You are a freelancer or self-employed, and you are looking for the best bank in Germany for freelancers? Look no further. We have compared the best banks for business, targeting specifically freelancers and small businesses in Germany.

You no longer have to pay horrendous fees to traditional private banks and deal with their non-digital slow services. The fintech industry has revolutionized banking for business. So sit back and choose the best bank for freelancers in Germany catering to your needs.

If you are short on time, and just want an answer. Here are the best banks for freelancers in Germany:

- Finom – free account with great add-ons for freelancers, some for extra fees.

- Kontist – great free option for all freelancers, self-employed and all other company types. Accounting add-ons with premium account.

- N26 – free business bank account, without specific perks for freelancers, but also no hidden fees.

- Qonto – for freelancers and small companies, with great accounting features at a premium.

- Commerzbank – great for personal branch service and cash deposits. The traditional bank that offers business banking with no frills.

| Finom | Kontist | N26 | Qonto | Commerzbank | |

|---|---|---|---|---|---|

| English Website & Support | Website no, Support yes |

||||

| No Monthly Fee | €9 | from €12,90 | |||

| Free Payment Card | Virtual Debit Visa Card | Virtual Debit Visa Card | Virtual Debit Mastercard | Debit Mastercard | Debit Girocard |

| No. of Free Transactions | Incoming: unlimited Outgoing: €2 | 10 | unlimited | 30 | 10 |

| Accounting Integration | with Premium | ||||

| Apple & Google Pay | |||||

| Cash Withdrawal Fee | 1-8% depending on the amount | €2 | free 3x a month | €1 | €2,50 |

| Foreign Currency Fee | 3% | 1,7% | free | 2% | not possible |

| Online or Branch Bank | Online | Online | Online | Online | Branch |

3 reasons why you should open a business bank account in Germany

As a freelancer, you are not required by law to have a business bank account. Only legal entities such as a GmbH or a UG are required to have a business account (Geschäftskonto). However, we absolutely recommend having a business account as a freelancer! Here is why:

1. Separation of professional and personal finances

When running your own business or a self-employed side hustle, it is essential that you separate your earnings, investments, and spendings from day one. Why? For your own good. You can hand out your business account number to clients and transfer a fixed amount to your private account, like your salary. This way, you will have a clear overview and understanding of your finances.

Are you also looking For A Private Bank Account?

Check out our guide on the Best German Banks For English Speakers

2. Taxes and accounting

The separation saves you a lot of time and hassle at the end of the year. Each year you will have to declare your taxes in Germany and provide your accounting sheets to the finance office (Finanzamt). Now imagine having your private expenses mixed in – I predict chaos and inefficiency. As an add-on, some of the best business bank accounts in Germany automatically calculate your taxes and offer you the option to send invoices straight from your online banking. That is what I call efficiency and convenience.

3. Terms and conditions of banks

By now, I hope you already understand the benefits of opening your separate business account. However, there is more. You might be violating your bank’s terms and conditions by using your private checking account for professional purposes, such as client payments.

Most private checking accounts (Privatkonto) are, as implied by their name, only for private use.

What are the best banks for freelancers in Germany?

Here are our top picks for the best banks and business accounts for freelancers in Germany.

1. Finom

Finom is a German/French fintech licensed digital banking service focusing on freelancers, self-employed and small businesses. It was founded by an international team in 2019 and operates in Germany and France.

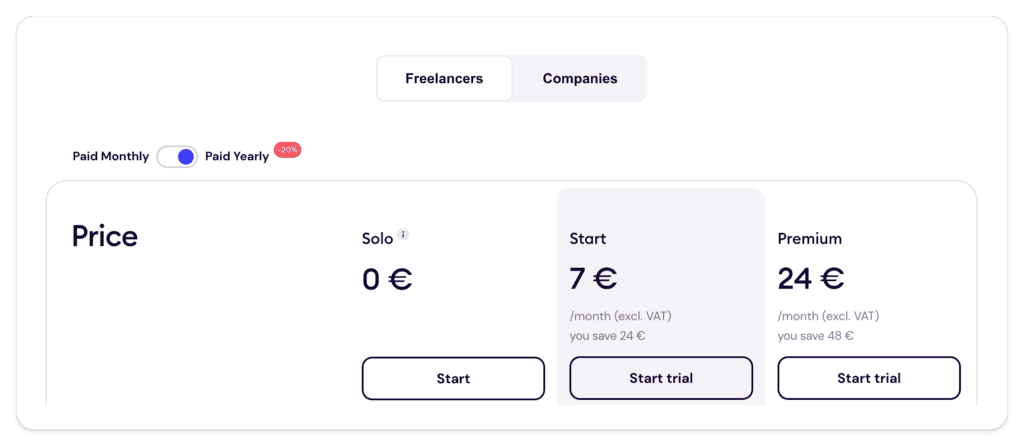

Finom offers a 100% digital solution that combines bank account for business, invoicing, and accounting features. Finom offers a free bank account, as well as two paid versions. Their webpage, app, and customer service are available in German and English.

