Commerzbank is Germany’s second largest private bank and was awarded the best branch bank in the past five years. They are a great choice for internationals in Germany who seek a traditional branch bank. As a plus, they offer their online banking, mobile app, and customer support in English. Only their sign-up remains in German, which is why this guide explains in detail each step of the registration process and gives you tips so you can successfully open your Commerzbank account.

These are the 5 steps you need to take to open a Commerzbank account:

- Apply for a Commerzbank account online

- Verify your identity

- Activate your online banking

- Get your girocard PIN through postal mail

- Get your girocard through postal mail

- Accessible for most nationalities

- English banking app

- Free instant transfers within Eurozone

- Free unlimited cash withdrawals & deposits at more than 6.000 Cash Group ATMs in Germany

- 4,90 euros monthly account fee

Important things to know before opening a Commerzbank account

Before you open a bank account with Commerzbank, keep the two points below in mind.

1. Requirements for international customers

Before you invest time in starting the process of opening a bank account with Commerzbank, you should meet the following requirements:

- You are a German resident.

- You are at least 18 years old.

- If you are a non-EU or non-EEA citizen, you will have to identify your identity personally. For this process, you will need to present:

- Your Meldebescheinigung (the document you receive after completing the Anmeldung).

- Your passport or ID

- Your residence permit (in some cases)

- Your tax ID (in some cases)

If you urgently need a bank account (to get your salary, for example) and you don’t have enough time to get the Meldebescheinigung, we recommend opening an online banking account with Wise (former Transferwise). This will allow you to start receiving your salary and have enough time to peacefully complete the bureaucratic steps after landing in Germany.

Once you are settled in Germany, you can consider opening a Commerzbank account as a second account.

2. Understand the Monthly Account Fees

The checking account from Commerzbank has a monthly maintenance fee of 4,90 euros. You will not be charged the 4,90 euros if you have a minimum balance of 50.000 euros invested as a sum in all of the Commerzbank portfolio (savings account, securities investment account, and, of course, the checking account).

Are you a Student in Germany?

If you are a student and younger than 28 years, you can open a student account with Commerzbank instead. It is entirely free of charge and even includes a free Mastercard credit card if you have 300 euros per month incoming in your account (e.g. from your blocked account).

How to open a Commerzbank account

Follow the 5 steps below to open your Commerzbank account.

1. Apply for a Commerzbank account online

To start your online application, please click on this link (students younger than 28 years, please use this link). Then click on the button ‘Open your current account’.

Simple Germany’s Hot Tip

If you use Chrome as a browser, you can right-click on the page and click on ‘Translate to English.’ Alternatively, you can click on the translation widget in the address bar. For more details on enabling these functions on Chrome, make sure to read Google’s help article.

