Are you looking to study in Germany or relocate with the Chancenkarte to find a job in Germany and stumbled across a blocked account requirement? In this guide, we will tell you what a blocked account is, why you need one, and which provider to choose. We review the best blocked account in Germany for you.

If you are short on time and just want an answer. Here are the providers for the best blocked account in Germany:

- Expatrio – Best added value for money.

- Fintiba – Most premium with most add-ons.

- Coracle – Most economical option.

| Expatrio | Fintiba | Coracle | |

|---|---|---|---|

| English Website & Support | |||

| Accepted Worldwide By All German Authorities | |||

| German IBAN | |||

| Partner Bank | Aion Bank (Belgium) | Sutor Bank (Germany) | Lemonway Financial Service Provider (France) |

| Banking Modell | Belgian partner bank with German subsidiary | German partner bank | Escrow System with French financial service provider |

| Availability | Worldwide* | Worldwide* (except for US tax residents) | Worldwide* (except for US citizens) |

| *There may be restrictions for individual countries (e.g. high-risk countries such as Iran and North Korea). | |||

| Account Set-up Fee | €69 | €89 | €99 or €59 (for students with the PRIME package) |

| Monthly Service Fee | €5 (paid upfront) | €4,90 | €0 |

| Additional Buffer Amount | €100 | €100 | €80 |

| Checking Bank Account Possible | |||

| Health Insurance Possible | |||

| Free Travel Insurance Possible | |||

| Available for Minors | |||

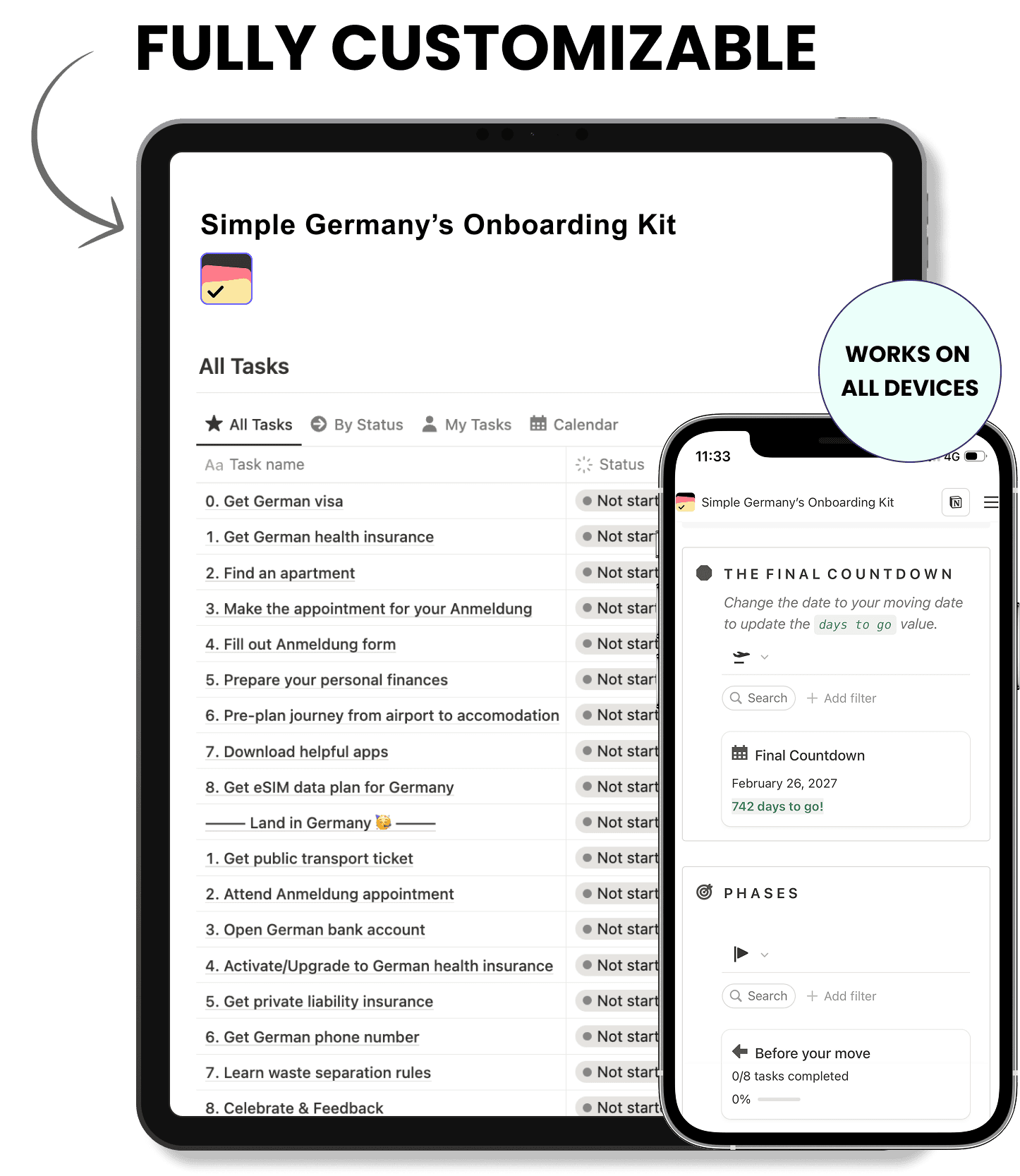

🛫 Moving to Germany soon? Stay organized with our Onboarding Kit — a prebuilt task manager and your step-by-step guide to ensure you don’t miss a thing during your move!

- Get a Prebuilt Task Manager for Your Move to Germany: Know what your next step should be.

- Save Time & Stay Organized: Don’t spend hours Googling → Get all the essential resources, critical steps, and links to governmental sites in one place.

- Fully Customizable: Adjust, add, or personalize the template to match your unique situation.

What is a blocked account in Germany?

A blocked account (Sperrkonto) is a specific bank account for international students and job-seekers in Germany. You need to open and transfer funds to a blocked account before your visa appointment, as it is a requirement to receive your visa.

