Each year, I research the German market to find the best liability insurance for foreigners in Germany.

I found three amazing policies, which I will review in this guide. I signed up with all three insurance providers and researched their policies and onboarding process in-depth.

Let’s get started!

If you’re short on time, here is a quick overview:

- Getsafe Premium: If you’re looking for a great and customizable policy in English.

- Feather: If you’re looking for a good comprehensive policy with premium customer service in English.

- Axa L Package: A great comprehensive policy – however, only available in the German language.

I’ve prepared this table to help you compare the different private liability insurance policies in Germany at a glance.

| Getsafe Premium | Feather | AXA L | |

|---|---|---|---|

| Our Total Rating | 9.9 | 9.1 | 7.4 |

| English Website & Customer Service | |||

| Coverage in Euros | up to 50 million | up to 50 million | up to 60 million |

| Maximum Coverage per Harmed Person in Euros | up to 15 million | up to 15 million | up to 60 million |

| Monthly Cost | from €4,14 | from €4,94 | from €3,94 |

| No Deductible | Optional | Optional | |

| Cancel Anytime | Possible, but NOT by a click of a button | ||

| Damages to Rental Apartments in Germany | |||

| Good for Families | |||

| Key Loss (Private and Work) | |||

| Damages to Borrowed Things | |||

| Worldwide Coverage for Damages to Others | |||

| Worldwide Coverage for Damages to Holiday Rental Home | Europe only | ||

| Protection in Case the Person Who Harmed You Cannot Pay (Bad Debt) | |||

| Coverage of Legal Fees from Bad Debt Claims | |||

| Damages from Drones (up to 5 kg) | Add-on Available |

How did I choose and Rate the best liability insurance for expats in Germany?

I researched the German market to find the best liability insurance for foreigners in Germany. A super important criterion was English-speaking service, as well as great insurance coverage overall.

I found 3 amazing policies. I signed up with all 3 insurance providers and researched their policies and onboarding process in-depth.

Then, I ranked them based on their English and product friendliness, product quality, customer service channels, and digitalization. I provide a final score for each product using our Simple Germany Scoring System.

The one thing I could not test was the insurance claim process. For that, I relied heavily on user reviews on Google and Trustpilot.

You don’t have to break the bank to get private liability insurance in Germany. Choose one of these policies, and for under €5 a month, you can have coverage for up to 50 million euros for accidental damage to other’s property, unintentional injuries, or even less dramatic but costly events like losing your keys.

What is the best liability insurance in Germany?

One challenge was finding what makes a good private liability insurance policy. For this measure, I relied heavily on the test results published by Germany’s most trustworthy consumer association, Stiftung Warentest. At the end of this guide, I detail the criteria used.

After analyzing the results, I was pleasantly surprised that the English-friendly policies are just as good as the German ones.

All of the private liability insurances below have the following benefits:

✓ 100% digital – No unnecessary paperwork or snail mail

✓ Easy sign-up process – You can do it from the comfort of your home

✓ Cancel anytime – Flexibility in case you ever leave Germany

1. Getsafe

Getsafe, based in Heidelberg, was founded in 2015. Getsafe is Germany’s first company to challenge the traditional insurance business.

One of their main products is liability insurance. They offer two policies, a basic and a premium plan. I think you should only consider getting the premium policy from Getsafe. For €1 more a month, you get better coverage.

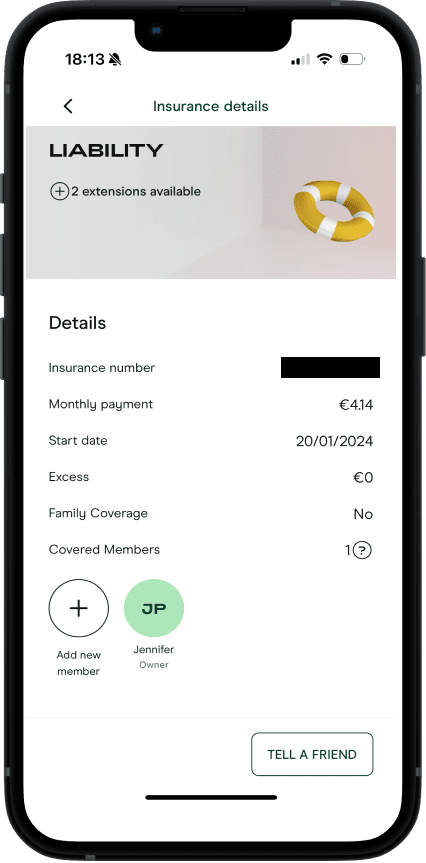

Their premium private liability pricing for a single person starts from:

- €2,70 /month with a 300 euros deductible

- €3,32 /month with 150 euros deductible

- €4,14 /month without any deductible

There is no real difference between paying a monthly or a yearly price.

