Germans do not like to leave things to chance. Avoiding risk and debt is somewhat in their DNA. That is why to no surprise; you must have car insurance in Germany when owning your own ride.

In this guide, we will give you the lowdown on the best car insurance in Germany. We will explain what car insurance you really need to have and what car insurance you should have. We will also give you some tips on how to pay less for your policy and whether or not you can use your current license on the German roads.

Is car insurance required in Germany?

Yes, it is! Anyone owning a car is legally required to have car liability insurance. In fact, you need a car liability policy to register your car.

By law these are the minimum coverage amounts for your car liability insurance:

- Up to 7.5 million euros in personal injury

- Up to 1.12 million euros in property damage

- Up to 50,000 euros in financial loss

Watch out

Do not confuse this one with your private liability insurance. Ideally, you have both.

3 car insurance types in Germany

Car insurance (Kfz Versicherung) in Germany is made up of three different types. Here is a quick overview of car insurance in Germany.

| What is covered | Haftpflicht | Teilkasko | Vollkasko |

|---|---|---|---|

| Damage to other people and vehicles | |||

| Theft and break-in attempts | |||

| Fire, flood, or other weather-related damages | |||

| Collisions with animals | |||

| Broken or cracked windows | |||

| Replacement of car locks, in case of lost or stolen car keys | depends on contract | depends on contract | |

| Gross negligence | depends on contract | depends on contract | |

| Damage to your own vehicle in an accident | |||

| Vandalism | |||

| Hit-and-runs |

1. Kfz-Haftpflichtversicherung (Car Liability)

As with all liability insurances, your car liability insurance covers damages caused to third parties. This must include damages to other people as well as property. In easier words, this insurance pays the damages you cause in an accident to others. It does not cover the damages to your car or health.

Since you are 100% liable for any damages you might cause to others in Germany, car liability insurance is required by law. 20% of German cars only have car liability insurance. Those are mostly older cars with little value.

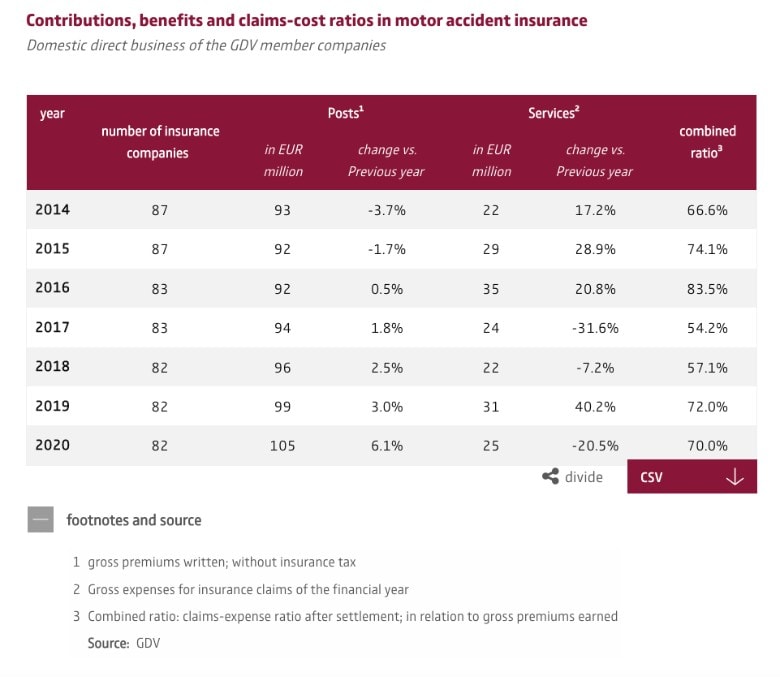

2. Teilkasko (Partial Cover)

Partial insurance cover includes car liability and adds cover for damages of random acts of nature to your car. The following cases are usually insured:

- Fire or explosion

- Theft

- Robbery

- Damages caused by nature (storms with windspeeds above 8, hail, flooding, lightning)

- Damages to your car’s wiring caused by a short circuit

- Broken glass (for example a broken or cracked windshield)

- Wild animal accidents & bites from marten (similar to a raccoon)

- Some policies also cover damages caused by snow or roof avalanches

However, vandalism is not covered by partial insurance cover.