In September 2024, they changed their pricing structure. The most significant change was made to the fees of transfers within the SEPA (European) region and direct debits. There is no longer a limit on free incoming transfers; however, there now is a €2 fee on every outgoing SEPA transfer or direct debit.

Finom Solo Benefits:

✅ Online account opening in a few minutes

✅ Full real-time control via the user-friendly app

✅ Free Finom Virtual Business Visa debit card

✅ 100% paperless

✅ Unlimited free incoming SEPA transfers

✅ English website and customer service

✅ Invoicing included

✅ Accounting integrations possible

Finom Solo Drawbacks:

⛔️ €2 fee on all outgoing SEPA transfers & direct debits

⛔️ €3 monthly maintenance fee for physical debit Visa card

⛔️ No free cash withdrawal on free plan

⛔️ 1-8% per ATM cash withdrawal depending on the amount

⛔️ 3% foreign currency fees

⛔️ No overdraft possibility

⛔️ No cash deposits possible

Add-ons for Finom Start (7 euros / month):

✅ 2 Users & 2 free Visa cards

✅ Unlimited free incoming & outgoing SEPA transfers

✅ Free cash withdrawals up to €500

✅ No foreign currency fees for payments up to €500

2. Kontist

Kontist offers banking for all levels of entrepreneurs in Germany – from freelancers and self-employed to GbR and GmbH. Its founders and the team have mostly been self-employed and freelancers beforehand. It was founded in 2016 and has partnered with the licensed solarisBank, specializing in digital companies.

Kontist offers a 100% digital bank account for freelancers and some handy bookkeeping add-ons for a premium fee. Their webpage, app, and customer service are available in German and English.

The free account remains free if you have more than 300 euros per month of incoming or outgoing transactions. Should you not use your freelance bank account regularly you will pay a 2 euros fee per month.

Kontist Benefits:

✅ Online account opening in 9 minutes

✅ No monthly account fee (with transactions over €300/month – otherwise €2/month)

✅ Full real-time control via the user-friendly app

✅ 100% paperless

✅ Google & Apple Pay

✅ No SCHUFA credit check

✅ English website, live-chat and customer service

✅ 500-5.000 euros possible overdraft

Kontist Drawbacks:

⛔️ 29 euros / year for physical Visa debit card

⛔️ Only 10 free SEPA transactions / month

(after that 0,15 euros / transaction)

⛔️ 2 euros monthly account fees if you have less than 300 euros incoming or outgoing / month

⛔️ 1,7% foreign currency fees

⛔️ 2 euros ATM cash withdrawal fee + 1,7% foreign currency fees

⛔️ no cash deposits possible

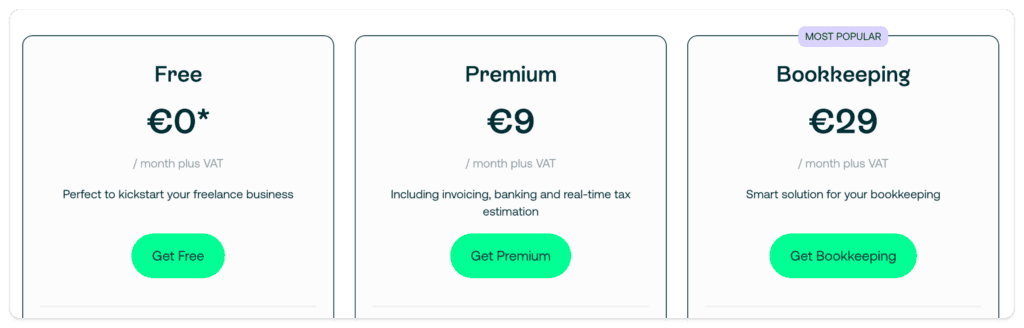

Add-ons for Kontist Premium (9 euros / month):

