Congratulations, you have made your move to Germany and have found a job! However, you are not sure what to make out of your well-earned payslip in German. In this guide, I will explain the most important abbreviations and words on a German payslip so that you can make sense out of it.

Salary deductions in Germany

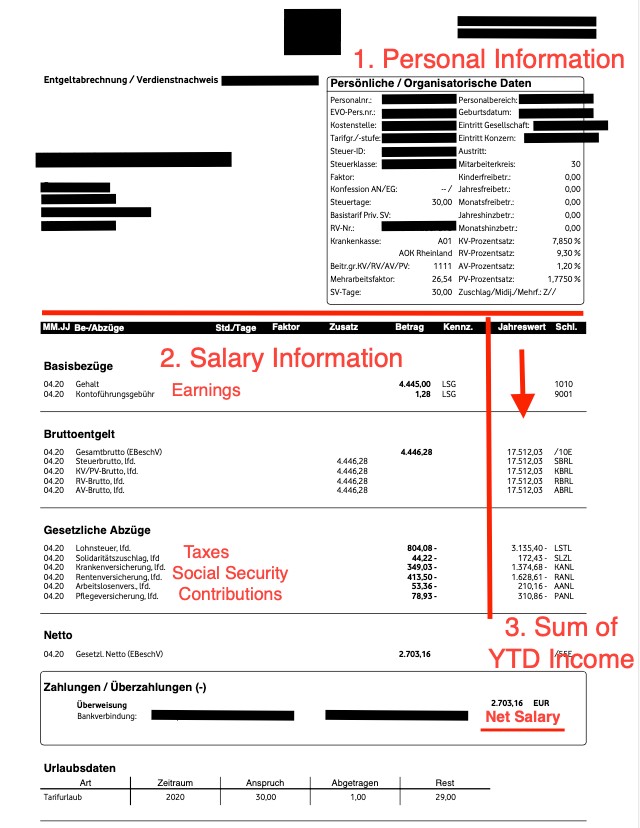

Once you receive your first payslip in Germany, you will notice a lot of deductions on it. Some of them are taxes; others are social security contributions. As a rule of thumb, you can estimate around 40% deductions from your gross salary.

What is left is the net salary you will receive via wire transfer to your German bank account. The actual deductions are very individual and depend on your income, tax class, health insurance, whether you are paying church tax, and where you are living in Germany.

Simple Germany’s Hot Tip

Even though the social system and coverage are extensive in Germany, personal liability insurance, one of Germany’s most important insurances, is not a deduction from your payslip. However, it is a must-have insurance in Germany, which you should purchase privately. Find out why in our guide below.

- from €2,44

- 100% in English and digital

- Cover up to 50 million euros

- Cancel anytime

Read Our Related Guide

With this German salary calculator, you get a detailed result of your net salary. It’s best to calculate your net salary before you start the job to have the correct salary expectations in Germany.

Read Our Related Guide

What Is Considered A Good salary in Germany? [Detailed Guide]

How to read a German payslip?

Towards the end of each month, all German employees receive their payslips. Please don’t ask me why, but several different terms are used as the title of the document. Here are a few examples: Lohnabrechnung, Gehaltsabrechnung, Entgeltabrechnung, Verdienstnachweis, Abrechnung der Brutto/Netto-Bezüge.

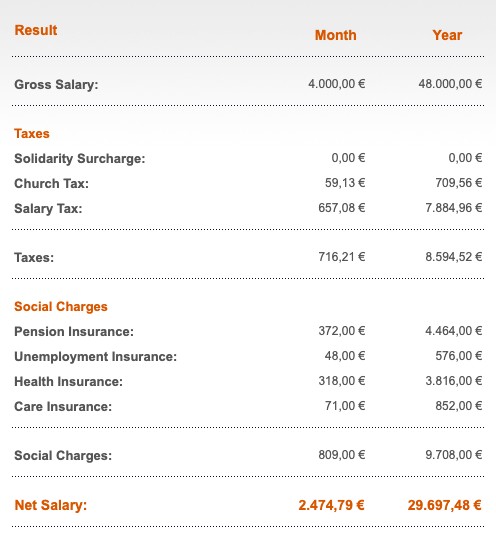

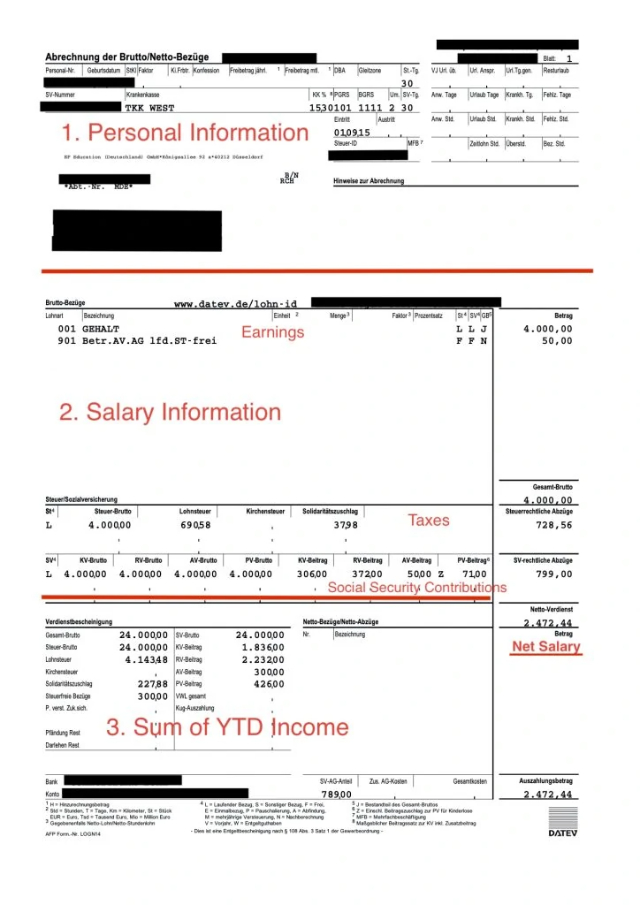

Since companies use different payroll systems and software, the format of the payslips can differ a lot. We show you two example formats, where the left one with all the abbreviations is the more common one.

