It may not be the most pleasant topic, but thinking about what happens to your assets when you pass is essential. When moving to another country, the inheritance law may differ from the one in your home country, which makes writing a will all the more critical. This guide will share everything you need to know about writing your will in Germany as a foreigner.

Do you need a will in Germany?

While having a will is not mandatory in Germany, it is highly recommended. Having a will is especially relevant if you have considerable assets or real estate, own a business, or wish to leave an inheritance to multiple family members or non-family members. If you parent underage children, it is also advisable to leave instructions on who should look after them in your will.

Without a will, your inheritance will be distributed according to German succession laws, benefitting your nearest living relative(s) as heir(s). In the below section What happens in Germany if someone dies without a will? we will detail the process.

Important

German succession regulations do not consider unmarried life partners, lifelong friends, business partners, caretakers, or anyone who is not directly related to you. You must put them in your will if you wish to leave them an inheritance.

What is a will called in Germany?

In Germany, a will is called Testament. In your Testament, you declare who should inherit (erben) your assets. Your heirs are called Erben, and the inheritance itself is Erbe. For your convenience, we have listed essential vocabulary related to wills in Germany below:

Das Testament – Will

Der/die Erblasser/in – Testator

Das Erbe – Inheritance

Der Erbe (m), die Erbin (f), die Erben (pl.) – Heir/Heirs

Zu erben – To inherit

Das Vermögen – Assets

Die Immobilie – Property

Der/die Notar/in – Notary

Die Testamentseröffnung – Reading of the will/probate

Gesetzliche Erbfolge – Legal succession

Der Erbschein – Certificate of inheritance

Der Pflichtanteil – Hereditary reserve

Das Nachlassgericht – Probate court

Gerichtliche Testamentseröffnung – Probate

How do wills work in Germany?

Having a will lets you determine who should inherit your assets after passing. It further enables you to leave instructions on guardianship for underage children or pets or anything else relevant to you after you die. The more precise you are in your will, the easier and faster your heirs can implement your last wishes and will get access to their inheritance.

Germany has two kinds of wills – the public and the holographic will.

The public will (notarial will) is a testament drafted and witnessed by a notary of your choice. As a legal expert, the notary will ensure that your will aligns with German inheritance law and can advise you on how best to set up your inheritance. The notary will further forward the will to your local probate court (Nachlassgericht), a division of your local Amtsgericht (municipal court) responsible for wills and inheritance in Germany. There your will is deposited and is accessible when needed.

A holographic, or personal will, is solely drafted by yourself. To be recognized by the probate court, it must be fully written by hand, as required by German law §2247 BGB. Typed wills are not recognized, even if printed and properly signed. If you do not speak German, your will can be written in any language, though an official translation to German will be needed in time for probate.

- Translations of all languages

- Website & Support in English

- Order online 24/7

- Express service possible

Note: If you cannot find a translator for your language on Lingoking, check out the database of translators from the German State Justice.

Holographic wills can be stored at home, though there is a risk of it not being found or handed in after your passing. A safer option is to deposit your will at the probate court for a one-time fee of about 75 euros. To do so, you will need to make an appointment at your local probate court and bring your will (and its official translation to German if needed) and your ID card and birth certificate.

Good to know

Mourning the loss of a loved one is a difficult situation, and having to arrange a funeral in the middle of it is an additional burden. Leaving instructions and preferences for your funeral and talking to your friends and family about it can significantly help those left behind.

To learn more about funerals in Germany, we have linked our guide Funerals In Germany [Regulations, Costs & Traditions].

Are handwritten wills legal in Germany?

While handwritten wills are legal, it can be tricky to formulate them without legal advice, especially if you wish to include multiple people or if property or businesses are involved. If instructions are unclear, probate courts may not recognize your last wishes and reject (parts of) your will. In such cases, legal succession will determine who becomes heir to your assets.

