I got married, and my life circumstances changed. I have also had long conversations with my dad on the topic. He is a certified tax consultant, and I love to pick his brain to expand my knowledge.

By reading my guide, you will learn about the 6 different types of tax classes. More important, you will understand when and why they apply. Married couples need to pay extra attention. I will provide you with the tools to check whether changing your tax class together with your spouse makes sense.

Before we get started, please note that the tax class is only relevant to employees in Germany. If you are self-employed or not working at all, you will not have a tax class. I also want to highlight right from the start that you can’t save taxes by changing your tax class. The tax class has absolutely no impact on how much income tax you are paying. I will explain why in this guide.

If you prefer video, I explain everything in detail in the video below.

What are the tax classes in Germany?

There are 6 tax classes (Steuerklassen) in Germany that are based on different life circumstances.

| German Tax Class | Marital Status |

|---|---|

| Tax Class 1 | You are single, widowed, separated/divorced |

| Tax Class 2 | You are a single parent |

| Tax Class 3 | You are married (or widowed within the first year of the spouse’s death) and the single earner or with a significantly higher income than your partner in tax class 5 |

| Tax Class 4 | You are married with both spouses earning similar income |

| Tax Class 5 | You are married with no income or a significantly lower income than your partner in tax class 3 |

| Tax Class 6 | The tax class for a second job (regardless of marital status) |

Your tax class gets assigned to you by the financial authorities. You can only change tax classes if your marital status changes.

The combination of tax classes 3 and 5 is only possible for married couples if both spouses live in Germany. If you are already working in Germany, but your spouse is not living in Germany yet, you will receive tax class 1. Once your spouse is also registered in Germany, you can apply for a tax class change. In this guide, you will learn below which tax classes make sense to you.

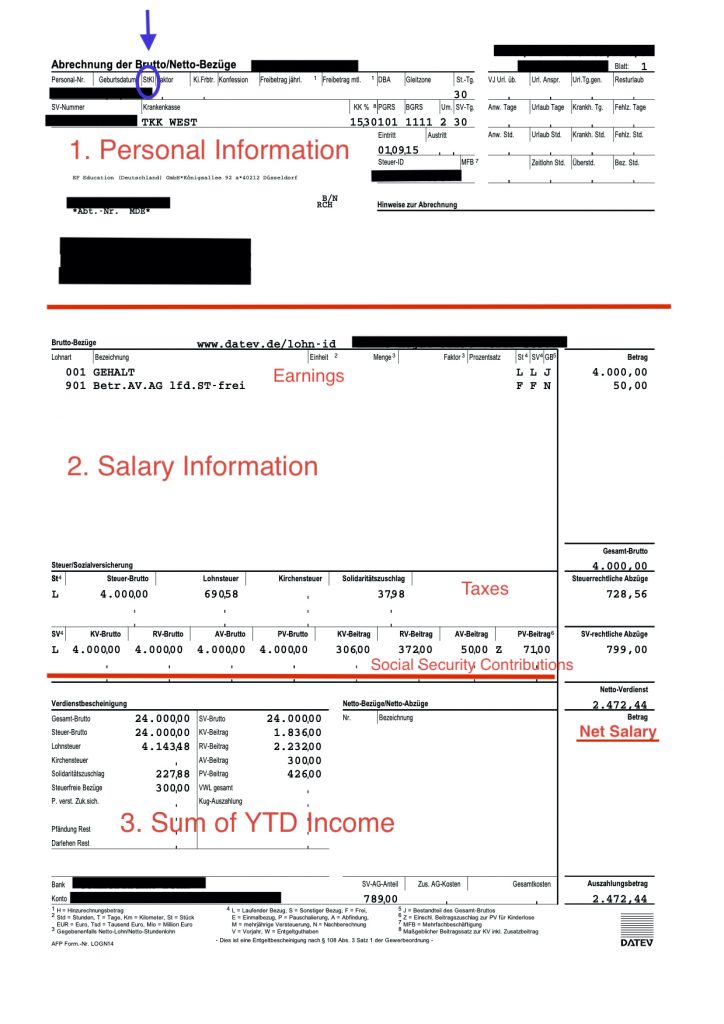

How to know your tax class in Germany?

You can determine which tax class you got assigned by looking at your payslip. You can usually find it somewhere at the top as Steuerklasse or with an abbreviation such as StKl.

Read Our Related Guide

How Does the Tax Class Work?