Simple Germany’s Hot Tip

Be sure to check your policy regarding the bites from marten and wild animal accidents. Your policy should cover not only the bites of a marten but also the resulting damages. As for wild animal accidents, your policy should cover all animals. Be careful, as some policies might exclude dogs and cows.

30% of all car owners in Germany are covered with Teilkasko insurance.

3. Vollkasko (Comprehensive Cover)

Comprehensive car insurance covers pretty much everything. It includes car liability insurance and partial cover. As extra coverage, it also includes vandalism and damages to your own car, even if you caused the accident. In the case of a hit and run, your comprehensive car insurance will still cover the damages to your car.

Most cars that have comprehensive insurance are worth more than 15.000 euros. It goes without saying that the comprehensive insurance cover is the most expensive one.

How to decide what types of car insurance to get?

Whether you should only get liability insurance or add Teilkasko or Vollkasko to it depends on your car’s value and your living circumstances. Ask yourself the following questions: what is your car worth? Should it be fully destroyed within the next year by a hit and run, will you be able to replace it with a car of equal value? If the answer is no, you might want to opt for Vollkasko.

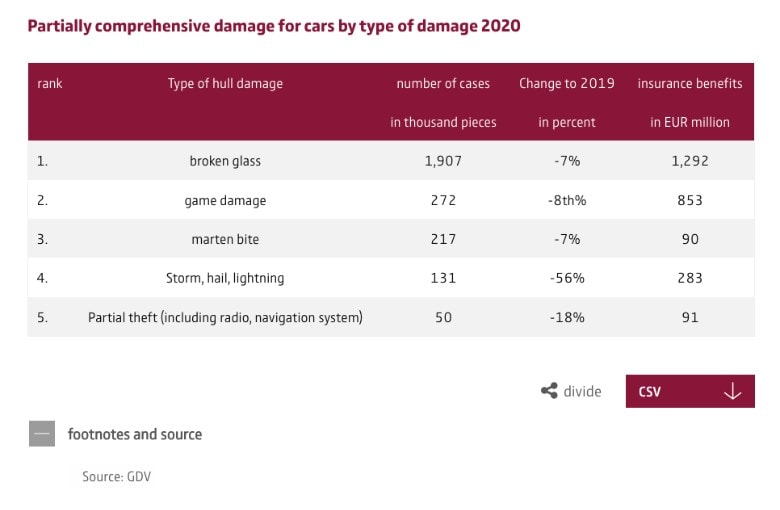

How much does car insurance cost in Germany?

According to the German Insurance Federation (GDV), the average annual car insurance premium in 2020 in Germany costs about 258 euros for liability, plus 329 euros for the fully comprehensive add-on, or 85 euros for the partial cover add-on.

These numbers can give you an idea; however, the factors defining your car insurance cost are as diverse and complicated as German grammar. Do not worry, though; we will help you through the jungle.

9 biggest factors that have an impact on the price of car insurance in Germany:

- The type of car you are insuring (diesel or petrol, amount of accidents this type of car had in the past three years, etc.)

- The years of driving experience you have

- Your previous driving record

- How many drivers you are insuring

- Your age and the age of the youngest driver

- Your postal code (whether you live in a city or more rural area – some areas have a higher theft and vandalism likelihood)

- How many kilometers you will be driving per year

- How you will use your car – for private or business purpose

- Where you will most often park your car overnight (whether outdoors, a private garage, a collective garage, etc.)

How to pay less for car insurance in Germany?

The following 8 tips can help you save money on your car insurance.

1. Choose a deductible

As with any insurance policy, the higher the deductible, the lower the insurance policy’s cost. Since damages to cars tend to be more costly, Stiftung Warentest recommends a deductible of 150 euros with Teilkasko and 300 euros with Vollkasko, to reduce the cost of your car insurance.

2. Choose annual pay

When paying your car insurance policy once a year, you will end up paying less than if you pay monthly or quarterly. Plus, not all providers offer monthly payments.

3. Estimate your annual mileage realistically

The more kilometers you will be driving per year, the higher the chance that you will be involved in an accident. Thus the more kilometers you put down in the sign-up process, the more your insurance policy will cost.

If you are not entirely sure, what the next year will bring, and where your new ride will take you, do not worry. Give the most realistic estimate you can and then have an eye on your mileage. Compare the numbers after six months. If you under- or over-estimated your mileage, simply contact your insurance company.