It is, therefore, highly advisable to seek legal counsel from a notary if your living situation is somewhat more complex. All notaries in Germany are registered in the Bundesnotarkammer (Federal Notary Chamber). Their website offers a fantastic platform to help you find a notary near you. There is an option to filter for languages so that you might find a notary speaking your native language through the portal.

Another useful point of contact is law firms specifically focusing on supporting foreigners in writing their will in Germany. Schlun & Elseven are a great example.

What happens in Germany if someone dies without a will?

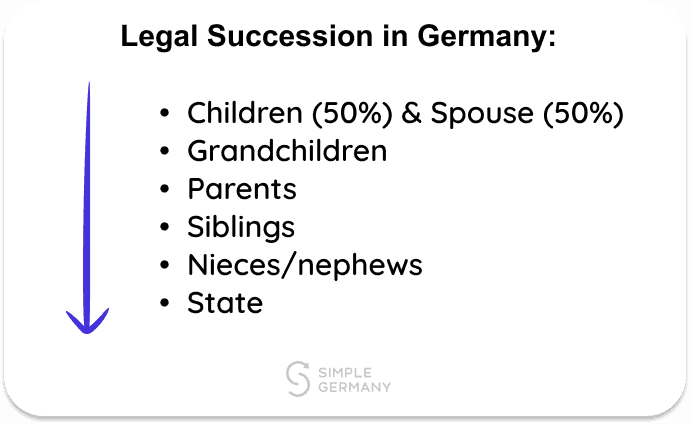

Without a will, German inheritance law applies the concept of legal succession, meaning that the inheritance will go to your immediate direct family.

In the first step, your spouse and children become heirs to your assets. Should they have passed, grandchildren would be next in line.

If you are not married and don’t have children, your inheritance will go to your parents or, should they have also passed, siblings or, ultimately, nieces and nephews.

Without living direct relatives, the inheritance will go to the state of Germany.

Legal succession is universal in Germany, meaning that heirs inherit assets and any outstanding debt.

You are free to reject an inheritance, which can be helpful should debts outweigh assets. To do so, you must hand in an official rejection letter (witnessed by a notary) within six weeks of finding out about the passing.

If you reject an inheritance, the successor(s) next in line become(s) the heir(s). Should all heirs reject the will, the inheritance will be left to the state. Please note that you can only accept or reject the full inheritance. You may not choose to keep the assets while rejecting the debts.

Important For Married Couples

Contrary to what many believe, spouses are not the sole heir to their husbands’ or wives’ fortune. By German succession law, widowed partners receive 50% of the inheritance, while the other half is split between the children of the deceased.

If you have no children, your spouse inherits three-quarters of your wealth. If your parents or siblings are still alive, they get the rest.

How to leave 100% of your inheritance to your spouse in Germany?

There are many cases in which leaving the whole inheritance to your spouse is essential (e.g., when paying for a mortgage). The so-called Berliner Testament (Berlin will) enables spouses to declare each other as sole heirs in a joint will. Only after both spouses have died would children or relatives next in line receive their inheritance.

As the format of the Berlin will is very straightforward, you can find templates for it online and easily hand-write your version yourself. Please note, though, that if you intend to make changes or add instructions, you should consult with a notary. Please also note that the Berliner Testament is not a valid joint will for unmarried partners.

We can only stress that if any other international matters or assets in your home country play a role always to seek counsel from a notray. A hand-written will may not suffice.

Does German succession law apply to you as a foreigner living in Germany?

You may wonder if Germany’s or your home country’s succession law applies to you as a foreigner living in Germany. The answer depends on where you are from.

Since 2015 the European Succession Regulation “regulates which national law of succession applies to successions with a transnational component (Articles 20 et seq. of Brussels IV)” for all European countries except for the UK, Ireland, and Denmark. According to the regulation, habitual residency determines which country’s law applies.

If you live in Germany with a residence permit for work, your habitual residence will most likely be Germany.

If habitual residency is not easily defined or you wish to apply the law of your home country, you can make a choice of law in your will.