Their premium policy covers up to 50 million euros in claims annually, with a maximum of 15 million euros per person harmed.

You can easily add family (partner, parents, or children) and drone coverage at a small extra cost. You can do so during the sign-up process or afterward.

Our Simple Germany rating for Getsafe

Here is our rating for the Premium private liability insurance policy from Getsafe:

Getsafe’s premium policy scores 10/10 in almost all categories, making it the best private liability insurance policy for English speakers in Germany. The one area of improvement is their onboarding process, where I found the steps to be tedious.

Product Quality

Note: One of our product quality ranking criteria was ‘Is the policy any good?’. We based our ranking of a good policy on the results published by Stiftung Warentest, Germany’s most respected consumer rating association.

Stiftung Warentest results: 0,9 (Getsafe’s Premium policy).

This is a really good score considering the scoring scale:

- 0,5 – 1,5: very good 👈

- 1,6 – 2,5: good

- 2,6 – 3,5: satisfactory

- 3,6 – 4,5: sufficient

- 4,6 – 5,5: poor

My Experience with Getsafe

I found the onboarding process smooth but with a few hiccups. I got an activation email, which took me to a screen telling me to download the app. I first had to go through a long form to create my account in the mobile app; then, I had to activate my policy manually 🙄.

Their terms and conditions of what is covered are easy to understand. They also provide an easy-to-scan overview of what is covered.

The only way to activate my policy was by downloading their mobile app. I have an iPhone, and in my experience, the mobile app is a bit slow.

I like that their app includes guides to learn more about insurance. The mobile app is not protected by any security measures (PIN or face ID). Reaching their customer service is easily accessible through their app. Although many customers complain that their response times are a bit long, I received a response within 48 hours after contacting them.

Get a 15 euro discount

Use our special Getsafe code SIMPLEGERMANY15 at checkout to get a 15 euros discount on your purchase.

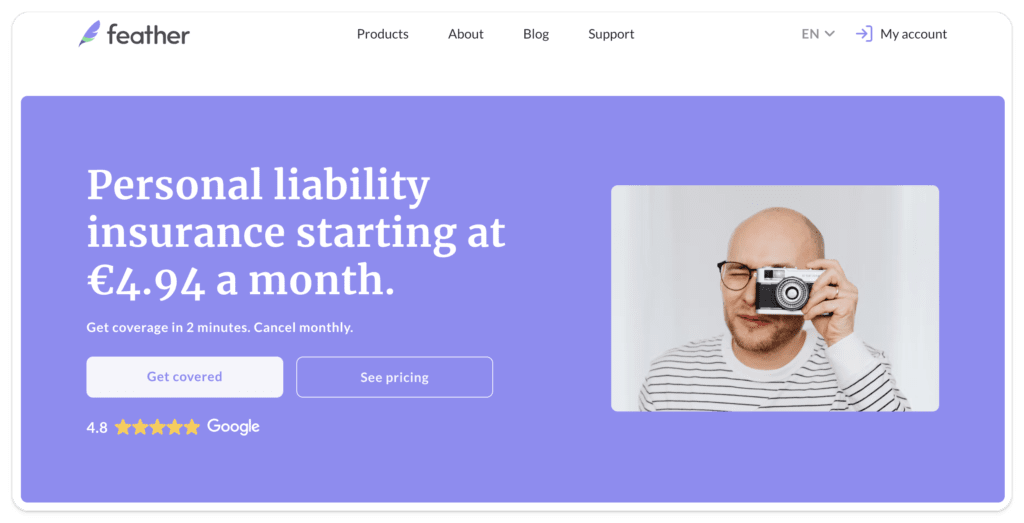

2. Feather

Feather Insurance was founded in 2018 and is based in Berlin. They are an insurance service provider that focuses heavily on expats in Germany. Their entire process is in simple and easy English and is highly efficient. Their goal is to make insurance in Germany easy for internationals.

