It probably didn’t take long until you heard about the SCHUFA after moving to Germany. It has a tremendous impact on our daily lives, Germans and expats alike. This article explains what it is, how to get SCHUFA, and how to stay on the good side of things.

What is SCHUFA?

SCHUFA stands for Schutzgemeinschaft für allgemeine Kreditsicherung (General credit protection agency), and the SCHUFA Holding AG (the biggest private credit tracking agency in Germany) tracks and rates your payment behavior and issues the report.

So if someone, like your landlord or bank, asks you to provide a SCHUFA record, they check how trustworthy you are in paying your bills on time. This report shows all companies you have purchased from who previously enquired about your solvency with the SCHUFA.

You automatically start your SCHUFA record by registering your address, opening a bank account, getting internet for your flat, or getting a mobile phone contract. The providers inquire with the SCHUFA each time before accepting you as a customer and thus leave a record.

Once you have completed one of the tasks mentioned above, you should wait at least one to two months before you request a SCHUFA certificate. That way, you give it time for your record to be built.

The system is designed so that your employment status or income does not influence the score, instead only your trustworthiness towards bills, contracts, loans, and other liabilities. So, for example, the world’s wealthiest person could not open a bank account or get a credit card in Germany with a bad SCHUFA score.

How to get a SCHUFA report in Germany?

There are four ways to get your SCHUFA score and report; each fulfills a different need.

1. How to get a SCHUFA report for free?

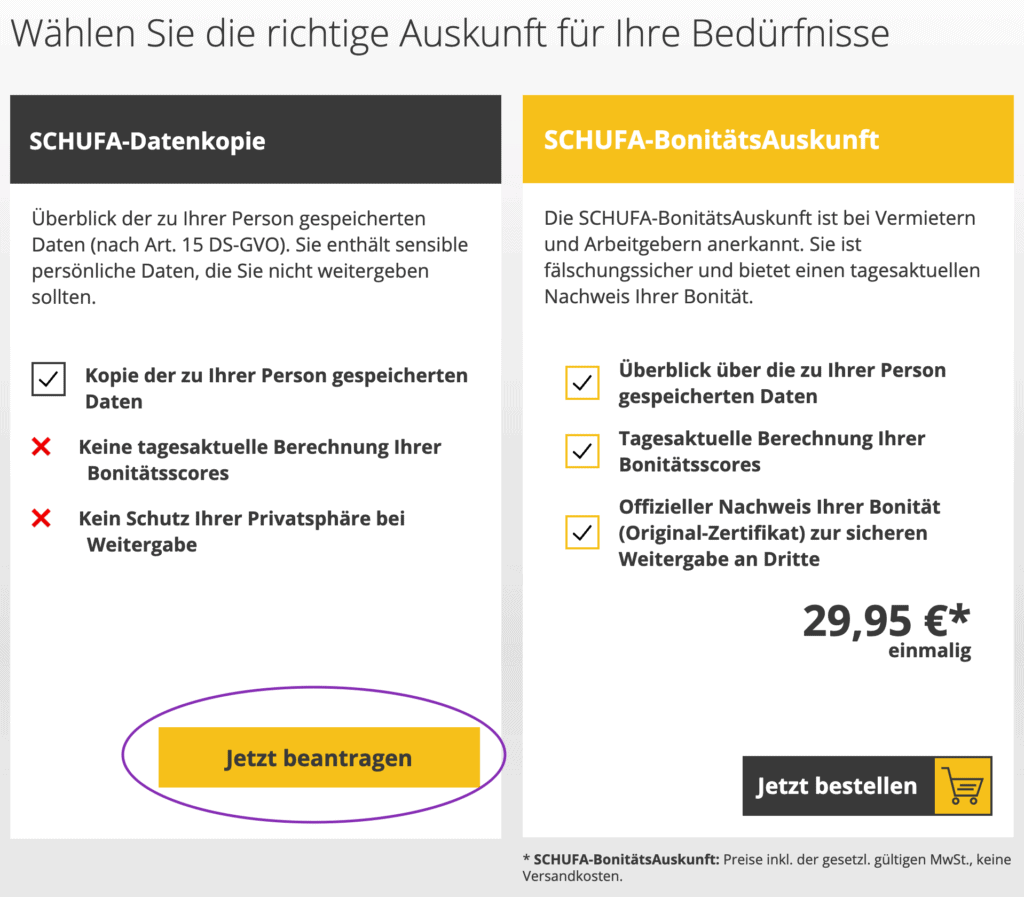

Every German resident is legally entitled to receive one free SCHUFA record per year, to see what data has been stored in the report. You can request it on the official website, and it is called Datenkopie (data copy). Click on ‘Jetzt beantragen’ in the left column and enter your personal information on the next page.

