If you want to move with your dog to Germany or get one here, you need to be aware that you might need two types of insurance for your four-legged friend: dog liability insurance and health insurance.

In this guide, we will explain the difference between liability and health insurance for dogs. We will also share what are the best dog insurance in Germany for expats. We hope this guide helps you decide whether to get one or both insurances for your dog while you live in Germany.

If you are short on time and just want an answer. Here are the best pet insurances in Germany:

- Getsafe – dog liability (50 million cover) and pet health insurance, with no deductible possible, and everything is available in English.

- Feather – dog liability insurance (20 million cover) and pet health insurance, all in English and all digital.

| Getsafe | Feather | |

|---|---|---|

| English Website & Support | ||

| Dog Liability Insurance | ||

| Dog Health Insurance | ||

| Coverage in Euros (Liability) | up to 50 million | up to 20 million |

| No Deductible (Liability) | ||

| Cancel Anytime | Liabilty: yes Health: only after 1 year | Liabilty: monthly Health: only after 1 year |

| Monthly Cost (Liability) | from €2,40 | from €5,58 |

| Monthly Cost (Health) | from €4,30 | from €18,10 |

What is the best dog insurance in Germany?

Here are our top picks for the best dog liability and health insurance providers in Germany.

1. Getsafe

Getsafe is a popular option for expats. Their services, contract, and website are all available in English. Their customers seem to be happy with their customer service and their app’s usability.

Dog Liability Insurance

Starting at 2,40 euros a month with no deductible, Getsafe offers dog liability insurance for up to 50 million euros in damages. They offer a Comfort and Premium plan. The Premium plan includes bad-dept cover, in case a third party cannot financially cover damage done to you or your dog.

Getsafe dog liability insurance benefits:

✅ Website, contract, and customer service available in English

✅ Up to 50 million euros of coverage

✅ No deductible possible (if desired)

✅ Easy to find everything that is covered

✅ Worldwide coverage – up to 5 years of being abroad

✅ Cancel anytime

✅ Waiver for payments up to 12 months in case of unemployment

✅ Cover for all breeds possible

With our special Getsafe code SIMPLEGERMANY15, you even get a 15 euros discount.

Dog Health Insurance

With Getsafe’s pet health insurance you can choose between three plans. OP Protection Comfort which covers medically necessary surgeries, or Full Cover Comfort or Premium, which also include cover for general vet costs for non-surgical curative treatments.

Both Comfort plans cover up to 5.000 euros for dogs per year, while the Premium plan has an unlimited insurance sum. The price starts from 10,50 euros a month for the basic surgery cover. You can lower the monthly price by choosing a 10% or 20% deductible.

Next to physical vet visits, Getsafe also offers 24/7 unlimited vet video consultations. Every policy comes with a 1-month waiting period, except for accidents. Certain diseases such as joint dysplasia, heart disease, or arthrosis may have a waiting time of one year.

All breeds can be insured, but only until the age of 8 years, in most cases even with pre-existing conditions. Those will be excluded from the cover though.

Getsafe Pet health insurance benefits:

✅ Choice of surgery only or full health cover

✅ Pays the vet costs up to 4 times the rate of the official fee schedule

✅ Their surgery and vet insurance is available with 0% deductible

✅ Worldwide cover for up to 12 months

✅ Insurance can be purchased for all breeds

✅ Free selection of vet and clinic

✅ 24/7 unlimited vet video consultations

✅ Animals with pre-existing conditions get accepted

✅ Direct payment to vet – no reimbursement necessary

✅ Easy to find everything that is covered

Getsafe Pet health insurance drawbacks:

⛔️ 1 month waiting period

⛔️ Cancel anytime only possible after 1 year

⛔️ For dogs younger than 8 years

⛔️ Only available for 1 pet per household

With our special Getsafe code SIMPLEGERMANY15, you even get a 15 euros discount.

2. Feather

Feather is the second English-speaking provider offering dog liability insurance and pet health insurance. Feather is a German all-digital insurance service provider that focuses on expats in Germany.

Related Review

Dog Liability Insurance

Starting at 5,58 euros a month, Feather offers dog liability insurance for up to 20 million euros in damages as part of their portfolio. Currently, they don’t cover purebred dogs that are considered dangerous. Their best coverage guarantee promises that Feather will cover any claim that would be covered by other dog liability insurance in Germany.

