Dental care in Germany is excellent but expensive. Your general public health insurance only covers basic dental treatments. In this guide, we shed light on who should consider dental insurance and which is the best dental insurance in Germany.

Here is a quick overview of the best private dental insurance providers in Germany for expats:

- Ottonova – Awarded as the best dental insurance in Germany in 2023. Website, customer support, and app in English. Very comprehensive cover, super-fast reimbursement, and no waiting period.

- Feather– Expat insurance provider, simple to use, website and customer support in English, basic and advanced plan.

- Getsafe – Simple to use, website and customer support in English, one-plan fits all, reimbursement within 48 hours.

Does German health insurance cover dental care?

Yes, as part of Germany’s public healthcare system, German health insurance companies cover basic dental care, such as yearly check-ups, including descaling your teeth, simple plastic fillings for frontal teeth, and wisdom teeth removal.

What treatments are included in your health care in detail depends on whether you have public health insurance (GKV) or private health insurance (PKV). Private health insurance usually has quite a comprehensive dental cover, and you can opt to increase your dental cover with a premium plan. So should you be insured through a private health insurer like Ottonova, you do not need to look into additional dental insurance.

Should you be insured by statutory health insurance, such as TK, AOK, or Barmer, this guide is for you. Private dental insurance might make sense to supplement your public health cover, as any advanced dental treatment can easily cost several hundred or even thousand euros and is only partially covered by public health insurance.

Why do you need dental insurance in Germany?

Good dental care can prevent many treatments. However, even with reasonable care, you cannot improve your genetics, and your genetics have a significant influence on whether you have good or bad teeth. In case your parents and grandparents have trouble with their teeth, the chances are high that you will need dental treatments in the future as well.

Should you already have a history of more advanced dental treatments in your home country, dental insurance makes sense for you in Germany.

Let’s take a look at some estimated dental treatment costs in Germany:

- Professional cleaning: 50 – 120 euros

- Root canal treatment: 300 – 1.000 euros

- Ceramic inlay: 400 – 700 euros

- Implant with ceramic crown: 2.500 – 3.500 euros

- Ceramic bridge 1.300 – 2.200 euros

Depending on your public health insurance, it might cover 30-60 percent of the treatment cost. A supplementary private dental insurance will cover a significant portion of the rest or even the entire remaining amount.

Example calculation for a full ceramic crown

What does dental insurance in Germany cover?

Dental insurance in Germany usually covers the following:

- Professional cleaning

- Dental treatment

- Dental prosthesis

- Inlays

- Crowns

- Bridges

- Implants

- Dentures

Every insurer and every policy, however, cover different amounts and include or exclude specific treatments. That’s why it is best to talk to your dentist about your vulnerable areas to get the best policy for your needs.

What is the best dental insurance in Germany?

There are 3 good dental insurances in Germany for expats.

❗️ Important Note

Only book supplementary private dental insurance, if you have public health insurance. Should you have private health insurance, you already have a better dental cover and you can choose to increase it directly with your private health insurer.

1. Ottonova

Ottonova is a private health insurance company in Germany. It was founded in 2017 and is challenging the status quo of traditional insurance companies. It is the first and only fully private health insurance company that is 100% digital and officially offers its services in English.