For any countries not included in the European Succession Regulation, private international law (conflict of laws) determines jurisdiction and, thus, which succession law applies.

This pretty much means it can become complicated and highly depends on your home country. To avoid putting your heirs through this complex and time-consuming process, it is advisable to sort your affairs in your will.

Are foreign wills recognized in Germany?

If you have a will set up in your home country, you are probably wondering if it is recognized in Germany or if you need to set up a new will.

In most cases, Germany recognizes international wills as long as they do not contradict German law or the law of the country in which the will was written. International wills are accepted in their local language but must be accompanied by an official German translation at the time of probate.

What makes a will legal in Germany?

For a will to be legal in Germany, the following must apply:

The testator needs to be 16 years or older

The testator must be deemed competent to look after their affairs (this will be challenged in cases of severe mental health issues, psychosis, or severe physical disability)

The Will is EITHER handwritten and signed with the date and city the signature took place OR attested by a notary

The will obeys German inheritance law

An important regulation in German inheritance law is that you can not entirely disinherit your next of kin unless there is a powerful reason for doing so. Such reasons include severe criminal activity or attempted murder. Not having a good relationship or not being in contact for multiple years are insufficient reasons.

If you do not include a next of kin in your will or specifically write them out, they can still get their so-called Pflichtanteil (hereditary reserve).

What is a Pflichtanteil in Germany?

Pflichtanteil (hereditary reserve) regulations state that heirs not included in the will are eligible for at least 50% of what they would have received had legal succession applied.

Let’s look at an example:

A person left a will giving his wife and his oldest child 50% each of his properties. The youngest child was left out because they didn’t get along. But according to German inheritance laws, this youngest child can still claim their ‘Pflichtanteil’, which represents half of what they would’ve normally gotten. So instead of getting 25% (which is half of the remaining 50% after the wife’s share), they can claim 12.5% of the total properties.

If the person didn’t have a will and German succession had applied, his wife would have received 50% of his assets, and the remaining 50% would have been split between Child 1 and Child 2, getting them 25% each.

The cost of making a will in Germany

Costs of making a will differ significantly depending on the type of will you choose and how large your fortune is.

While holographic wills kept at home are free of charge, you can expect fees of about 75 euros if you wish to deposit them at a probate court.

If you hire a notary, fees are based on your assets when making your will. Prices are state-regulated and defined as shown in the table below. If your assets are worth more than one million euros, fees revolve around 0,17% of your total asset value.

| Value of Assets up to | Notary Fees |

|---|---|

| €10.000 | €75 |

| €25.000 | €115 |

| €50.000 | €165 |

| €250.000 | €535 |

| €500.000 | €935 |

| €750.000 | €1.335 |

| €1.000.000 | €1.735 |

How long does German probate take?

Probate in Germany can take quite some time. In our experience, it took more than three months for friends to receive a copy of the will from the probate court.

If there is no will and you are an heir in legal succession, you must reach out to the probate court to request a certificate of inheritance, called Erbschein. This document confirms that you are the legal heir and allows you to access your inheritance. The process of getting your Erbschein can take several weeks.

If you are unsure whether the deceased person left a will, reach out to the probate court and ask. You should contact the court overseeing the location of the deceased.

Good to know

If you have shared expenses, it is useful to get a power of attorney (Bankvollmacht) for your partner’s or parents’ bank accounts to keep them accessible. You can request a power of attorney directly with your bank.

Otherwise, when an account holder dies, their bank accounts get frozen until the heir has the required documents (either a copy of the will or the Erbschein) to regain access to the accounts. This can take up to multiple months.

Is inheritance taxed in Germany?

Inheritance is taxed in Germany, though there are generous tax allowances in taxation depending on the value of the inheritance and your relationship to the testator.

The closer you are in lineage to the testator, the higher the tax-free amount you can inherit or get as a gift. Heirs of the first degree, meaning children and spouses, benefit from a tax-free allowance of 400.000 and 500.000 euros, respectively. On the other hand, unrelated heirs must pay taxes on any inheritance exceeding 20.000 euros.