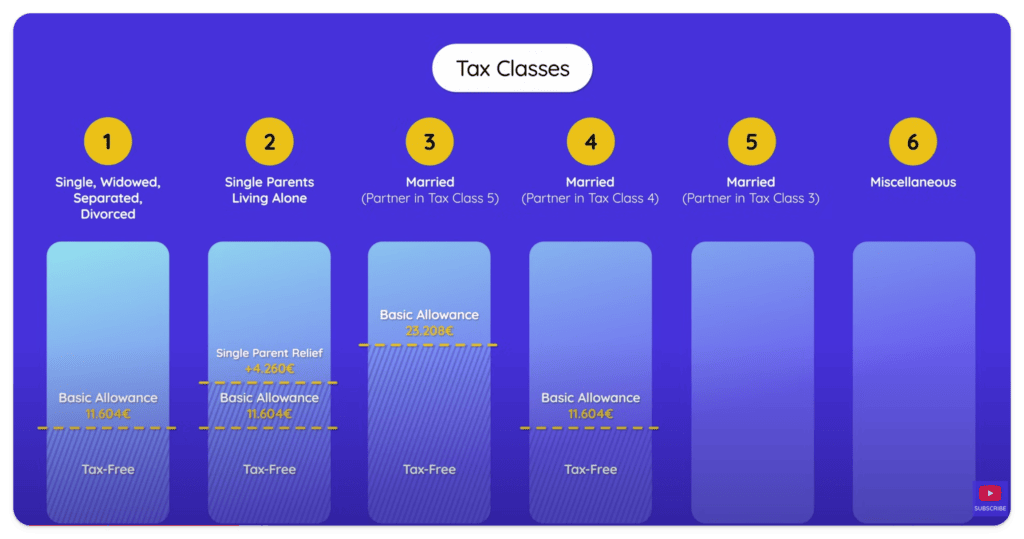

The tax class serves to simplify the German tax system. The 6 tax classes don’t have different tax rates. The difference lies in the pre-determined tax-free allowances that get automatically applied to the wage tax on your payslip.

In the graphic below, you can see how the tax-free allowance (Grundfreibetrag) gets assigned per tax class. In 2025, the allowance is 12.096 euros. It increases every year. Any income until that threshold is tax-free in Germany.

Tax classes 1-4 consider the basic tax-free allowance. However, single parents in tax class 2 get an additional tax relief to lower their tax burden.

Tax class 3 gets double the basic tax-free allowance, and in return, tax class 5 doesn’t get any. We will look at the pros and cons of the tax class combination 3 and 5 for married couples further down in this guide.

❗️ Important

There is a misconception that the tax class impacts how much income tax you pay in Germany. That is wrong. Your income dictates how much taxes you need to pay. The tax class is a mere tool to adjust how much taxes you pre-pay per month via your payslip vs. how much you pay at the end of the year through your tax declaration.

Only by handing in a tax declaration will you be able to determine the exact income tax you should be paying.

Read Our Related Guide

What Impact Does the Tax Class Have?

The tax class impacts the amount of salary tax you pre-pay every month via your payslip.

If you are not married, the tax class is not really relevant to you. You can’t change it anyway, and its impact lies in receiving the most accurate salary taxation possible.

However, if you are married and both spouses live in Germany, you can choose between different tax class combinations with your spouse. The impact of the different tax class combinations can be very big.

How big the impact can be depends on how big the salary difference between spouses is. Let’s look at that in detail.

Which tax class combination is best for married couples?

There are 3 different tax class combinations for married couples in Germany:

- Tax class combination 4 and 4

- Tax class combination 3 and 5

- Tax class combination 4 and 4 with Factor

When you get married in Germany, the Finanzamt will automatically change your tax class from 1 to 4. This is what happened to me and my wife. We remained in tax classes 4 and 4 as we both earned a similar income and thus, it was the best combination for us.

Let’s look at the different combinations and when they make the most sense. The chosen combination also determines whether you have to file a tax declaration or not.

Option 1: Tax Class Combination 4 and 4

Tax class combination 4 and 4 makes the most sense when both spouses earn a similar gross salary in Germany. The ratio should be anywhere between 50-50% and 56-44% of the total shared income. You don’t have to file a tax declaration the following year.

My wife and I always chose to file a tax return each year. We received between 500 and 1.000 euros back each year.

The reason for receiving a significant amount of taxes back is that with a ratio of 56-44% between spouses, you are most likely slightly overpaying taxes each month.

Option 2: Tax Class Combination 3 and 5

Tax class combination 3 and 5 makes the most sense when one spouse earns significantly more than the other spouse. It starts to make sense if the gross salary ratio is 60-40% or bigger.

The higher earner gets tax class 3, and the lower earner gets tax class 5. The salary tax rate is progressive in Germany; the more you earn, the more tax you pay. Therefore, the higher earner would pay significantly more tax than the lower earner.

To balance this out, the tax-free allowance, as we have seen in the graphic above, gets shifted from the lower earner to the higher earner. That way, the higher earner reduces their taxable income and consequently pays less salary tax.

This oftentimes leads to a higher net salary and, therefore, more liquidity. Sounds fantastic, right? Well, yes and no. Let me explain.

If this were all that is to the tax class, it actually would mean that you can literally save taxes with the tax class combination of 3 and 5. However, as I stated beforehand, this is a wrong misconception.

With tax class combination 3 and 5, you must file a tax declaration the following year. And the bigger the difference between the salaries, the higher the likelihood that you are underpaying taxes every month.

This means that you need to pay the underpaid tax all at once with the tax declaration. This could easily be more than 1.000 euros. In my opinion, tax class combination 3 and 5 comes with a certain ‘danger’ and should only be chosen very consciously.

