I’m excited to write this Feather Insurance review for you. I’ve been a happy Feather customer since 2023. I love their products because they aim to make our lives as expats in Germany a lot simpler.

Here are the key takeaways of this review:

Feather Insurance Pros

Flexible plans – you can cancel most policies at any time

Great insurance coverage

Stellar customer service – they are one of the best in Germany

Digital account management – no snail mail ever!

Everything (including terms & conditions) is in English

Feather Insurance Cons

No immediate customer service – communication happens mainly through email or a pre-set appointment

Not the cheapest policies in the market – compared to other providers

Reasons to get Feather Insurance

💪 Great coverage

Feather Insurance has a strong standing in the German insurance market.

Their policies offer great coverage when compared to insurance providers that are just in German.

I like them because they focus on lean, honest, clear, and modern policies to cover all the needs of expats in Germany.

⚙️ Insurance policies that you can easily manage

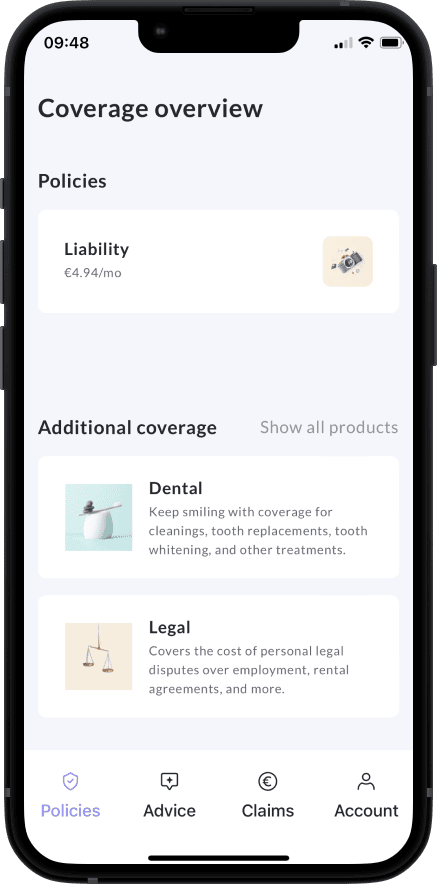

With their website and mobile app (for iOS & Android), you can easily access your policy’s terms and conditions, cancel your policy, submit claims, and get new policies.

🤯 An insurance that doesn’t send you unnecessary paperwork

Feather Insurance is a fully digital insurance provider. So you don’t have to worry about missing important snail mail. They communicate either via email or through your account (which you can access through their website or mobile app).

🚀 Flexibility on your contract

You can cancel most of your Feather Insurance policies every month. They don’t tie you to a 24-month contract (which is common in Germany).

You can easily cancel your policies through their website or mobile app on a monthly basis. It’s as easy as clicking a button. In the majority of cases, you don’t need to contact their customer service or send a lengthy email explaining why you want to cancel.

⭐️ Great customer service

The reviews for Feather Insurance in Germany on Trustpilot are impressive. It’s one of the few companies I’ve seen with 4.9 stars.

I can also confirm that every time I’ve reached out to them, they’ve replied to my inquiries in a quick, personalized, competent, and friendly manner.

💬 English language support

I love that Feather Insurance has focused on developing its products and experience with English as a priority.

Everything is in English – the terms & conditions, their customer service, your customer portal, and filing for claims.

So, if you’re not comfortable with German yet, you can rest assured that you will be able to communicate with Feather easily.

Cons you should consider before purchasing Feather Insurance

🐌 You can’t reach them immediately

At the time of writing this review, Feather does not offer a hotline that you can call to ask your questions directly.

You always have to either send them a message through their website or schedule a call with them.

In my experience, I’ve received a reply to my messages within 24 hours. I’ve also found slots that would allow me to speak to someone at Feather in as little as 48 hours.

💎 Expensive policy prices – compared to other competitors

Feather Insurance is not the cheapest option in the market when it comes to insurance policies.

They make it clear on their website that their focus is on quality and not on quantity.

In my opinion, the decision of whether to purchase an insurance policy or not should not be solely based on the price. Instead, it should be based on the coverage, how quickly the claims are solved, and the ease of communication.

Before I got my insurance with Feather, I would have to jump through several hoops to communicate with my insurance provider. The claim resolution process would be slow, and I would need to wait for snail mail to arrive to proceed with easy processes.

Frequently Asked Questions

Is Feather insurance good?

Yes! With over 55.000 customers, more than 3.500 successful claims, and 4.9 stars in review sites like Trustpilot, Feather Insurance has made a dent in the insurance world in Germany.

Is feather insurance legit?

Yes. Feather Insurance has solved over 3.500 insurance claims successfully since 2018. Their founders have both been expats and are committed to simplifying & digitalizing the insurance market in Germany.

What products does Feather Insurance in Germany offer?

🔥 Recommendation Tool

One of Feather’s most popular products is their recommendation tool. Based on your lifestyle, their tool recommends what insurance policies you should consider.