Feather provides a good policy from Barmenia Allgemeine Versicherungs-AG. Even though they are a third-party provider, all claims and communications run through Feather. They do an amazing job of making the whole experience feel seamless.

Their private liability insurance policy starts at 4,94 euros a month for a single person without any deductible. The coverage is up to 50 million euros in claims annually, with a maximum of 15 million euros per person harmed.

You can easily add your partner, kids, and/or parents to your policy at an extra cost when you sign up. Their sign-up process is easy. Users are in love with their excellent customer service.

Feather is the only provider that offers the possibility to purchase their insurance before you arrive in Germany.

Our Simple Germany Rating for Feather

Here is our rating for Feather’s private liability insurance:

Feather’s private liability insurance is a great policy with almost a 10/10 in all of our ranking criteria. The low score in customer service channels is because I could not find a visible phone number to contact them. I can only schedule a call on their online calendar.

Unfortunately, it does not get a 10/10 in product quality.

Product Quality

Note: One of our product quality ranking criteria was ‘Is the policy any good?’. We based our ranking of a good policy on the results published by Stiftung Warentest, Germany’s most respected consumer rating association.

The lower score in their product quality is because their policy only covers damages to rental homes or apartments in Europe and not worldwide. The worldwide criteria is a new must-have in the study done by Stiftung Warentest. If this is not important to you, Feather’s policy is just as good as Getsafe’s.

Stiftung Warentest results: 2,6

Here is the scoring scale:

- 0,5 – 1,5: very good

- 1,6 – 2,5: good

- 2,6 – 3,5: satisfactory 👈

- 3,6 – 4,5: sufficient

- 4,6 – 5,5: poor

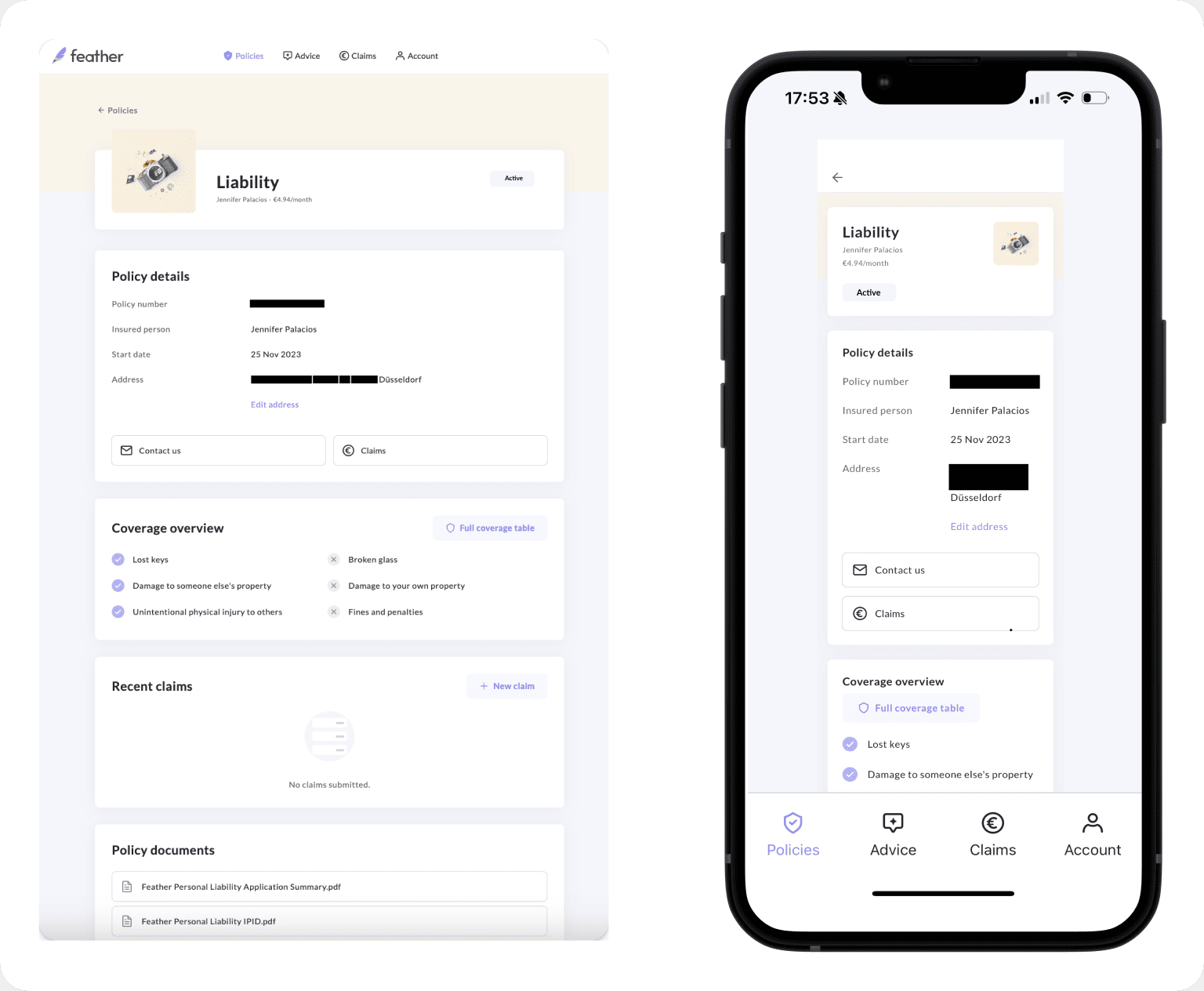

My experience with Feather

I found the onboarding process super smooth. I had no hiccups. Their communication was clear in every step of the way.

Their terms and conditions of what is covered are very legal-looking, making it a bit harder to understand. You can access your policy through their website.

I was able to beta-test their mobile application, which is coming soon. The mobile app was responsive and fast on my iPhone. It is very minimalistic, and you have the most essential information at a glance. Their mobile app has security protection through a PIN or face ID.

You can contact their customer service through their website or mobile app. I understand why their customers rave about their customer support. All of my questions were answered in around 24 hours. Their replies were very detailed and personal.

I’ve been a happy customer since November 2023. I chose Feather because of its lean sign-up process and premium customer service.

Related Review

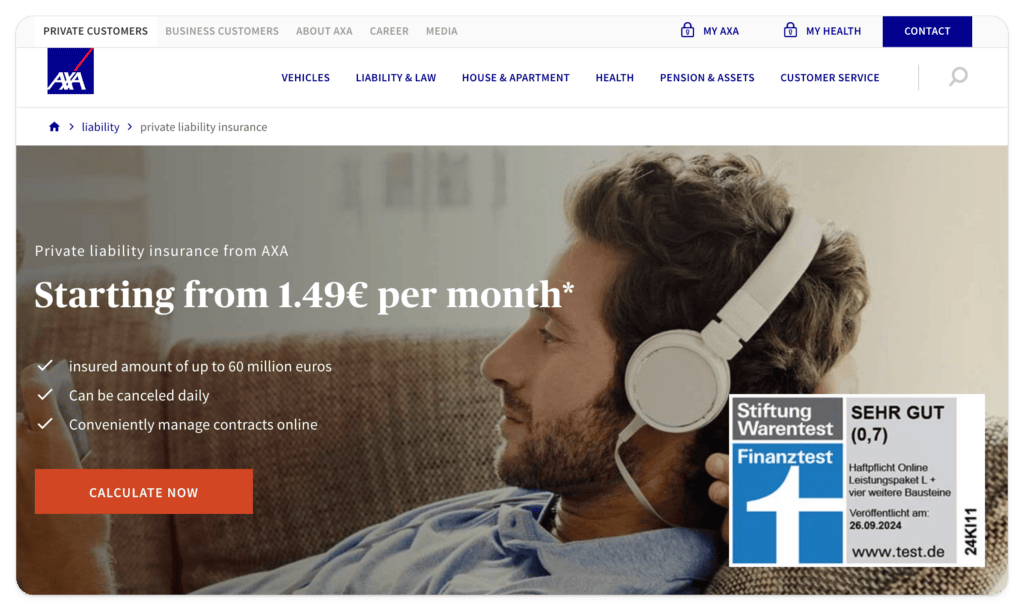

3. AXA

AXA is a traditional German insurance based in Cologne with a history that dates back to over 150 years. They have modernized and digitalized their insurance products, including private liability insurance. The main downside with AXA is that they mainly cater to the German market and have no customer support in English.