We have recorded an explainer video with an example calculation for the different scenarios. Watching this video should clear any doubts about the impact of the tax class.

Exception: Tax class combination 3 and 5 for Single-Income Families

If one spouse is the sole income earner in a couple, tax class combination 3 and 5 makes the most sense. In this case, there is usually no risk of underpaying taxes each month. As long as the other spouse does not earn more than a fixed taxed mini-job (556 euros), you are also not obliged to file a tax declaration. You may want to consider filing a tax return, though, as you have chances of getting money back.

Option 3: Tax Class Combination 4 and 4 with Factor

Tax class combination 4 and 4 with a factor is, in theory, the combination that provides the most accurate tax pre-payment. In reality, however, it is not much utilized. You are also obligated to file a tax declaration with this combination.

German Tax Class Calculator

For a quick estimation of whether you should consider a tax class change to 3 and 5, you can use this German tax class calculator. It is in German but pretty self-explanatory. You have to enter both spouses’ gross salaries and tick the box on whether you have children.

This calculator is just a rough estimate. You can only get a qualified answer from a certified tax consultant.

- Individual tax declarations for high earners

- Fully in English

- Fully digital all over Germany

- Specialized on Expats in Germany with income from abroad

By choosing the right combination of tax classes, you can decide whether:

- you would rather pay more tax each month and then get a higher tax refund with your annual tax return. This is usually the case if both spouses stay in tax class 4 and earn similar incomes.

- or you pay less tax each month instead and thus have a slightly higher monthly net income available. This is usually the case with tax classes 3 and 5. In return, you will only receive a small tax refund or maybe even pay some underpaid taxes extra to the Finanzamt after you have submitted your tax declaration.

❗️ Important

At the end of the day, you won’t make any profits or losses when changing tax classes, as the amount of income tax remains identical. The tax class has no impact on the amount of income tax you have to pay yearly. Instead, the tax class only impacts the monthly distribution of the income tax you have to pay.

How to change your tax class?

Changing your tax class in Germany as a married couple is fairly easy and only involves one bureaucratic document. Currently, a big yellow box is blocking the online entry of data on the form to request a tax change (Antrag auf Steuerklassenwechsel bei Ehegatten). To circumnavigate this yellow box, you can follow these steps:

- Download the document first by clicking on the pdf icon on top.

- Print it, fill it out, and sign it – both spouses have to sign it.

- Send it to your Finanzamt.

- The Finanzamt should inform your employer; however, you can also inform them about the change.

You could fill it out in the official German Elster tax system, but that would require you to register, which can take up to two weeks and everything is purely in German.

Once you change to tax classes 3 and 5, you are automatically obligated to file a joint tax declaration the following year.

- Individual tax declarations for high earners

- Fully in English

- Fully digital all over Germany

- Specialized on Expats in Germany with income from abroad

How To Fill Out The Antrag Auf Steuerklassenwechsel Bei Ehegatten

Line 1: Steuernummer – your individual tax number assigned by your local tax office to catalog your documents faster. If you have filed a tax declaration before, you can find it on your last tax assessment (Steuerbescheid). Otherwise, leave it empty.

Line 2: An das Finanzamt – the name of your city or relevant tax office.

Line 3: Bei Wohnsitzwechsel: bisheriges Finanzamt – in case you moved, name your previous tax office.

Lines 4-10: Antragstellende Person – the partner filing the request.

Line 5: Identifikationsnummer (IdNr.) – Tax ID (the number of the partner filing the request), you can find it on your last payslip.

Lines 6-9: Personal details and address of the spouse filing the request.

Line 10: Verheiratet/Verpartnert seit – married since

Verwitwet seit – widowed since

Geschieden seit – divorced since

Dauernd getrennt lebend seit – permanently separated since

Line 11: Identifikationsnummer (IdNr.) – Tax ID of the other spouse

Lines 12-15: Personal details and address of the other spouse.

Line 17: Bisherige Steuerklassenkombination – previous tax classes, check the box to the left of “IV/IV”

Line 18: Wir beantragen die Steuerklassenkombination – we request the tax class combination (partner filing the request / other spouse), check the box to the left of “III/V” or “V/III” depending on which spouse has the higher income.

Line 19: Tick the box if you want the tax class change to be effective retroactively since the day of the wedding.

Leave part C blank.

Line 43: Both spouses have to sign; the partner filing the request signs first.

Conclusion

Your marital status determines your tax class in Germany. The only time you can choose your tax class is after getting married. Both spouses’ income determines whether a tax class change makes sense to receive a temporary tax advantage on your monthly income. Remember, though, that the amount of income tax per year remains identical.

Disclaimer: Neither myself as the author of this article, nor Simple Germany as a business, are qualified to provide tax advice under German law. We cannot provide specialist tax services beyond any of the general tips contained herein. For tax advice, we strongly recommend you consult a professional tax consultant. The information given in this article is purely based on our research and our own experiences.