Feather dog liability insurance benefits:

✅ Website, contract, and customer service available in English

✅ Up to 20 million euros of coverage

✅ Worldwide coverage

✅ Cancel monthly

✅ Best coverage guarantee

Feather dog liability insurance drawbacks:

⛔️ Dangerous purebred dogs can’t be covered

⛔️ No T&Cs listed to see the full cover in detail

Dog Health Insurance

A new addition to the Feather Insurance offering is pet health insurance for dogs and cats. Starting from 18,10 euros a month, depending on the age and breed of your furry friend, will determine the cost of the chosen plan. Currently, there are two plans to choose from: Surgery and Standard Plan.

Feather Dog Health Insurance Benefits:

✅ Choice of surgery only or full health cover

✅ Pays the vet costs up to 3 times the rate of the official fee schedule for regular cases and up to 4 times for emergencies

✅ Their surgery and health insurance is possible with 0% deductible

✅ Worldwide cover for up to 12 months

✅ Free selection of vet and clinic

✅ Video consultations included in the Standard Plan

✅ Customizable plans

✅ Available for more than 1 pet per household

Feather Dog Health Insurance Drawbacks:

⛔️ Surgeries for pre-existing conditions not covered

⛔️ Pets must be younger than 9 years on the insurance policy’s start date

⛔️ 1 month waiting period

⛔️ Cancel anytime only possible after 1 year

Dog liability insurance in Germany – Everything you need to know

Dog liability insurance in Germany covers the financial damages caused by a person’s four-legged friend to a third party.

In Germany, every dog owner is legally liable for the damages caused by their pet to third parties – even if the owner is not present while the dog causes trouble or if someone else is looking after them. You will need to purchase dog liability insurance as your private liability insurance will not help you in these cases.

For example, you enter a shop and leave your dog Lukas outside. Lukas is tired and decides to lie down on the floor, directly in front of the door. A customer from the shop exits and does not see that Lukas is there, trips, and falls. She sues the owner for 15.000 euros. In court, the judge rules that the owner should pay this amount. If the owner does not have dog liability insurance, they need to pay from their pocket.

No matter how well-behaved your furry friend might be, shit always happens. According to the Federation of Private Insurers in Germany (GDV), every year, dog liability insurance companies pay over 80.000 claims caused by four-legged friends. On average, such damages cost around 1.000 euros. However, there are around 100 accidents per year that cost 50.000 euros and more.

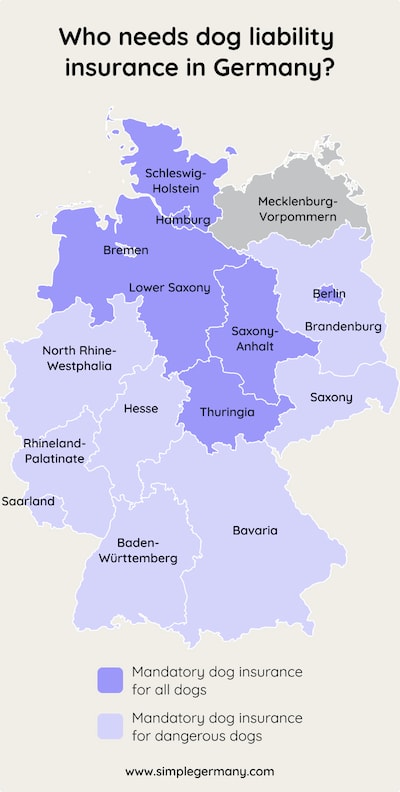

Who needs dog liability insurance in Germany?

Dog owners in Germany are legally liable for the damages caused by their dog to third parties in all sixteen German states.

Six out of the sixteen German states require dog owners, regardless of their dog breeds, to have liability insurance by law: Berlin, Hamburg, Lower Saxony, Saxony-Anhalt, Schleswig-Holstein, and Thuringia.

North Rhine Westfalia requires you to have dog liability insurance if you own a dog with a shoulder height of more than 40cm or a weight of more than 20kg.

Each of these states has a different minimum required for the damages the policy has to cover.

| State | Minimum Personal Injury | Minimum Property Damage |

|---|---|---|

| Berlin | €1 million | €1 million |

| Hamburg | €1 million | €1 million |

| Lower Saxony | €500.000 | €250.000 |

| Saxony-Anhalt | €1 million | €500.000 |

| Schleswig-Holstein | €500.000 | €250.000 |

| Thuringia | €500.000 | €250.000 |

| Source: hundehaftpflichtversicherungen-vergleich.de | ||

In most other federal states, only dog owners of dangerous breeds have to have dog liability insurance. Dangerous dogs might include American Staffordshire Terrier, Staffordshire Bull Terrier, and Pit Bull Terrier.