AXA provides a great private liability insurance policy. We are only comparing their best coverage plan – the L plan. It starts at just €3.94/month, you get coverage of up to 60 million euros in claims annually.

You can easily add your partner, family, and kids during sign-up. Their sign-up process is intuitive, and it guides you through the process. You can use Google or DeepL to translate the browser window into the language of your choice.

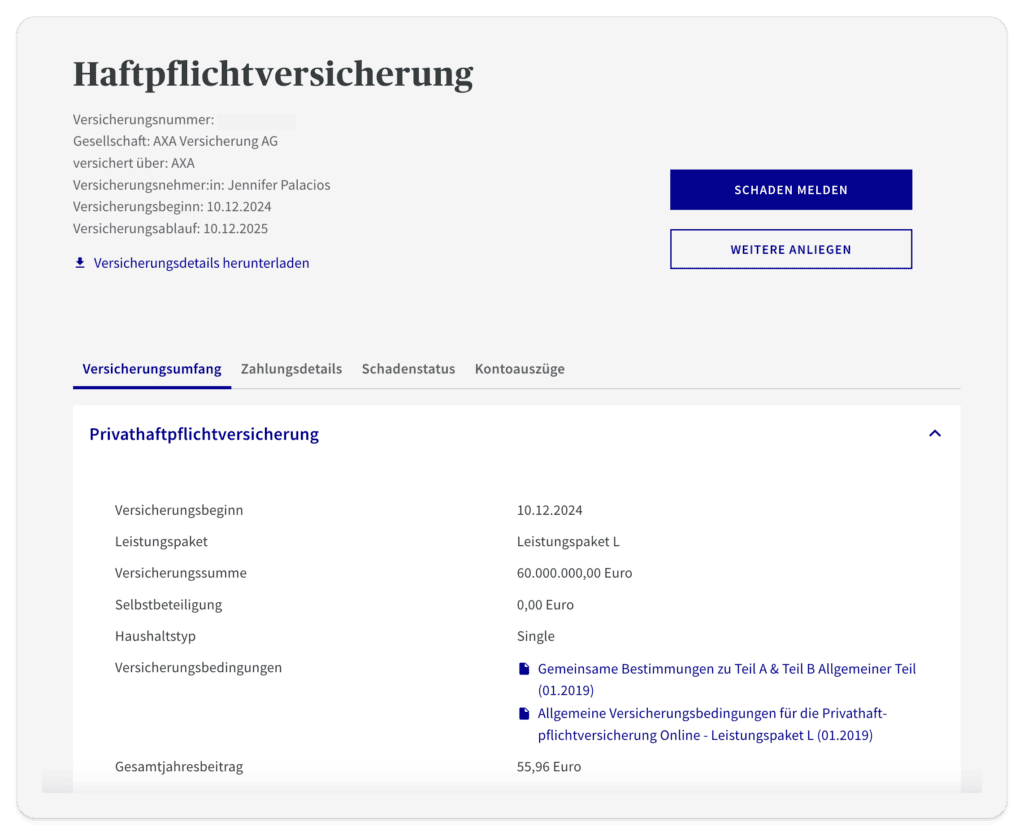

Our Simple Germany rating for AXA

AXA’s L private liability insurance policy is very good. Their biggest downside is that their entire product is in German only. We believe it is important that you understand all of the terms & conditions of an insurance you are signing up to. That’s why they received a 0/10 in English-friendliness.

Another ‘annoying’ factor is that even though the sign-up process and account management is fully digital, I had to wait 5 days to get a letter with my access code for my online account. This step has not been digitalized yet.

Another negative aspect of AXA is the fact that they advertise with daily cancelation. However, there is no option to cancel digitally via the customer portal. I have to either engage in a lengthy conversation with their chatbot or write an email or letter to cancel.

Additionally, you can only sign up if you have a European bank account since the only payment method available is to provide an IBAN number for direct debit. No card payment is available.

Product Quality

Note: One of our product quality ranking criteria was ‘Is the policy any good?’. We based our ranking of a good policy on the results published by Stiftung Warentest, Germany’s most respected consumer rating association.