Should you drive more, you will have to pay more. Should you drive less, your policy will be reduced for the next year, and if you are really lucky, you might even get some money back for the year you paid already.

4. Transfer your current driving record

A lot of German insurance companies accept your current driving record, depending on your home country. Should you have a clean record without any accident for a few years, this will tremendously lower your car insurance cost. To apply it, ask your previous insurance company for an official summary of your good driving history and hand it to your new German car insurance.

5. Stay accident free

For each year that you stay accident-free and do not use your car insurance, you receive a no-claim bonus. However, if you cause an accident or have your insurance pay to fix vandalism, your annual premium will be increased in the following year. This is determined by your Schadenfreiheitsklasse (no-claim class); the higher it is, the bigger the bonus, which gets deducted from your insurance contract.

In your insurance documents, you will find a table with the different Schadenfreiheitsklassen from your insurer.

Here is a general overview to give you a better understanding.

| No-claim years | Schadenfreiheitsklasse | Bonus |

|---|---|---|

| 2 years | SF2 | 15% |

| 3 years | SF3 | 30% |

| 4 years | SF4 | 40% |

| 5 - 8 years | SF5 - SF8 | 45 - 50% |

| 9 - 15 years | SF9 - SF15 | 55 - 60% |

| 16 - 25 years | SF16 - SF25 | 65 - 70% |

| 26+ years | SF26 and above | 75 - 80% |

6. Accept Werkstattbindung

If you take out a contract with Werkstattbindung you can save around 10% on your premium. Werkstattbindung means that you have to get your car fixed in a workshop that is approved by your insurer. If you live in an urban area, you should not have any disadvantages. In a rural area, you should double-check how far away the next partner workshop is.

7. Deduct it from your taxes

If you are employed, you can deduct parts of your car insurance from your taxes. If you are self-employed, you can deduct the full amount of your car insurance when you file your tax declaration. This is, however, only possible if you own the car and the car insurance.

8. Compare to cheaper insurance every year

It is worth your time to compare your current insurance to other policies with comparison tools like Tarifcheck every year. A lot of German car insurances usually renew themselves automatically, traditionally on January 1st. You usually have a one-month notice period, so November 30th is the last chance to cancel your current car insurance. Changing your car insurer has no impact on your Schadenfreiheitsklasse.

However, some insurances run one year from your purchase date as well. Since the majority of German contracts can be changed in November, this is known as the month of car insurances and you will find a lot of special offers and advertisements on the streets.

Which is the best car insurance in Germany?

There are 91 different car insurance companies in Germany. As you have read above, there are so many individual factors that play a big role. So we won’t be able to give you a top five comparison. The best way to find car insurance that fits your needs is via a comparison tool like Tarifcheck, which offers a 100% digital and transparent car insurance price calculator for Germany.

Once you have selected the best car insurance for you, you can simply apply online. You will then receive your eVB number (elektronische Versicherungsbestätigung) via email (sometimes in less than 24 hours). When registering your car, you will need to present your eVB number, to confirm that you have purchased car insurance.

I have recorded an over-the-shoulder step-by-step video to guide you through the process with Tarifcheck.

Here is some helpful German vocabulary translated to navigate Tarifcheck:

Versicherung wechseln – change insurance

Neues Auto versichern – insure new car

Vorversicherung – previous car insurance

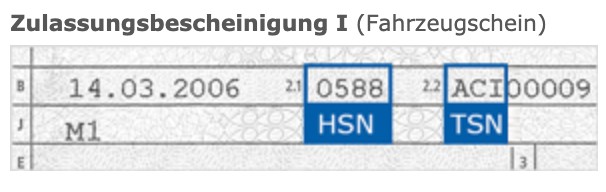

Fahrzeugschein – car registration paper

HSN und TSN Nummer – see screenshot of your car registration paper

Marke und Modell – brand and model

zusätzliches Fahrzeug / Zweitwagen – additional vehicle

Zulassung als Pkw – registration as a passenger car

Fahrzeug – vehicle

Neuwagen – new car

Gebrauchtwagen – used car

Erstzulassung – date of first registration

Ungefährer Neuwert – approximate value as new

Nutzung des Autos – use of the car

Privat (inkl. Arbeitsweg) – private including commute to work

Gewerblich – for business

Jährliche Fahrleistung – estimate of annual mileage

Saisonkennzeichen – seasonal license plate

Finanzierung des Autos – how did you by the car (cash, loan, leasing)