1.1 Personal details

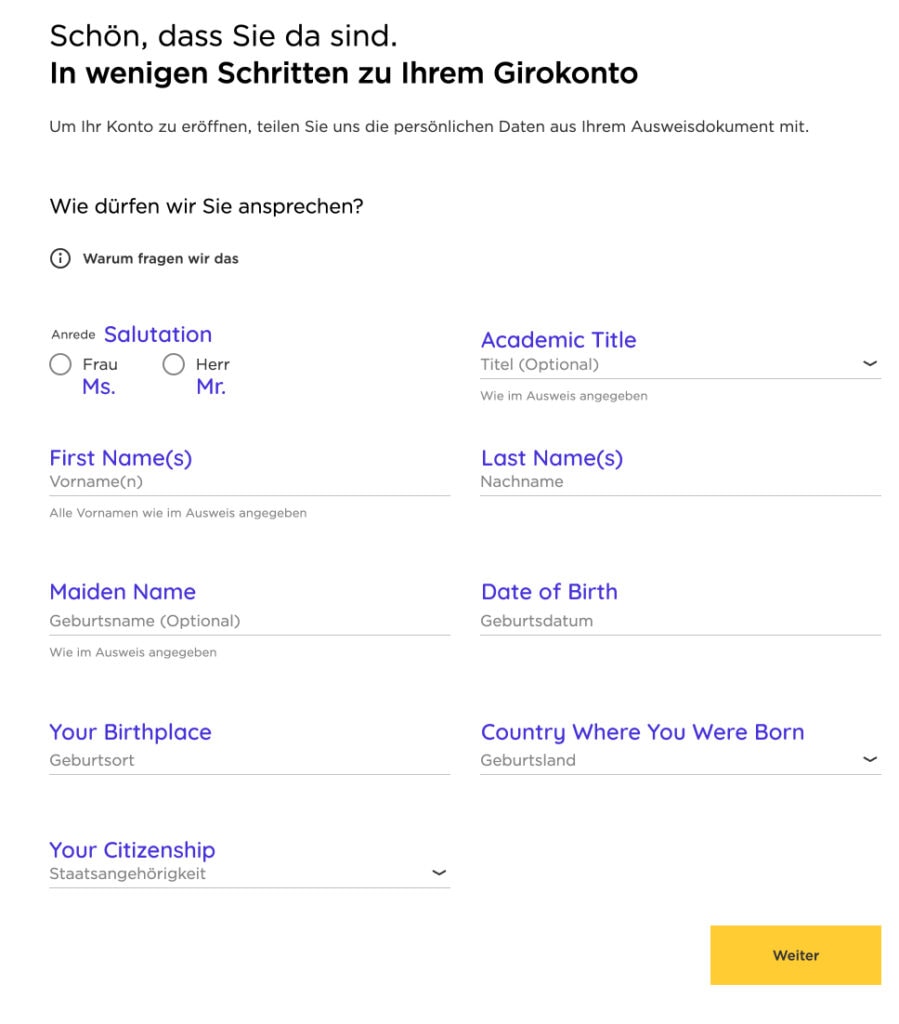

1.1.1 Fill Out Your Personal Details

Anrede: Select your salutation (Frau: Ms. / Herr: Mr.)

Titel (optional): Select your academic title

Vorname(n): Your first name(s) as stated on your passport

Nachname(n): Your last name(s) as stated on your passport

Geburstname (optional): Your maiden name, if applicable

Geburtsdatum: Your date of birth

⚠️ If you use Google’s translate function, make sure to disable it when you enter your date of birth. When you have the translation function on, the date’s format becomes DD/MM/YYYY. If you try to submit the form, it will throw an error because the expected format for the DOB is DD.MM.YYYY.