Stiftung Warentest results: 0,7 (Axa’s L policy)

This is a really good score considering the scoring scale:

- 0,5 – 1,5: very good 👈

- 1,6 – 2,5: good

- 2,6 – 3,5: satisfactory

- 3,6 – 4,5: sufficient

- 4,6 – 5,5: poor

My experience with AXA

I found the purchase process quite simple and easy to follow.

The one thing I did not like is that you can only purchase a policy by providing an IBAN. Credit or debit cards are currently not accepted.

Additionally, I was only able to select quarterly, bi-annual, or annual payments. However, after purchase, I was able to change the payment method to monthly in my customer area.

I received my insurance application and terms and conditions quickly in my inbox.

However, I had to do an extra step to get a ‘Freischaltcode‘ to activate my account. I got this code via letter, which took 5 days to arrive.

Once the activation was complete, I was taken to my customer area, which looks quite lean and has all the relevant information at a glance.

In my customer area, I had to option to cancel my policy. I would have needed to write them an email or letter. I ended up revoking my contract.

Guide to buying liability insurance in Germany

Private liability insurance in Germany is a type of insurance coverage that pays in case you accidentally hurt someone else or break or damage their things.

Liability insurance in Germany is called Private Haftpflichtversicherung.

Here are some things you should consider when looking for liability insurance.

Liability insurance coverage

The German Insurance Association (GDV) has developed general conditions liability insurance in Germany needs to meet.

Based on these conditions, the highly respected German consumer organization, Stiftung Warentest, ran some tests. They evaluated more than 400 liability insurance policies. They published their results in 2023.

Here is a quick overview of the absolute minimum coverage a private liability insurance should have:

Overview Of What Private Liability Insurance in Germany Covers

Damages you might cause to someone else’s stuff.

The physical or mental damage you might cause to others.

Accidental damages to your rental home.

Damages you cause while driving a car.

Damages done by your pet (dog or horse).

Damages you cause to your stuff.

What Should A Good Liability Insurance In Germany Cover

After reading the results from Stiftung Warentest, here are the key factors you should consider when selecting liability insurance:

- Minimum coverage: Your policy should cover a minimum of 10 million euros in damages to others and their stuff and 500.000 euros to your rental apartment.

- Bad debt coverage: This covers you if a third party hurts you or your things, and they can’t pay for the damages. A court must rule that the person who did the damage does not have the money to pay you.

- Cross-liability claims: This includes unintentional physical harm to anyone in your household covered by your insurance policy.

- Voluntary work: Any damages you might cause while doing voluntary work.

- Worldwide coverage: If you hurt anyone or their things while abroad.

- Worldwide holiday apartment coverage: Any accidental damages you do to a holiday rental apartment or room worldwide.

- Gradual damage: Damage that occurs over time, such as moisture, soot, or smoke. For example, you drill through a wall and do not notice that you broke a water pipe. The insurance would cover gradual water damage.

- Cyber damages: If you accidentally send a virus or malware to someone else.

All three policies compared in this guide cover all 8 aspects above. The one exception is Feather’s policy with point number 6, as they do not cover damages to holiday apartments worldwide, just in Europe.

What Private Liability Insurance in Germany Does Not Cover

No matter how good a liability insurance policy is, it will most likely not cover:

- Intentional damages.

- You get the insurance after you’ve done the damage.

- You get fines or penalties for doing something unlawful.

- Damages in your apartment as a result of mold growth.

- Your kids draw on the walls of your rental apartment (you have to repair that yourself).

- Damages by your dog → dog liability insurance covers this.

- Damages or theft to your stuff (electronics, furniture, etc.) → home contents insurance covers this.

- Damages while driving a car → car liability insurance covers this.

Who does it Protect?

You can add anyone who lives with you, including parents, children, partners, and au pairs, to your private liability policy. The one requirement is to live in the same household.

Examples of when private liability insurance in Germany is a life-saver

Example 1: You’re running late for work. You cross a red pedestrian light. A driver swivels his car to avoid hitting you and crashes. Their injuries are bad, and they won’t be able to work for some time.

The driver’s health insurance covers the medical expenses – at first. The driver will be asked how they got hurt, and they will explain they were trying to avoid hitting you. The driver’s health insurance will go after the person responsible to claim their costs. In this example, it would be you.