They don’t require your email, phone number, or payment information to provide you with transparent advice.

At the time of writing this, Feather has 17 insurance policies you can choose from:

- Public health insurance: You can choose to sign up for Barmer, TK, DAK, or AOK. Feather acts as a middleman between these German public health insurance providers and you.

- Private health: If you qualify for private health insurance, Feather can help you set up your policy with high-quality private health providers in Germany.

- Expat health: The perfect interim health insurance for new arrivals in Germany, freelancers, visa seekers, students, post-doctorates and researchers, mini jobbers, or interns.

- Student health: If you’re going to do your studies in Germany and you’re under 30, you can get this specific health insurance.

- Travel health: Worldwide coverage for dental care, in-patient and out-patient treatment, rescue & repatriation, pregnancy complications & medical prescriptions.

- Dental: An add-on for those with public health insurance. It covers things like preventative treatments, high-quality fillings, tooth replacement, root canals, crowns, and more.

- Personal liability: The #1 insurance all internationals need to have in Germany. It covers the damages you accidentally cause to others or their property. I’ve been a happy customer of their private liability insurance policy since 2023.

- Legal: An insurance that will cover the lawyer fees, court costs, and other fees related to any legal proceedings.

- Life: If you’re the sole breadwinner in your family, this insurance will pay your family a set amount in the case of your death.

- Income protection: If you’re no longer able to work due to an occupational disability (like burnout or chronic back pain), this insurance will pay out a monthly sum to cover your expenses.

- Household: An insurance that covers the damages to the stuff in your home in case of a fire, flood, or burglarly. If you have expensive things, you should consider getting it.

- Bike insurance: It covers the cost of replacing your bike if it gets stolen. If you have a nice bike, you should consider getting this. Bikes get stolen in Germany frequently.

- Dog liability: If you own a dog, you should get this insurance. In some states, it is mandatory to have it. It covers the costs if your dog causes damage to someone else or their property.

- Pet health: A nice-to-have insurance for dog owners. It covers costs like surgery, checkups & medications.

- Private Pension: A supplement to your public pension insurance in Germany. If you plan to stay in Germany long-term, you should consider this insurance.

- Basis/ Rürup pension: Another supplement to your public pension insurance in Germany subsidized by the government. You should consider it if you plan on staying in Germany long-term and retire here.

- Company insurance policies: Feather can help you get any insurance for your company. For example: company health, life, pension, and cyber liability.

Related Guides

If you would like more details about each insurance, make sure to check out our Insurance in Germany section.

Feather Insurance cancellation

Most of Feather’s insurance policies can be canceled at any time.

Here is an overview:

- Cancel monthly: expat, personal liability, legal, life, income protection, household, bike, dog liability, pension.

- Yearly cancellation: travel insurance & dog health. You can cancel it so it doesn’t renew.

There are other insurance policies that have their own terms and conditions for cancellation:

- Dental Insurance: If you don’t have any claims, you can cancel every month. If you do have claims, you need to wait one year.

- Basis / Rürup: You can pause your contract and stop paying into it. However, you can never cancel it.

Good to know

If you’re moving away from Germany, you can cancel any policy as long as you show your Abmeldung, regardless if you purchased a yearly or monthly contract, except for the Basis Rürup plan.

The Story of Feather Insurance – A Company That Aims to Help Expats

For this review, I would like to provide a bit more context on who the founders are and their motivations for creating this company.

Rob Schumacher

According to an interview on Medium, Rob was born in Germany.

When he was 3, he moved with his parents to the UK. When he was an adult, he moved back to Germany.

He’s the insurance genius behind the company. He has a Ph.D. in insurance mathematics.

During the process of signing up for health insurance, he realized how bureaucratic the whole process was. He had to fill out multiple forms and talk to an insurance agent multiple times.

He was not impressed or happy with his experience. He wanted to do something about it.

Vincent Audoire

According to an interview on N26’s blog, Vincent was born and raised in France. He moved to Germany to work as an iOS developer.

His dream was to found his company one day. He was one of the first developers in the N26 team.

He and Rob met at Entrepreneur First, an incubator based in Berlin. They both shared the pain of signing up for insurance in Germany and believed that together, they could change the market.

In 2018, they founded Feather. Today, they are one of the pioneers in making the sign-up to insurance policies in Germany a breeze.

At their core, they believe in referring the insurance policies that make sense to your lifestyle instead of pushing you to purchase all kinds of unnecessary insurance policies.

Conclusion of this Feather Insurance Review

Feather is a great option if you’re looking for a modern, digital, fully in-English insurance provider with great coverage and customer service.

The one downside of their customer service is that you cannot talk to them immediately. All of their communication is done through mail. In my experience (and from other reviews), their customer service is quick to reply.

If you’re unsure about which insurance to get for your lifestyle, you can use Feather’s recommendation tool. It aims to provide you with transparent advice.