The blocked account serves two purposes:

- To prove to the German government that you have enough financial resources to live from while in Germany.

- To set a monthly allowance to cover your living expenses. Yep, the German government wants to make sure that you don’t spend all of your money at once or end up running out of it towards the end of your stay.

❗️Word of warning

Upon your research, you will find other providers in your home country who offer a blocked account for Germany. You might be able to get your visa with these providers, but not your residence permit from the Foreigners Office, once in Germany. We therefore strongly suggest that you choose one of the three providers mentioned in this guide to avoid difficulties after your arrival in Germany.

What is the minimum amount for a blocked account in Germany?

As of the winter semester in 2024/2025, the minimum amount you need to transfer to your blocked account to apply for a student visa is 11.904 euros per year, so your allowance will be 992 euros per month. This reflects the perceived amount that one person needs to cover the most basic living costs in Germany.

The blocked amount needed for the Chancenkarte visa is slightly higher: 13.092 euros (that is 1.091 euros per month).

Read Our Related Guide

Is a blocked account necessary in Germany?

Yes, a blocked account is necessary if you are a non-EU citizen and looking to move to Germany on a student or job-seeker visa without having a scholarship or a sponsorship certificate proving your financial means.

If you plan to visit Germany as a tourist, you do not need a blocked account. Should you move to Germany on a work visa or with a Blue Card, you also don’t need a blocked account but should instead look into opening a checking account in Germany.

Read Our Related Guide

Along with a blocked account, you also need to provide proof of having travel insurance for your arrival in Germany and German health insurance once your studies or work starts. You could get all of these individually, or you can choose a package from one of the providers listed in this guide along with your blocked account to save time and money.

How can you open a blocked bank account in Germany?