In addition to medical expenses, you are responsible for other costs such as “pain and suffering” damages to the driver, damages to the car, and damages caused by the car during the accident. This claim could easily be tens of thousands of euros. It could ruin any private person financially. But if you have private liability insurance, you’re covered.

Example 2: An old water pipe breaks in your apartment. There is severe damage to both your rental apartment and your neighbor’s.

Who pays?

- Your landlord’s building insurance should cover the repair of the water pipe.

- Your private liability insurance should cover the damages to the floor of your rental apartment and your neighbor’s apartment and stuff.

- Your home contents insurance should cover the damages to your things like furniture and appliances.

Example 3: You turn off your radiators while you are on holiday. You set the thermostat to 0, which is below the snowflake icon. A snowflake on the thermostat marks the minimum temperature needed to prevent pipes from freezing in winter. The pipes freeze. The water pipe breaks. There are damages to both your rental apartment and your neighbor’s.

Who pays?

- Your landlord’s building insurance can reject the claim because it’s something you caused.

- Your private liability insurance should cover all the costs.

- Your home contents insurance should still cover the damages to your stuff like furniture and appliances.

The cost of liability insurance

Private liability insurance in Germany that covers up to 50 million euros in damages can cost as little as 45 euros a year for a single person or 63 euros a year for the whole family without any deductible. That’s only 4 or 5 euros a month!

The Consumer Protection Association in Germany (Verbraucherzentrale) recommends that liability insurance should cover at least 10 million euros in damages.

Monthly vs. Yearly Payment

While searching for liability insurance in Germany, consider whether you would like to pay a monthly or yearly fee. Unlike an annual contract, a monthly one will allow you to cancel it anytime. Since there is no real price difference, I chose a monthly plan to keep my flexibility.

Deductible

Getting a policy with a deductible will make your liability policy cheaper. A deductible is the amount you contribute from your pocket before your insurance kicks in to help with the costs.

F.A.Q.s

Requirements For Private Liability Insurance In Germany

To get a third-party liability insurance policy in Germany, you need to:

- Be 18 years or older.

- Live in Germany – you need to have a German address*.

*Feather is the only private liability provider allowing you to purchase it from abroad.

Is liability insurance mandatory in Germany?

No, it is not mandatory. However, you should get one, as you are responsible for damages you cause to third parties and their things. Over 80% of Germans have it. You can have peace of mind for as little as 4 euros a month. If you ever accidentally cause damage to others and their property, you don’t have to worry about it.

Why do Germans have liability insurance?

By German law, you are liable for any damages you cause to others and their property. Liability cases are taken seriously. Alone in 2022, the insurance providers paid over 5 billion euros in liability claims.

How Do You File A Claim With Your Liability Insurance?

If your liability insurance covers your case, you need to:

- Take some pictures of the damage.

- Gather the details of the person you did damage to. This includes email, postal address, and phone number.

- Find the invoice – if the damage was done to a thing.

- Submit your case to your insurance provider.

- Wait for the claim to be processed – it can take from a few days to a few months (depending on the claim).

Be attentive to your postal mail and email – insurance providers might have follow-up questions.

Which insurances are required by law in Germany?

The following insurance is required by German law in Germany:

- Health insurance – depending on your situation, you can get public or private health insurance.

- Car Liability Insurance – if you own a car.

- Dog Liability Insurance – in some German states, if you own a dog.

What Are The Benefits Of Having Private Liability Insurance In Germany?

The first benefit is that you have peace of mind if you do anything wrong in an unfamiliar culture. On top of that, you get worldwide coverage of at least 50 million euros from as little as 4 euros a month!

Conclusion

After reviewing the three liability insurance providers above, picking a clear winner is tough. Here are my conclusions:

- Getsafe Premium: With a 9.9/10 score, this is the best policy overall.

- Feather: With a 9.1/10 score, it is a good policy with fantastic customer service and onboarding process. The only big difference to Getsafe is that they don’t cover damages to holiday rentals worldwide.

- AXA L: With a 7.9/10 score, it is the best option from a traditional German insurer. Watch out, as everything is in German.

I hesitated to get this insurance during my first 2 years in Germany. After meeting my now-wife, Yvonne, who is German, we discussed this topic. She explained the importance of this insurance. Suddenly, it all made sense! I got my policy the next day.

Learn from my mistakes and get your policy as soon as possible!