✅ Free Visa debit card

✅ Real-time tax calculation on transactions

✅ Photograph and save your receipts with the app

✅ Integrated accounting with unlimited invoices

✅ Integration with bookkeeping tools

3. N26 Business

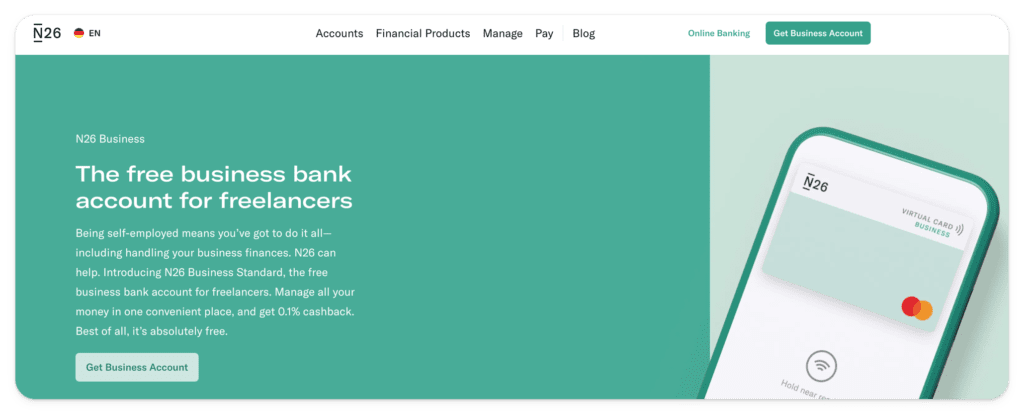

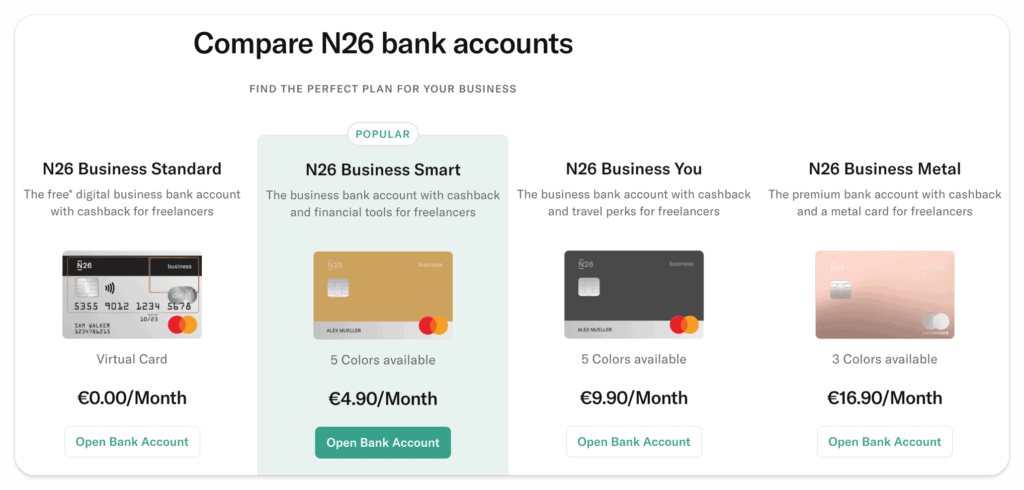

Unlike all other banks in this comparison, N26 also offers private checking accounts. It was founded in 2013 in Berlin and has since become the largest mobile bank in Europe. Its strength lies in international banking, as it offers free worldwide payments.

N26 offers four different business accounts, ranging from free to 16,90 euros per month. The paid accounts include travel insurance and other perks. All services are available in English, French, Spanish, Italian, and German. However, N26 does not have any accounting or invoicing add-ons specifically for freelancers.

Important to know

Currently, N26 does not allow you to have a private and business account with them.

N26 Benefits:

✅ Online account opening in a few minutes

✅ No monthly account fee

✅ Full real-time control via the user-friendly app

✅ Free virtual business debit Mastercard

✅ 100% paperless

✅ Unlimited free SEPA transfers

✅ Free worldwide payments (no foreign currency fees)

✅ Up to 3 free Euro ATM cash withdrawals / month

(after that 2 euros / withdrawal)

✅ Free unlimited cash withdrawals & deposits at selected retail stores via CASH26

✅ 0,1% cashback on all purchases

✅ English website, live-chat and customer service

✅ Overdraft possible

N26 Drawbacks:

⛔️ 1,7% foreign currency fees on ATM cash withdrawal

⛔️ No accounting integration

⛔️ One-time 10 euros fee for physical debit Mastercard

Add-ons for N26 Business Metal (16,90 euros / month):

✅ Up to 8 free ATM cash withdrawals in Germany

✅ Unlimited free ATM cash withdrawals in other currencies

✅ Shared sub-accounts with up to 10 other N26 users

✅ Dedicated N26 Metal customer service line

✅ Included Allianz travel insurance

✅ Car rental & phone insurance

✅ 0,5% cashback on any purchases

4. Qonto

Qonto is a French licensed digital banking service focusing on freelancers and small companies. The Fintech neobank was founded in 2016 and operates in several European countries. Their services are available in French, English, Italian, Spanish and German.