You can upload a copy of your passport and your Meldebescheinigung (the paper from your registration) to help them identify you faster and avoid further queries. They will send you your free report via snail mail a few days later. This report is meant only for you and not to hand over to third parties, e.g., your future landlord, when apartment hunting.

2. How to get a SCHUFA report for landlords?

While the free report gives you an overview of what data is stored, it is for your eyes only and you should never give it to someone else. To rent an apartment, a lot of landlords request the paid version of your SCHUFA report.

You can order a detailed report on the official website, and it is called SCHUFA-BonitätsAuskunft (Bonität means solvency). Again click on ‘Jetzt bestellen’ and enter your data on the following pages. This report costs 29,95 euros and will be sent to you via snail mail within the next few days. Here is an example of a SCHUFA-BonitätsAuskunft.

3. How to get a SCHUFA report immediately?

If you are in a real rush, you can get your SCHUFA-BonitätsCheck within three minutes online via ImmobilienScout24. The report you get is the official certificate, which is valid to give to landlords; however, it does not give you all the details like the SCHUFA-BonitätsAuskunft. It still costs 29,95 euros, but you benefit from being able to download it directly. So you can either print it or e-mail it to your possible future landlord.

If you are actively searching for a new apartment, we highly recommend signing up for the premium membership of ImmoScout24. It is called MieterPlus and includes a new SCHUFA certificate every month. The premium membership fee pretty much covers the cost of a one-time SCHUFA certificate. On top of that it offers many other benefits to increase your chances to find a new apartment.

With our eBook ‘Get Your Keys’ you receive over-the-shoulder videos on how to best prepare your tenant profile on ImmoScout24, get your SCHUFA certificate and many more tips on how to land your long-term apartment in Germany.

Gain the knowledge to:

- Understand the German rental culture

- Build the perfect tenant profile on ImmoScout24

- Nail your long-term apartment

4. How to get a credit report In Person?

To get your German credit report in person, head to your closest Postbank branch and request a SCHUFA-BonitätsAuskunft at the terminal until one hour before the end of their opening hours.

You can find the closest branch on their branch finder website. Bring your passport and Meldebescheinigung. The cost of 29,95 euros gets collected via direct debit from your bank account.

You do not need to have an account with Postbank to use that service. However, you need to have a German bank account to pay for the service successfully.

Read Our Related Guide

What is a good SCHUFA score?

A very good SCHUFA score is 97% or higher, and a good score has a minimum of 95%.

The Basisscore, the one you start with at the beginning, is 100%. If you don’t pay your bills on time, the score drops lower. Here is an overview of what risk you portray of not meeting your liabilities properly.

How to improve your credit score in Germany?

To improve your SCHUFA credit score in Germany, you can do the following 9 things:

- Avoiding late payments automatically improves your score.

- Avoid having too many bank accounts, especially inactive ones.

- Don’t change your bank account too often.

- Don’t zero out your bank account; try to keep a healthy balance.

- Don’t have too many credit cards, and cancel those you don’t use.

- Consolidate your loans. One loan has less impact on your score than many smaller loans.

- Regularly check your SCHUFA score once a year via the free version. If you find a wrong record, you can officially object and ask for the record to be deleted.

- Solve a matter that harms your score immediately and ask the company or creditor to withdraw their SCHUFA statement.

- Don’t move too many times, as this can impact your score negatively.

Read Our Related Guide

How to find an apartment without a SCHUFA

Expats often need a SCHUFA certificate to show their potential landlord but do not have one yet because they are not registered yet – a typical chicken & egg situation. There are three ways to solve this challenge:

- Get a flat for the first few months from a furnished flat provider like Housing Anywhere, which does not require a German credit score and allows you to register with it. That way, you can start settling in, set up the first services, get to know the different neighborhoods of your new home, and hunt for a more permanent apartment in person.

- If Housing Anywhere is not your thing, you can also look for a flatshare (WG short for Wohngemeinschaft).

- You can also try to look for flats that don’t require a SCHUFA. Some landlords are fine with just getting the deposit or a recent bank statement to prove your liquidity.

Read Our Related Guide

Conclusion

The SCHUFA needs to be your friend, whether you like it or not. The report tracks and rates your payment behavior and impacts whether you will be able to get a loan, a mobile phone contract, or that new TV that you want to pay in installments.

The landlord of the apartment you want to rent might ask for a SCHUFA report to prove your good payment history. You can get your report online for 29,95 euros.