Geburtsort: Your birthplace

Geburtsland: Country where you were born

Staatsangehörigkeit: Your citizenship

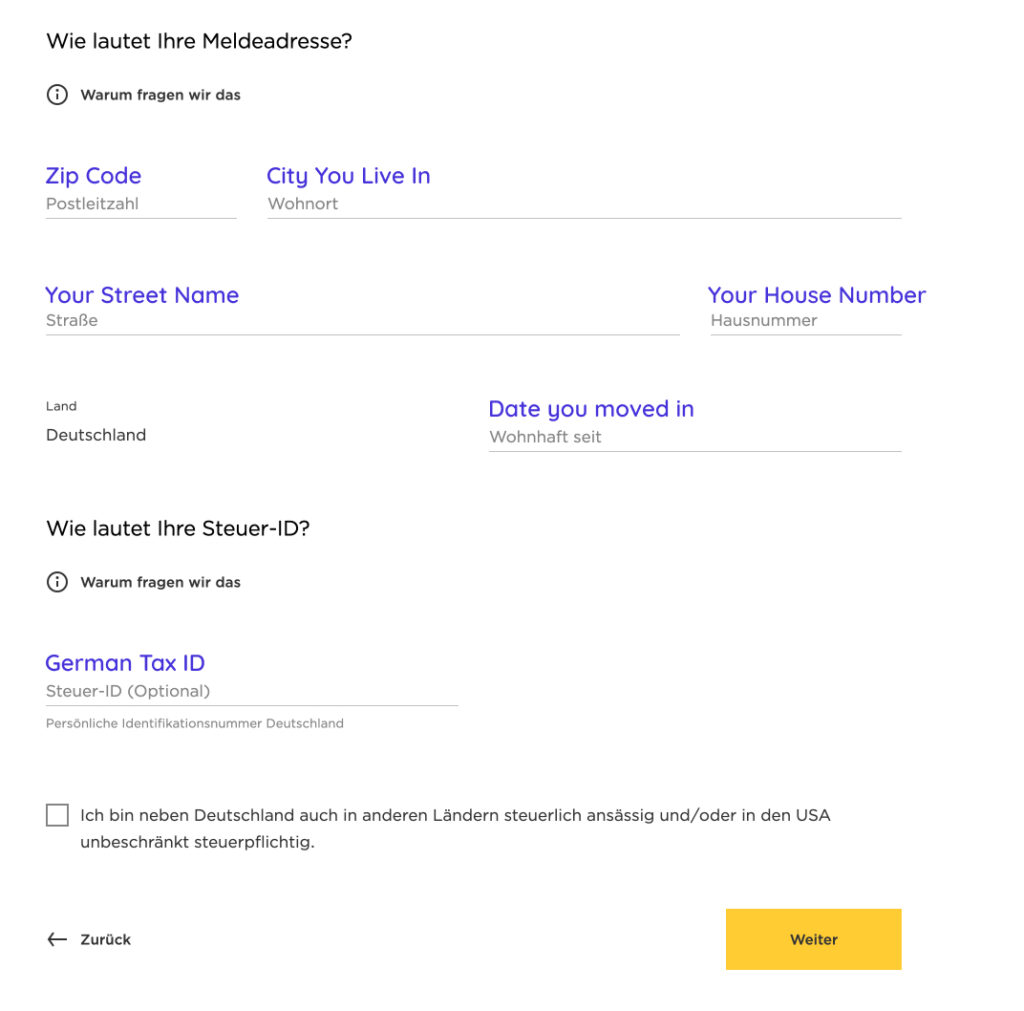

1.1.2 Fill out your address and Tax information

After you complete the online form, Commerzbank will send you a few critical letters to the address you provide in this step. So please be sure to be at this address for the next couple of weeks to be able to take action once the letters arrive through postal mail.

Postleitzahl: Your zip code

Wohnort: The city you live in

Straße: Your street name

Hausnummer: Your house number. Make sure to check out the section on German address format in our guide How To Send A Letter in Germany

Wohnhaft seit: Enter the date since you are living at that address. This date is usually found in your Meldebescheinigung (the document you got after completing your Anmeldung)

Steuer-ID (optional): Enter your German Tax ID. If you don’t have yours yet, leave it blank. Our guide Tax Number And Tax ID In Germany might be helpful if you don’t know where to find this number.