Example 1 of German Payslip

Example 2 of German Payslip

The payslip details your monthly earnings (salary plus possible bonuses), your social security contributions, and your deducted taxes. Germans love abbreviations, and your payslip is full of them. Let’s decipher what they stand for.

1. Personal information

- Arbeitnehmer Nr. or Personal-Nr. – Employee number

- Geburtsdatum – Date of birth

- StKl. (Steuerklasse) – Tax class

- Ki.Frbtr. (Kinderfreibeträge) or ZKF (Zahl der Kinderfreibeträge) -Number of tax exemptions for children (1 per child)

- Konfession or Rel. (Religion) – Religion (RK = Roman Catholic; EV = Protestant; — = No religion)

- Freibetrag or Steuerfr. Bezug (Steuerfreibezug) – Tax-free allowance

- St. Tg. (Steuertage) – Tax days (The relevant time period. For a full month it is usually 30)

- SV-Nummer (Sozialversicherungsnummer) or RV-Nummer (Rentenversicherungsnummer) – Social security number

- Krankenkasse – Your health insurance fund

- KK % – Your health insurance contribution rate

- Eintritt or Eintrittsdatum – Date of hire

- SV-Tg. (Sozialverischerungstage) – Social security days (The relevant time period. For a full month it is usually 30)

- BGRS or SV Schlüssel / Beitr.gr. (KV/RV/AV/PV) – Social security codes, indicating your level of contribution (1 = full contribution)

- Steuer-ID or Lohnsteueridentifikationsnummer (IdNr.) – Tax ID number

- Url. Anspr. (Urlaubsanspruch) – Vacation days as per contract. By law 20, up to 30 are common

- Url. Tg. gen. (Urlaubstage genehmigt) – Approved vacation days year to date

2. Salary information

Not all terms listed below will appear on your payslip. Some might only appear on specific months, depending on bonuses, etc.

Earnings

- Brutto Bezüge – Gross earnings

- Bezeichnung – Description

- Gehalt – Monthly base salary

- Geldw. Vorteil or Sachbezug – Non-cash benefits, subject to tax and social contributions

- VL AG (Vermögenswirksame Leistungen Arbeitgeberanteil) – Voluntary employer contribution to savings plan

- Betr. AV or BAV (Betriebliche Altersvorsorge) – Employer contribution to savings plan

- Einmalbezug or Einmalzahlung – One time bonus (e.g. for Christmas, holidays, or achievement)

- Urlaubsgeld – Holiday pay

- Gehaltsumwandlung: Deduction for tax or any other social benefits.

- ST-frei (Steuerfreie Bezüge) – Tax-free benefits

- Gesamtbrutto or Steuer-Brutto – Total gross salary (taxable amount)

- Nettoverdienst or Auszahlungsbetrag – Net salary paid to your bank account listed at the bottom of your payslip

Taxes

Your employer automatically deducts these taxes from your gross salary and pays them to the German tax authorities (Finanzamt).

- Lohnsteuer (LSt.) – Income tax calculated progressively (14-42%)

- Kirchensteuer (KiSt.) – Church tax based on whether you have a confession (8-9%)

- Solidaritätszuschlag – Solidarity surcharge paid by all states of former West-Germany (max. 5,5%) – UPDATE: from 2021 you only have to contribute if you earn more than 73.000 euros gross per year.

- Steuerrechtliche Abzüge – Sum of all tax reductions

Social security contributions

The social security contributions are paid 50% by the employee and 50% by the employer.

- SV (Sozialversicherung) – Social security insurances

- KV-Beitrag (Krankenversicherung) – Contribution to statutory health insurance (15,5% - 17,3% depending on your health insurance fund – TK example)

- PV-Beitrag (Pflegeversicherung) – Contribution to long-term care insurance (3,4-4%)

- RV-Beitrag (Rentenversicherung) – Contribution to pension insurance (18,6%)

- AV-Beitrag (Arbeitlosenverischerung) – Contribution to unemployment insurance (2,6%)

- Zusatzbeitrag – Additional contribution

- SV-rechtliche Abzüge – Sum of all social security reductions, usually 50%

- SV-AG-Anteil (Sozialversicherung Arbeitgeber Anteil) – Sum of all social security contributions paid by the employer, usually 50%

Simple Germany’s Hot Tip

Should you ever decide to leave Germany and move back home or to another country, you may have the chance to request a refund of your pension insurance contributions. To find out more, read our guide below.

Read Our Related Guide

3. Summary of year to date (YTD or TD) income

On most payslips, you will find a bottom section (Verdienstbescheinigung), which sums up the total earnings and reductions of the year to date (YTD or TD).

Conclusion

Payslips in Germany are full of bureaucratic words referring to the comprehensive tax and social security system. I hope that you feel confident in reading and understanding your payslip with my translations and examples above. Be aware, though, that you might receive some personal benefits out of the scope of this guide. If they are unclear, it is best to talk to your HR department or supervisor.