The social security number in Germany is a crucial number for employees to have. It is a 12-digit number that gives you access to Germany’s social security system. If you have public health insurance or if you are an employee in Germany, you most likely already have a social security number assigned to you.

In this guide, I will explain to you in detail how to find or get yours and why it is important.

Let’s get started!

What does the Social Security Number in Germany look like?

An example of how the Sozialversicherungsnummer in Germany looks like is: 13 110587 M 565. It consists of 11 numbers and 1 letter. The number consists of five parts with the following attributes:

- 1-2: number of the local pension insurance office

- 3-8: your date of birth (DD/MM/YY)

- 9: the first letter of your last name

- 10-11: serial number telling your gender (00-49 = male and 50-99 = female)

- 12: a random check digit

Where can you find your German Social Security Number?

If you have public health insurance, you will most likely already have a social security number. Here are three ways to find it:

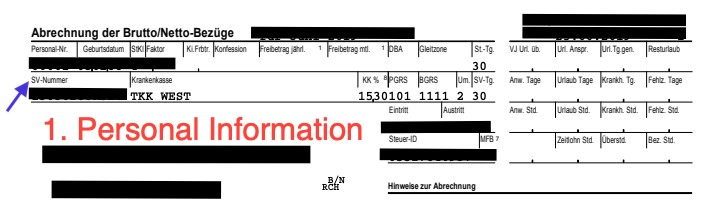

- If you are employed, you can find it on your payslip – often stated as SV-Nummer

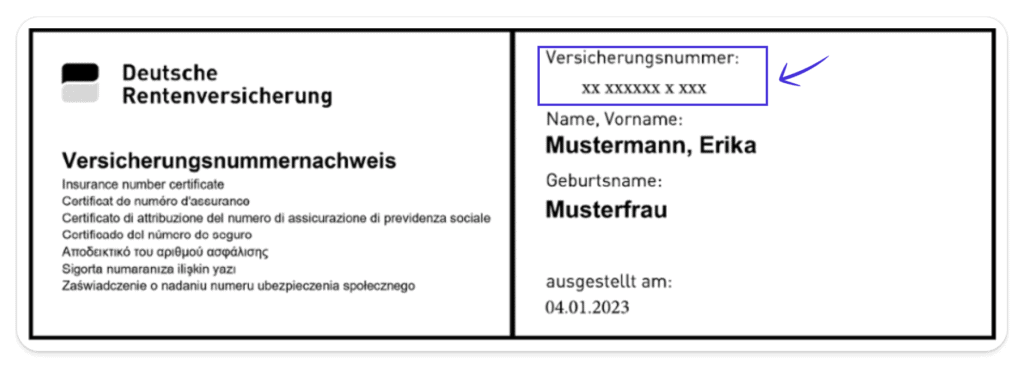

2. You can look for the letter from the Deutsche Rentenversicherung. You should have received it within your first weeks after starting to work.

It has this section which shows yourVersicherungsnummer:

This document used to be called Sozialversicherungsausweis (social security card). Since 2023, it is referred to as Versicherungsnummernachweis (insurance number certificate). Be sure to store it in a safe place.

If you lose this paper, you can order it again online from the German pension fund. You have to select the last option ‘Neuausstellung eines Versicherungsnummernachweises wegen Verlust / Zerstörung / Unbrauchbarkeit’. To do that, however, you need to know your social security number.

3. You can request a membership confirmation (Mitgliedsbescheinigung) from your public health insurance. It states your social security number. Most public health insurance funds offer this service online.

If you are with Techniker Krankenkasse, you can follow these steps to get your Rentenversicherungsnummer:

- Log in to Meine TK

- Go to Anträge und Bescheinigungen

- Click on Allgemeine Versicherungsbescheinigung herunterladen

- Click on Bescheinigung herunterladen

How to get your German Social Security Number For The First Time?

Since January 2023, the employer must inquire about your social security number from the pension insurance data center via their payroll system. If no number has ever been assigned to you, employers must request a Sozialversicherungsnummer for you.

Getting your social security number yourself

In case your employer insists that you provide the social security number, you will have to get it yourself from the German pension insurance fund (Deutsche Rentenversicherung).

You can make the request via email or in person. Let’s look at both options.

Requesting your Versicherungsnummernachweis via email

You can either fill in their contact form and request your Versicherungsnummernachweis. You will need to select which pension fund is responsible for your region. The regions are not that clear, so I suggest that you google ‘DRV + your city’ to find out which pension fund is responsible for your area. Sometimes, you find a direct email for this office, so you can also write to them directly instead of filling out the general contact form.

Here is a German template for you to copy to request the correct information:

Guten Tag,

ich bin neu in Deutschland und habe noch keine Sozialversicherungsnummer. Bitte schicken Sie mir meinen Versicherungsnummernachweis sobald wie möglich zu. Anbei finden Sie meinen Pass und meine Meldebescheinigung.

Vielen Dank!

Mit freundlichen Grüßen

Your first and last name

It is important that you attach a scan of your passport and your Meldebescheinigung (the paper you got while registering your address).

You can expect to receive the important paper with your Versicherungsnummer two to six weeks later via postal mail. So, be sure to have your last name on your mailbox.

Requesting your Versicherungsnummernachweis in person

Visiting your local pension fund office in person usually gets you your social security number on the spot. You need to bring your passport and Meldebscheinigung.

During my research, I called five different pension fund offices. In some, you can just walk in without an appointment. In others (like in Berlin), you need an appointment.

I suggest you google ‘DRV + your city’ and call them directly to find out how to proceed best. If you happen to live close to an office of the pension fund, just stop by and try your luck in person.

What is the Social Security Number Called in Germany?

The social security number in Germany has many equivalent names. The most common ones are:

- Sozialversicherungsnummer (social insurance number)

- SV-Nummer (abbreviation for social insurance number)

- SVNR (abbreviation for social insurance number)

- Versicherungsnummer (insurance number)

- VSNR (abbreviation for insurance number)

- Rentenversicherungnummer (pension insurance number)

- RV-Nummer (abbreviation for pension insurance number)

- RNVR (abbreviation for pension insurance number)

The social security number in Germany is an individual 12-digit number. German citizens get it assigned at birth. Foreign employees need one when starting employment. It gets assigned once and remains the same for the rest of your life.

Why do you need the Social Security Number in Germany?

The four German social contributions that get subtracted from your payslip get tracked through your social security number:

- your public health insurance

- your public pension insurance

- your public long-term care insurance

- your unemployment insurance

To claim any of these benefits, you need to provide your social security number.

Even once you leave Germany, you need your social security number to claim back your pension contributions. Please read my guide below to learn whether you have the right to claim those contributions or not.

Read Our Related Guide

If you are a freelancer or self-employed and you have private health insurance, it’s possible that you don’t have a social security number, as you don’t contribute to the German social system.

Conclusion

All employees in Germany, regardless of whether they are citizens or foreigners, need to get a social security number. Your public health insurance, employer, or German pension insurance fund will register you to receive your insurance number certificate number via postal mail. Your employer needs this number to subtract the correct social contributions from your salary. Be sure to always keep your social security card in a safe place.