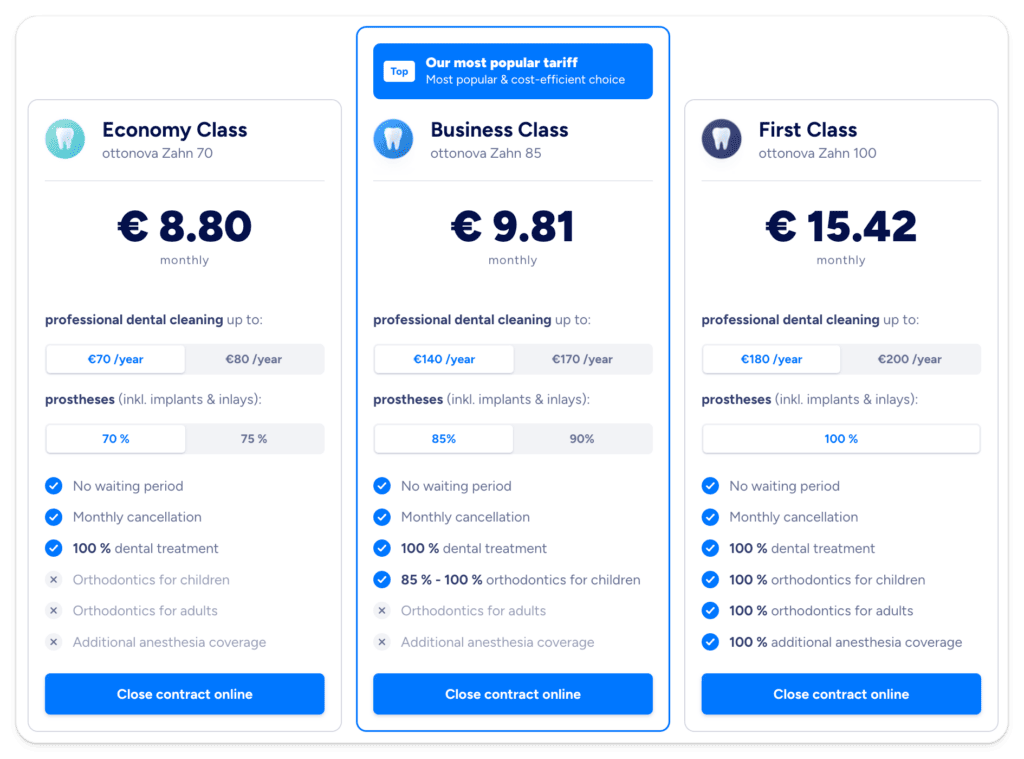

Ottonova has won the most prestigious consumer product test in 2023 for the best private supplementary dental insurance policy and offers 3 different plans for different levels of dental coverage.

Economy Class Starting From 8,80 Euros A Month

Includes:

- Dental treatments like root canal, periodontal, and plastic fillings (100%)

- Dental prosthesis (100% if public health insurance covers partially)

- Dentures including implants and inlays (70%)

- Professional cleaning up to 70 euros a year

- Functional analytical and functional therapeutic services (70%)

The monthly cost depends on your age, and it does have a limit to its cover the first four years, starting from 800 euros and adding 800 euros each year.

Business Class Starting From 9,81 Euros A Month

Includes Economy Class plus:

- Orthodontics for children (85-100%)

- Two professional cleanings up to 70 euros per cleaning

- Functional analytical and functional therapeutic services (85%)

The insurance premium depends on your age, and it does have a limit to its cover the first four years, starting from 1.000 euros and adding 1.000 euros each year.

First Class Starting From 15,42 Euros A Month

Includes Business Class plus:

- Dentures including implants and inlays (100%)

- Orthodontics for children (100%)

- Orthodontics for adults (100% up to 2,000 euros if public health insurance covers partially)

- Additional anesthesia services

- Two professional cleanings up to 90 euros per cleaning

- Functional analytical and functional therapeutic services (100%)

The premium depends on your age, and it does have a limit to its cover for the first 4 years, starting from 1.250 euros and adding 1.250 euros each year.

All 3 Ottonova policies have no waiting period.

2. Feather

Feather is a modern insurance broker for expats in Germany. They know the obstacles internationals face in Germany and offer all of their services 100% digital, easy, and in English. When it comes to private dental insurance, Feather offers two different policies: Basic and Advanced. Feather dental insurance cover starts the following day after purchase without a waiting period.

Basic Cover Starting From 10,90 Euros A Month

Includes:

- Professional teeth cleaning (up to 150 euros / year)

- Dental treatments including

- High-quality composite fillings

- Root canal treatments

- Periodontal treatments

- Mouthguards against bite splints from teeth grinding

- Pain relief and anesthesia

- Orthodontic treatments

The basic insurance premium is dependent on your age, and it does have a limit to its coverage for the first two years, starting from 150 euros and adding 150 euros in the second year. All treatments, except orthodontics, have unlimited coverage starting the third year of being insured. Orthodontics has a limit of 2.000 euros from the third year onwards.