There are three providers of blocked accounts in Germany that our readers trust: Expatrio, Fintiba and Coracle. With these three German providers, you can easily open your blocked account online and in English. We will compare them below.

Deutsche Bank used to also offer Blocked Accounts; however, they discontinued their offer in July 2022.

Which is the best Blocked Account in Germany?

Here is our detailed review of the best blocked account in Germany. All three providers have stellar reviews on Google and Trustpilot.

1. Expatrio

Expatrio is a modern company founded by three Germans in Berlin in 2017. They specialize in helping students and job-seekers acquire their German visa and relocate to Germany. Next to English, their website is also available in 11 other languages. Expatrio has a very intuitive website design and offers many more benefits with its Value Package. Such benefits are free incoming travel insurance for up to 92 days and convenient sign-up for public health insurance with Techniker Krankenkasse or private health insurance like Ottonova, as well as a free ISIC student card for one year.

Expatrio has a very low set-up fee of 69 euros; however, they also charge a 5 euros monthly service fee, which you need to deposit in advance. So, if you need a blocked account for 12 months, the blocked account with Expatrio will cost you 129 euros up front.

Expatrio works directly with their partner bank Aion, which is based in Belgium and has a subsidiary in Germany.

Read Our Related Guide

Expatrio benefits:

✅ Accepted worldwide by all German authorities

✅ Blocked account with German IBAN and on your own name

✅ Account opening confirmation within minutes

✅ Only 69 euros set up fee per year (sometimes revoked as cash-back)

✅ Value Package including health insurance, incoming travel insurance, ISIC card

✅ Customer service response guarantee within 24 hours

✅ Customer service via email, phone, and WeChat

✅ Money-back guarantee in case of visa denial

✅ Monthly cancellation or extension possible

✅ Optional free checking account for payouts when in Germany

✅ Website available in 12 languages

✅ How-to tutorials on their Youtube channel

Expatrio drawbacks:

⛔️ Not available for minors

⛔️ You can’t deposit more than 11.904 euros per year (governmental minimum)

2. Fintiba

Fintiba is another all digital platform founded in 2016 in Frankfurt am Main. It sets itself apart from Expatrio and Coracle, by offering the innovative Fintiba app, with which you can open your blocked account, upload documents and manage your payouts once in Germany.

It is a premium full-service provider with comprehensive support, sophisticated product bundles beyond a basic blocked account.

Next to the Fintiba Plus package of blocked account + health insurance with DAK + free travel insurance, Fintiba offers various other solutions such as Fintiba Companion, Fintiba Transfer, language learning offers, and the Fintiba Academy.

Except for Expatrio and Fintiba, most other blocked account providers work with financial service providers. Fintiba works directly with the German Sutor bank. Their blocked account has a set-up fee of 89 euros and a monthly fee of 4,90 euros, which gets charged, the moment you deposited money to the account (so already before your arrival to Germany).

Disclaimer: Those who cannot open blocked accounts through Fintiba include people with a US Tax Status, Residents of Iran, and Residents of North Korea. This is because of underlying banking regulations and/or international anti-money laundering measures.

Fintiba benefits:

✅ Accepted worldwide by all German authorities

✅ Blocked account with German IBAN and on your own name

✅ Account opening in less than 10 minutes

✅ Fintiba Plus, including health insurance & incoming travel insurance

✅ Premium customer service via email, phone, and chat

✅ Monthly cancellation or extension possible

✅ Fintiba app for easy access

✅ You can deposit more than the minimum 11.904 euros per year

✅ Website available in English and sign-up also in Chinese and Spanish

✅ Works directly with the German Sutor bank

✅ Very active and informative Youtube Channel

✅ Available for minors

Fintiba drawbacks:

⛔️ Not available for US tax residents

3. Coracle

Coracle was founded by two expats in 2016 in Hamburg. Coracle actually started as a health insurance broker and added the blocked account to their portfolio in 2018. They pride themselves on their speedy responses.