Next to the amount that is tax-free, the tax rate that is applied to any exceeding amounts also depend on your relationship with the testator.

Let’s look at two tables, to clarify this more.

The first table shows an overview of the different tax allowances for an inheritance or a gift in Germany (amounts that are tax-free).

| Heir Type | Tax Allowance (every 10 years) | Tax Class |

|---|---|---|

| Spouses & registered partners | €500.000 | 1 |

| Children | €400.000 | 1 |

| Grandchildren, whose parents are deceased | €400.000 | 1 |

| Grandchildren, whose parents are alive | €200.000 | 1 |

| Great-grandchildren, parents & grandparents | €100.000 | 1 |

| Siblings, nieces & nephews, stepchildren, stepparents, in-laws, divorced partners | €20.000 | 2 |

| All other | €20.000 | 3 |

The second table shows an overview of the various tax rates that apply depending on the tax class. The tax class in this context gets defined solely by your relationship to the testator.

Important

These tax classes solely apply to inheritance and gifting and are different and independent from the tax class that applies to your income.

| Taxable Inheritance or Gift | Tax Class 1 | Tax Class 2 | Tax Class 3 |

|---|---|---|---|

| Up to €75.000 | 7% | 15% | 30% |

| Up to €300.000 | 11% | 20% | 30% |

| Up to €600.000 | 15% | 25% | 30% |

| Up to €6.000.000 | 19% | 30% | 30% |

| More than €6.000.000 | Up to 30% | Up to 43% | Up to 50% |

Let’s look at an example:

A testator leaves his inheritance to his spouse and two children. His total inheritance is 1,5 million euros. His spouse can inherit 500.000 euros tax-free. His two children can inherit 400.000 euros each without paying taxes. That leaves 200.000 euros that need to be taxed. Since spouses and children have tax class 1, an 11% tax rate must be applied according to our table above. Therefore the family needs to pay 22.000 euros in inheritance tax.

A common practice to reduce inheritance tax is to gift property or assets to children during your lifetime. If you gift part of your inheritance to your heirs before your death, the same tax allowances and tax rates apply, as after death. However, the important thing to know is that you can benefit from the tax allowance every ten years.

Let’s look at an example:

The same testator as in the above example gifts his two children 400.000 euros each in 2012. He dies in 2023 and leaves a remaining inheritance of 700.000 euros to his spouse and two children. His spouse can inherit 500.000 euros tax-free. His two children can inherit up to 400.000 euros each without paying taxes. They don’t need to pay taxes on the inheritance since the gift they received from the testator was more than 10 years ago. Therefore, the entire family does not pay any inheritance tax.

If in the same example, the gifting would have only taken place in 2015, then only 8 years would have passed until the testator died. The missing 2 years (to complete the 10 years) count as 20%. This means, that 20% of the gifted 800.000 euros get added to the inheritance amount. Therefore, 160.000 euros get added to the inheritance of 700.000 euros. Since the widow and children together have a tax allowance of 1,3 million euros, they still don’t have to pay any inheritance tax.

Please note that these are very simplified examples and any gifting should always be discussed with a professional counsel.

Conclusion

We hope that we have been able to give you a better understanding of wills and succession in Germany. If you wish to set up a will in Germany, you can do so at any time by writing it by hand (remember to add the city, date, and your signature). As wills can be complex, however, seeking legal consult from law firms like Schlun & Elseven or notaries is advisable. Without a will, legal succession determines who becomes heir to your assets.

Disclaimer: This guide is no legal or immigration advice and does not replace seeking professional counsel. The information given in this guide is purely based on our research. Neither myself as the author of this article, nor Simple Germany as a business, are qualified to provide legal advice under German law. We cannot provide specialist legal and immigration services beyond any of the general tips contained herein. For legal & immigration advice, we strongly recommend you consult a professional consultant or your local German embassy or Foreigners office.