The tax number in Germany and the tax ID are two different numbers that serve two different purposes. We explain the differences and need for both numbers and what the freelance tax number and VAT number in Germany are.

What is the tax number in Germany?

The tax number in Germany (Steuernummer) is a unique but not permanent number assigned to a person by the local financial authority (Finanzamt). It helps the local Finanzamt identify your records faster, for example, when you file your tax declaration.

If you have never filed a tax declaration, you most likely don’t have a Steuernummer yet. Its format varies depending on the German state you live in, but it mostly has 10 to 11 digits in the format 133/8150/8159. The unified federal format, however, always has 13-digits written like this: 5133081508159.

Should you move to a different city within Germany, and thus your responsible tax office changes, you will get a new tax number assigned by the new tax office. When you get married and file a joint tax declaration at the end of the year, you will get one tax number together.

Should you register your own business or start as a freelancer, your tax number will also change. (See below)

Where do you find your German tax number?

You will receive a German tax number after you have filed your first tax declaration. You can find it on the tax assessment (Steuerbescheid) from the tax authorities.

What is the tax ID in Germany?

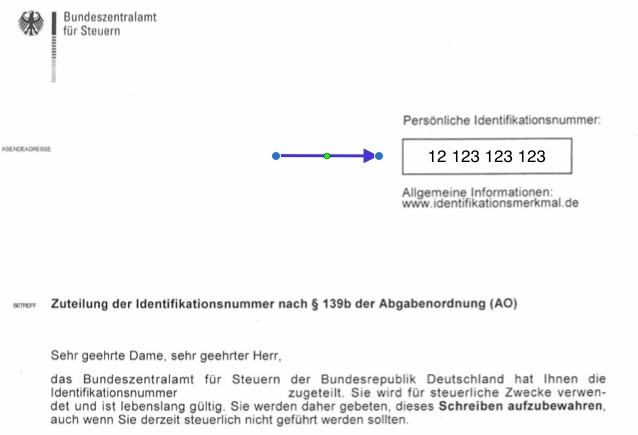

The tax ID in Germany has many names. Look out for the names Steuer-ID, Steueridentifikationsnummer, IdNr., TIN, or Persönliche Identifikationsnummer. It is your personal tax identification number in Germany. This number consists of 11-digits in the format 12 123 123 123 and is permanent.

As an expat, you automatically receive it by postal mail a few weeks after registering your address for the first time in Germany (Anmeldung). Your German tax ID will never change, and you should store that piece of paper securely. Babies born in Germany get this number assigned a few days after birth. So if you have kids in Germany, don’t be surprised to get a letter addressed to your child a few days after its birth.

Who needs Your tax ID in Germany?

Your employer needs your tax ID to pay you correctly. Only once you inform your employer of your tax ID will the payroll department be able to deduct the correct tax amount from your gross salary. You also need to provide your tax ID when opening a bank account in Germany.

Where do you find your German tax ID?

You can find your tax ID in Germany on the following documents:

- The official document you receive via post from the Bundeszentralamt für Steuern after you register your address

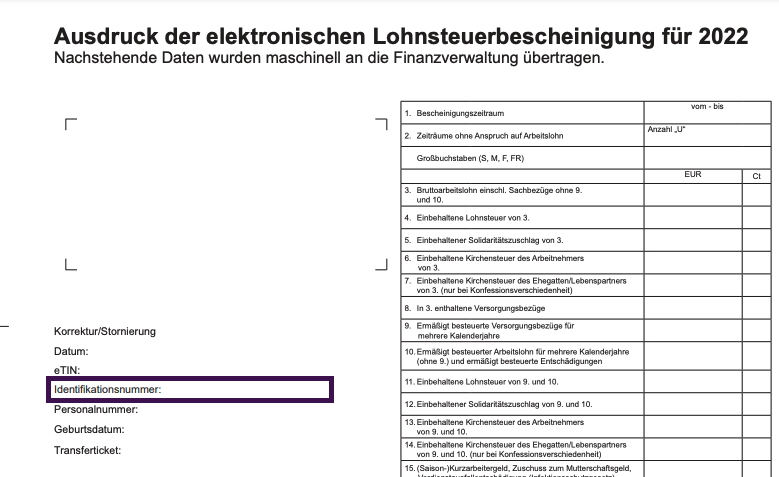

- Your income tax report (elektronische Lohnsteuerbescheinigung) you receive from your employer at the end of the year

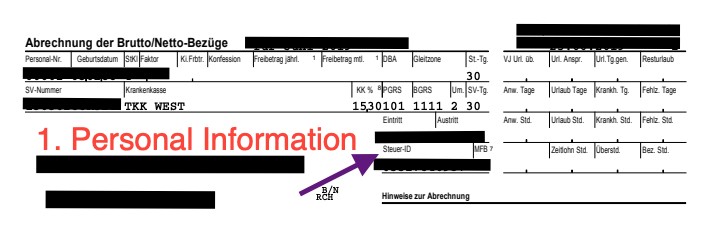

- Your payslip (Gehaltsabrechnung)

What if you have lost your German tax ID?

If you have lost or thrown away all of the above documents because you didn’t know of their importance, you can request a new letter with your tax ID from the Finanzamt for free. You need to fill in this online form and be patient.

It takes up to six weeks for the letter with your tax ID to arrive. Should you be in a hurry, you can also personally go to your local Finanzamt and ask for your tax ID. They can print it out for you on the spot. Just enter your postal code in the search bar to find your responsible Finanzamt.

What is the freelance tax number in Germany?

Just to confuse you more, there is another tax number that you will receive when registering your own business as a freelancer or self-employed. This tax number looks exactly like the non-business tax number you receive with your first tax assessment. You will have to put your freelance/business tax number on all invoices you write.

When registering your business with the Finanzamt, you get to fill out a somewhat complicated seven-page form called the Fragebogen zur Steuerlichen Erfassung (questionnaire for tax registration).

Sorted is an amazing web app that helps you fill out this questionnaire in English and for free.

Read Our Related Guide

What is the VAT number in Germany?

The VAT number in Germany is called Umsatzsteuer-Identifikationsnummer or USt-ID. It is a 9-digit number starting with the country code (DE for Germany): DE123456789.

Every business that operates outside of Germany and within the EU needs a VAT number. If you register a small side business (Kleingewerbe) or only operate within Germany, you do not need a VAT number. You need to place your VAT number on every invoice and in the imprint (Impressum) of your website, instead of your business tax number.

To request a VAT number, be sure to tick the relevant box when filling out the Fragebogen zur steuerlichen Erfassung (questionnaire for tax registration), when registering your business.

Should you have tax-related questions about your own business, we strongly advise you to talk to a certified tax consultant.

Next to offering general tax support for freelancers, Sorted also gives you access to English-speaking certified tax consultants who specialize in freelancers in Germany.

- 100% in English

- Guided tax registration for freelancers

- Easy digital accounting

- Access to certified tax consultants

Conclusion

Steuer-ID, Steuernummer, Steuernummer for self-employed, and VAT number are all different numbers that serve different purposes. We hope that this guide helped you navigate the German tax number jungle. If you have individual tax questions or need help with filing your tax declaration, you can reach out to Prinz.Tax. They are certified tax advisers who specialize in providing tax services to expats in Germany.

- Individual tax declarations for high earners

- Fully in English

- Fully digital all over Germany

- Specialized on Expats in Germany with income from abroad

Disclaimer: Neither myself as the author of this article, nor Simple Germany as a business, are qualified to provide tax advice under German law. We cannot provide specialist tax services beyond any of the general tips contained herein. For tax advice, we strongly recommend you consult a professional tax consultant.