The blocked account with Coracle has a set-up fee of 99 euros with no monthly fees. As a university or language student, you can benefit from their PRIME package, which includes the blocked account, free travel insurance for up to 6 months, and sign-up to public health insurance for only 59 euros with no additional monthly fees.

This package which offers so much more value than just booking the blocked account is unfortunately not available for job seekers.

When choosing health insurance additionally to your blocked account, Coracle gives you the option to choose between different German public health insurance funds, such as TK, Barmer, and AOK.

Coracle is the most economical provider and great for anyone looking for a simple, streamlined budget option. Its website is leaner with less information, fewer add-ons and a ‘pick and mix’ model. They don’t have a direct partner bank, but instead work with the French financial service provider Lemonway. They hold your money in an escrow account for you.

Disclaimer: Coracle can’t be used by US citizens.

Coracle benefits:

✅ Accepted worldwide by all German authorities

✅ Account opening confirmation within 2 hours

✅ Blocked account with German IBAN and on your own name (most nationalities)

✅ No monthly fee

✅ Only 60 euros fee for extension for a second year

✅ Special PRIME offer for BA & MA students of only 59 euros set-up fee

✅ PRIME offer includes health insurance and free incoming insurance

✅ Fast customer service in English, Spanish and Russian via email, phone, and WhatsApp

✅ Money-back guarantee in case of visa denial

✅ Monthly cancellation or extension possible

✅ You can deposit more than the minimum 11.904 euros per year

✅ Available for minors

Coracle drawbacks:

⛔️ Prime package of blocked account and health insurance only available for students

⛔️ Not available for US citizens

How Long Do Money Transfers Take?

Many students ask how long the transfer of their funds to the German blocked account takes and how long it takes to transfer the funds to their German checking account once in Germany.

In all honesty, the time for transfers depends on the bank or service you use in your home country and the bank you choose to have your German checking account with. Samy, the founder of Coracle, told me that transfers to your German checking account, once in Germany, are a lot faster with a mobile bank like N26 than with a traditional bank like Sparkasse.

How to transfer money to your German Blocked Account?

Before you simply go to your local bank at home and initiate the transfer of the necessary funds, consider looking into remittance services such as Wise (former Transferwise). It will not only save you a big amount of fees but also time. Wise will only take a few hours instead of taking days, as a regular international bank wire. However, they are not available in every country in the world yet, but they keep adding countries and currencies.

How to withdraw money from your blocked account once in Germany?

Once in Germany, you need to activate your blocked account. To do so, you must provide your German address, stamped visa and/or university registration, and German checking account information. Expatrio already offers a checking account included in their Value Package. However, if you need or want to do this step by yourself, the mobile bank N26 or the student account from Commerzbank are great and free choices.

Read Our Related Guide

Once you have opened your checking account, you need to connect it to your blocked account, either online or with the customer service team’s help. You can then set up a monthly wire transfer with your monthly allowance.

Step-by-Step summary for getting a German Blocked Account

Let’s summarize all the detailed information in this guide. If you think you are in need of a blocked account in Germany to relocate, these are the steps you should take:

- Inform yourself with the local German embassy or consulate whether you need to have a blocked account.

- Choose one of the providers reviewed in this guide at least three weeks before your visa appointment to allow the process and transfer of your funds enough time.

- Be sure to also get health insurance and travel insurance individually or with your blocked account, as you require these for your visa as well.

- Research the fastest and cheapest way to transfer money internationally to your German blocked account, for example, Wise (former Transferwise).

- When traveling to Germany, bring some extra money with you. Either in cash, on your Wise account, or a credit card, as it will take some time to activate and access your blocked account, so don’t let this be your only money source.

- Open a German checking account with N26 or Commerzbank to activate your blocked account and to use it as your daily bank account. Should you need more funds while in Germany, send money to your checking account and not your blocked account.

For more tips on how to beat Germany’s bureaucracy, take a look at our Moving To Germany section.

Best of luck with your relocation!