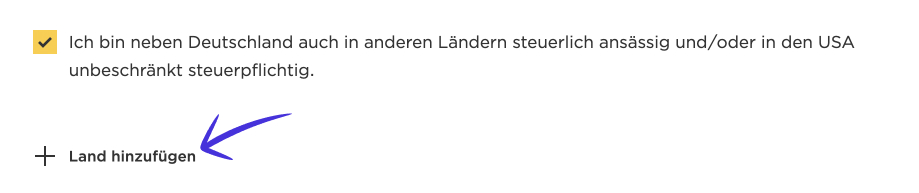

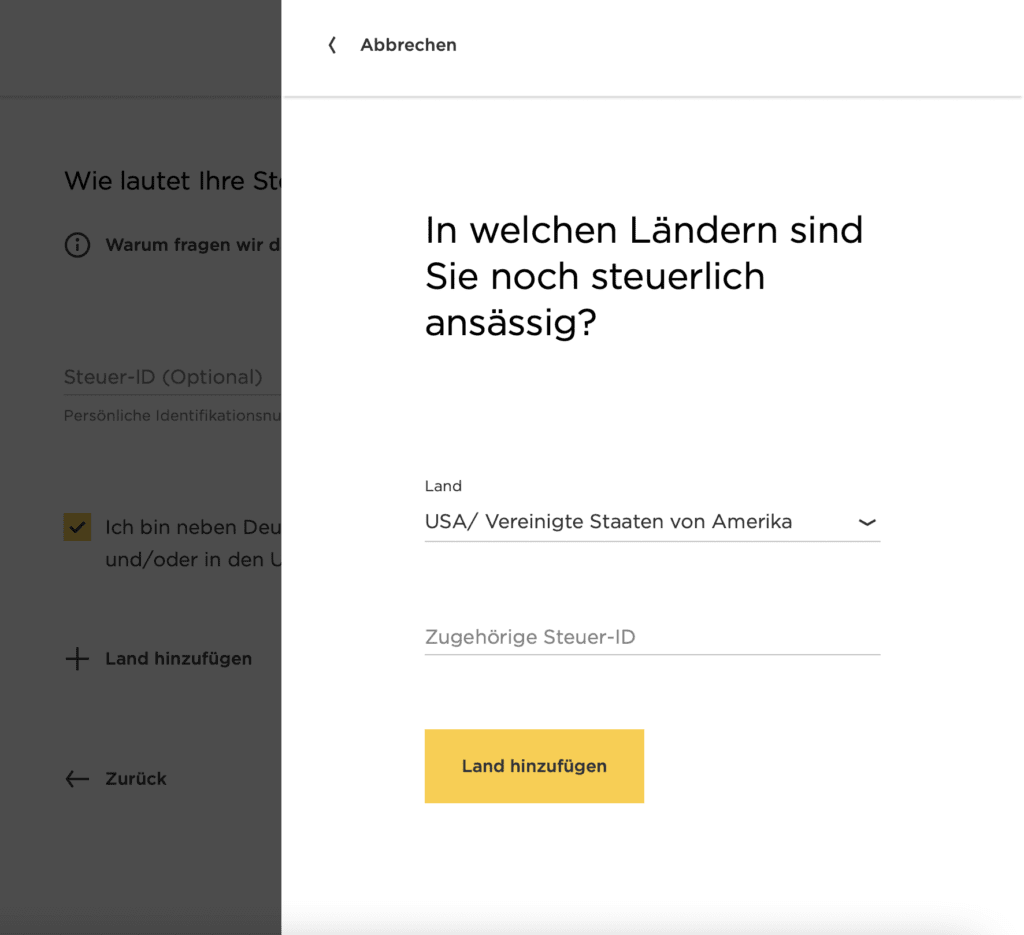

Steuerpflichtausland: Tax liability in another country. If you are tax liable in another country, like the USA, make sure to tick this box. Then, click on “Land hinzufügen” (add country), and a pop-up will appear for you to enter the country and your tax identification number.

1.1.3 Type of Employment

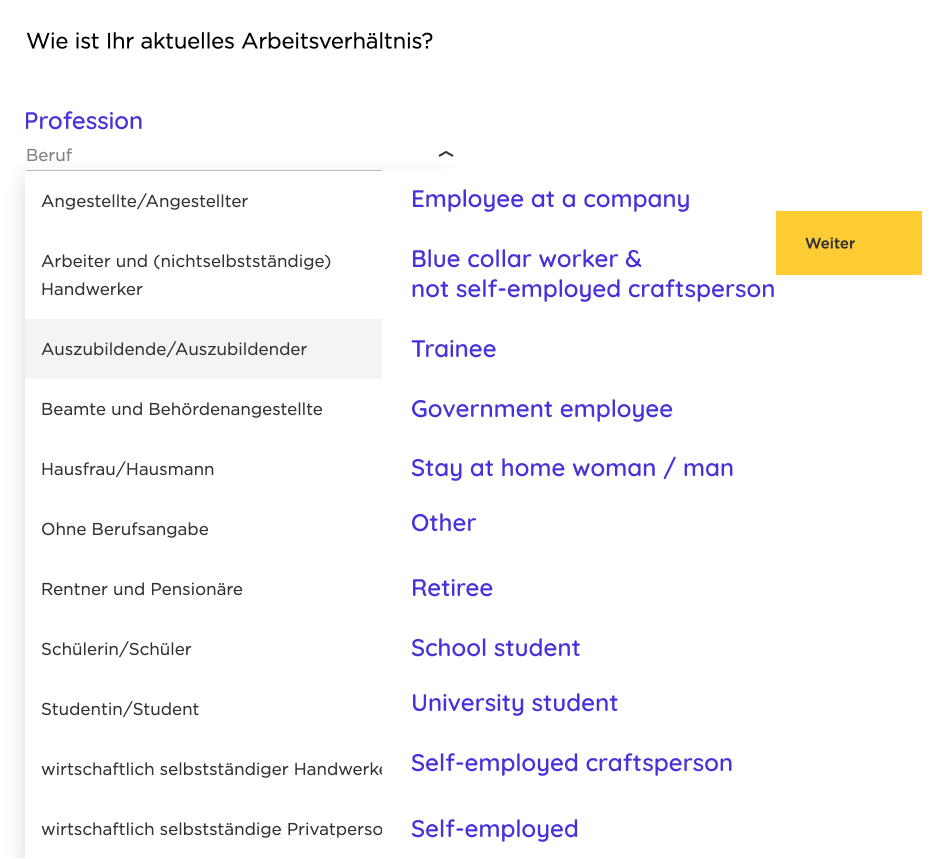

When you click on the dropdown list, you will see a long list of available professions.