Remember, even if your state does not require you to have dog liability insurance, you are still liable for any damage your dog might cause.

What does dog liability insurance cover in Germany?

Dog liability insurance in Germany usually covers the following five areas:

- Personal injury: The costs of medical care a third-party needs because your dog caused them harm. For example, your dog bites your neighbor.

- Property damage: The costs of repairing damages your dog did to buildings, flats, living quarters, or other property.

- Broken things: The cost of repairing or replacing things your dog breaks, like chewing a friend’s shoe or breaking a fancy flower pot.

- Financial loss: Any situation where your dog caused a financial loss to someone. For example, your dog causes someone to be late for a business meeting, and they lose a contract with a client.

- Passive legal fees: The legal and lawyer fees you might incur for fighting an unjustified claim in court.

Good liability insurances will also include:

- Worldwide coverage: Dog liability insurance from a German provider usually covers your dog for all stays outside Germany.

- Without leash: Damages caused by your dog when they are without a leash.

- Self-defense: Damages caused by your dog because they defend themselves.

- Bad debt protection: If the dog owner who hurt your dog does not have insurance, your dog liability insurance will cover the costs.

- Foreign guardian: The insurance would still cover the damages your dog causes even if a friend or family member is watching over them.

Depending on the insurance provider, you can purchase the following add-ons:

- Unintentional mating: If a male dog mates with a female dog without the owner’s permission, the owner of the male dog must pay for the damages that arise due to the unwanted pregnancy.

- Damage to rented property: For example, your dog pees in a rental car.

- Puppies: This applies to female dogs; their offspring have liability protection for up to six or twelve months (depends on the insurance provider). This does not apply if the puppy is given to someone else.

- Dog health insurance (with surgeries included): covers the vet’s bills for medically treating your dog.

What does dog liability insurance NOT cover in Germany?

Most dog liability insurance do not cover:

- Specific dog breeds: Some insurance providers have a list of dog breeds not covered by the policy.

- Damages to your property: If your dog damages your property or accidentally injures you or people living in the same house as you.

- Intentional damages: For example, if someone intentionally commands their dog to attack someone.

- Wear and tear: For example, if your dog scratches the parquet floor in your apartment with their long nails every day. Your dog would cause wear and tear to your floor and therefore the insurance would not cover this.

- Glass damage: In case your dog breaks mirrors or glass doors.

- Some electrical appliances: Damages to heating and electrical and gas appliances.

Dog health insurance in Germany – Everything you need to know

A visit to the vet is unavoidable if you have a dog. Whether it is for a general check-up, to get vaccines, or due to an accident or illness. The bills you get from such visits can sometimes be thousands of euros.

If you don’t want to pay for your dog’s visits to the vet from your pocket, we recommend purchasing dog health insurance.

There are two types of dog medical insurances in Germany:

- Dog health insurance

- Dog surgery insurance

Simple Germany’s Hot Tip

If you want to have your dog covered against all medical costs and possible surgeries, you should consider getting premium insurance that covers both cases.

What does dog health insurance cover in Germany?

Dog health insurance in Germany usually covers the following five areas:

- Outpatient and inpatient treatments: for example, an ear infection.

- Checkups: For example, to get vaccinations.

- Medicine

- Diagnostics: for example, x-rays, MRIs, ultrasounds.

- Accommodation in a veterinary clinic.

Good to know

Most dog health insurance allow you to choose whichever vet you pick to treat your four-legged friend.

Things to consider before purchasing a medical insurance for your dog:

- Age and breed: Be aware that your dog’s age and breed will have an influence on the price of the policy. The younger your dog is, the cheaper medical insurance policies tend to be.

- Vet fees: In Germany, there is an official fee schedule for veterinarians (a.k.a. GOT), which is set by the government. Vets are allowed to charge up to 3 times the amount established in the GOT. So make sure that your insurance explicitly shows that they will pay for claims that are up to three times more than the official fees so you are fully protected.

Conclusion

The insurance coverage you should choose depends on your personal wishes, your dog’s needs, and your financial situation.

Getsafe offers a higher cover from the start and pays up to 4 times the rate of the official fee schedule. The 24/7 video consultation with vets is a handy add-on.

We hope your dog remains healthy! 🐶