Advanced Cover Starting From 16,00 Euros A Month

Additional coverage:

- Unlimited professional teeth cleaning

- Teeth whitening up to 200 euros every two years

- Dentures and tooth replacements

- Bridges and crowns

- Implants

- Inlays and onlays

The advanced insurance premium is also dependent on your age; however, it does not limit its cover for all the treatments included in the basic plan for the first two years, except for orthodontics, for which the limits are the same as in the basic cover.

The Advanced cover, however, does have limits to restorative treatments for the first four years. It also considers whether you have missing teeth at the time of sign-up, as this has an impact on the cover limit.

The Feather policies do not have a waiting time as long as you haven’t booked the dentist appointment before taking out dental insurance with Feather.

You can cancel your policy anytime as long as you haven’t made a claim within the first year. Should you make a claim in the first year, you cannot cancel your policy in the first year, but only after your contract has passed the one-year mark.

Related Review

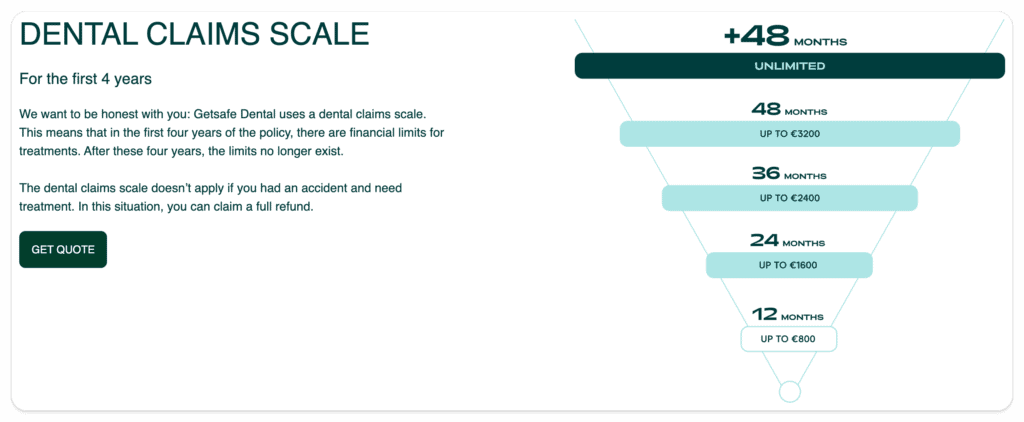

3. Getsafe

Getsafe is a modern insurtech company revolutionizing the traditional insurance industry. 100% digital, easy, and English-speaking are three attributes of Getsafe. When it comes to private dental insurance, Getsafe offers one simple basic plan, with clear English guidelines on what is covered and what’s not.

Basic Dental Cover Starting From 9,38 Euros A Month

Includes:

- Professional dental cleaning up to 80 euros per year

- Tooth treatments

- Composite fillings

- Root canal treatments

- Periodontal treatments

- Functional analysis and therapy services (75%)

- Dental Prosthesis (75%)

- Inlays and onlays

- Crowns and bridges

- Veneers & dentures

- Implants & bone grafts

The dental insurance from Getsafe no longer has a waiting time.

Getsafe prides itself with super fast reimbursement within 48 hours after submitting a claim. Similar to

With our special Getsafe code SIMPLEGERMANY15, you even get a 15 euros discount.

Simple Germany’s Hot Tip

Before you get any advanced dental treatment done, ask your dentist for a Heil- und Kostenplan (a cost estimate) and submit it to your public health and dental insurance. They will let you know how much they will cover, and in some cases, without providing this plan, they won’t cover at all.

Conclusion

Getting additional private dental insurance to extend your general public health insurance cover can be worth your while if you tend to have bad teeth. It depends on how extensive you would like your cover to be and on how old you are. When we take a look at the most comprehensive coverage of all providers at age 32, you would pay 28,44 euros per month with Ottonova, 25,80 euros with Feather, and 12,68 euros with Getsafe.