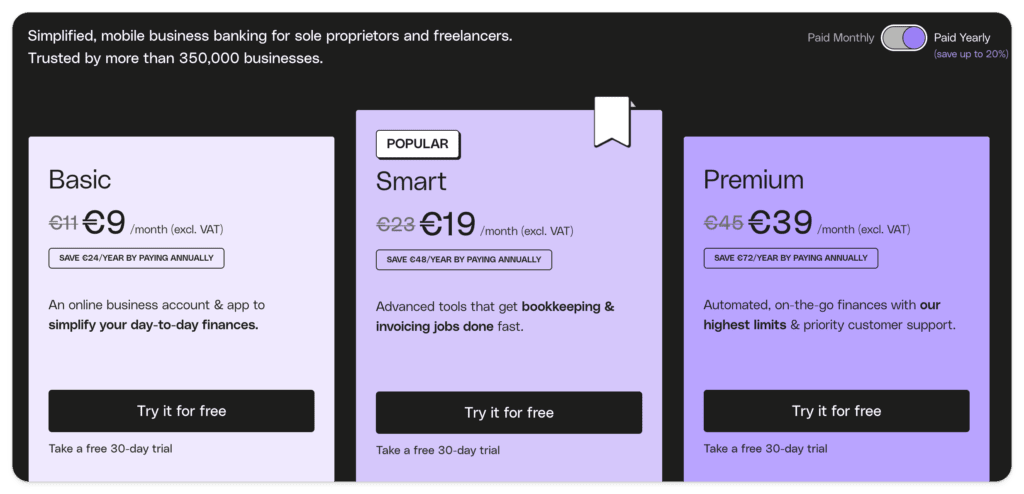

Qonto does not offer a free business bank account. It offers three different types of bank accounts for freelancers ranging from 9 to 39 euros per month when paying yearly.

Qonto Solo Benefits:

✅ Online account opening in 10 minutes

✅ Full real-time control via the user-friendly app

✅ Free Debit Mastercard

✅ 100% paperless

✅ Photograph and save your receipts with the app

✅ VAT taxes are automatically recognized

✅ Possibility to connect your accounting software

✅ English website and customer service

✅ Overdraft up to 20.000 euros (card limit) / month

✅ Basic travel insurance included

✅ Apple & Google Pay

Qonto Solo Drawbacks:

⛔️ 9 euros monthly account fee when paying yearly

⛔️ Only 30 free SEPA transactions / month

(after that 0,4 euros / transaction)

⛔️ 2% foreign currency fees

⛔️ 1% ATM cash withdrawal fee

⛔️ No live-chat

⛔️ No cash deposits possible

5. Commerzbank

Commerzbank has been voted Germany’s best branch bank for four consecutive years. It is the most modern of the traditional branches. They offer three different business bank accounts, for freelancers, self-employed and Start-Up founders. The monthly price ranges from 12,90 euros to 29,90 euros. However, currently, Commerzbank offers the first six months for free for the Classic Business account.

The website and sign-up process are in German only, however, the online and mobile banking app is available in English and it is a great option for anyone wishing for branch access and unlimited cash withdrawals and deposits.

Commerzbank Classic Benefits:

✅ Online account opening in 10 minutes

✅ Full real-time control via the user-friendly app

✅ Free Debit Girocard

✅ English online banking and customer service

✅ Overdraft possibilities

✅ Credit and loan possibilities

✅ Personal contact at local branch

✅ Unlimited cash withdrawals at Cash-Group ATMs

✅ Cash deposits possible at Commerzbank ATMs

Commerzbank Classic Drawbacks:

⛔️ 12,90 euros monthly account fee (currently first 6 months for free)

⛔️ Only 10 free SEPA transactions / month

(after that 0,20 euros / transaction)

⛔️ No accounting integration

⛔️ 2,50 euros fee for cash withdrawals or deposits

Conclusion

The business banking market is very exciting. As you can see from this comparison, there are several best banks for freelancers in Germany. Fintech companies dominate the market, offering specialized value. We have summarized which business account suits what purpose best, so you can choose based on your needs.

Finom – best free business bank account for freelancers, with bookkeeping and invoicing options.

Kontist – business bank account with bookkeeping integration.

N26 – the free business bank account in Germany, without add-ons for freelancers.

Qonto – business bank account for freelancers with accounting integration.

Commerzbank – business bank account with branch access at a traditional bank and no frills.

We wish you happy banking and an even happier business!

Good to know

The providers of online ID verification via video call do not always support the passports of all nationalities. In that case, you will have to go to your local post office and identify yourself there via PostIdent.