Nächtlicher Stellplatz – where do you park your car most nights

Versicherungsbeginn / Tag der Zulassung – inception day / day of registration

Führerschein erworben am – date of receiving your license

Familienstand – marrital status

Beruflicher Status – employment status

PLZ und Wohnort – postal code and city

Teilnahme am begleiteten Fahren – did you learn to drive with accompanied practice at the age of 17

Punkte in Flensburg – see below

Regelmäßiger Zugriff auf weitere Pkw – do you have regular access to other cars

Fahrer des Autos – who will be driving the car

Versicherungsnehmer (und weitere Fahrer) – insuree (and other drivers)

Können Sie die weiteren Fahrer angeben? – Can you name the other drivers?

Fahrer hinzufügen – add driver

Lebt mit Ihnen in einem Haushalt – living in the same household

Hauptnutzer des Fahrzeugs – main user of the vehicle

Halter des Fahrzeugs – owner of the vehicle

Rabatte – discounts

Weitere Pkw auf Sie oder ein Familienmitglied versichert – are other cars insured by you or a family member

Kinder unter 17 Jahren im Haushalt – children below the age of 17 in the household

Selbstgenutzes Wohneigentum – do you own real estate in which you live

Jahreskarte für den öffentlichen Nahverkehr – do you have a yearly pass for the local public transport

BahnCard Besitzer – do you own a BahnCard

Automobilclub-Mitglied – are you a member of an automobile club (e.g. ADAC)

Motorrad-Besitzer – motorcycle owner

3 other important factors regarding car insurance and driving in Germany

1. Can you drive in Germany with your foreign driver’s license?

That really depends on how long you are staying in Germany and whether your home country has a repatriation agreement with Germany.

If you hold an EU license, you don’t have to take any action and can simply use your license until it expires. If your driving license is from outside the EU, take a look at our guide to find out what steps you need to take.

Read Our Related Guide

2. What are Flensburg Punkte?

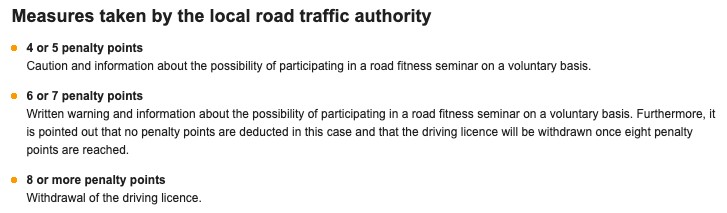

During your questionnaire on Tarifcheck, you will be asked whether you have any bad driver points in Germany, a.k.a. Flensburg Punkte. The Flensburg Punktesystem is the schedule of fines issued by the Federal Office of Motor Traffic, named after its location in Flensburg (a city in northern Germany). When breaking the traffic rules, you can get fines and collect points in Flensburg.

Obviously, having points is bad, as it increases the premium for your car insurance. Should you accumulate a total of 8 points, you will lose your license.

3. What to do in case of an accident?

Unless you are blocking traffic, try not to move the involved vehicles. My advice is to always call the police (phone number 110). It is not a legal requirement, especially if there are just minor damages.

In case another car or person is involved, be sure to fill out the European accident report (Europäischer Unfallbericht); ideally, you carry one with your car insurance documents at all times. Also, write down the name, address, and plate number of other involved persons. Get the contact details of possible witnesses and take pictures of the damages and the road.

In case of injuries, of course, call an ambulance (phone number 112). It is very hard to determine whether you or other people will have consequential injuries or pains under shock.

File a report with your insurance once you are back home. If you want or need to find out other people’s insurance, you can call the Zentralruf der Autoversicherer (central service center for car insurers). You can reach them within Germany at 0800 250 260 0, and outside of Germany at +49 40 300 330 300. They can also help you identify the insurance of other involved parties within the EU and Schengen area. They speak English, and their service is free of charge.

Conclusion

I hope you have learned a lot about the ins and outs of German car insurance. In summary, you are required by law to at least have liability car insurance. The costs and policies are very individual. It is best if you compare different insurance providers according to your needs with a tool like Tarifcheck.

Happy and safe driving! 🚘