Beruf: Profession

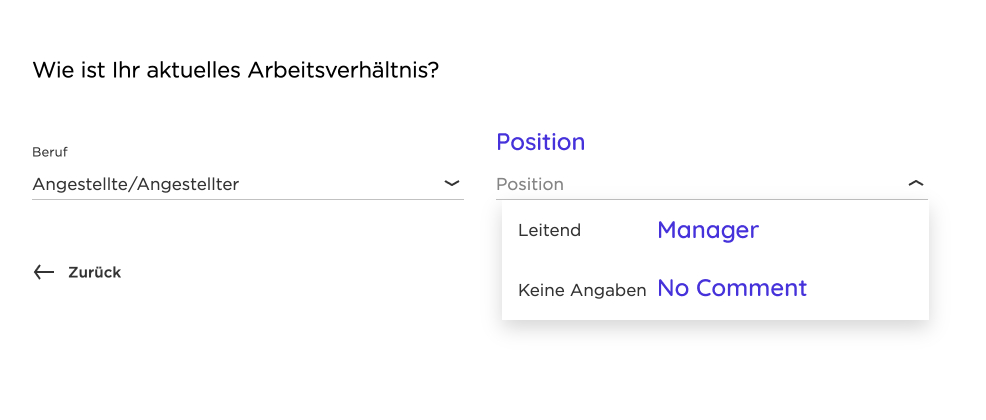

Angestellte/Angestellter: Employee at a company.

- Position:

- Leitend: Manager

- Keine Angaben: No comment

Arbeiter und (nichtselbstständige) Handwerker: Blue collar worker and not self-employed craftsperson

Auszubildende/Auszubildender: Trainee

Beamte und Behördenangestellte: Government employee

Hausfrau/Hausmann: Stay at home woman / man

Ohne Berufsangabe: Other

Rentner und Pensionäre: Retiree

Schülerin/Schüler: School student

Studentin/Student: University student

Wirtschaftlich selbstständiger Handwerker: Self-employed craftsperson

Wirtschaftlich selbstständige Privatperson: Self-employed

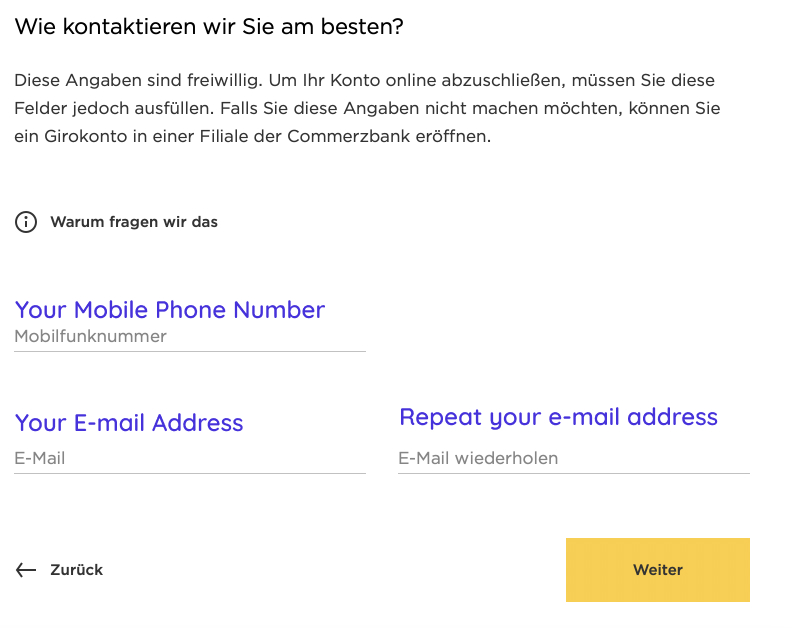

1.1.4 Contact details

Mobilfunknummer: Mobile phone number. You can either enter it as +491621234567, 00491621234567, or 01621234567. For more information on the Best Mobile Network In Germany make sure to check our guide out.

E-mail: Your e-mail address

E-Mail wiederholen: Repeat your e-mail address

1.2 Online banking details

Your online banking login data consists of three parts:

- Your username / login name

- Your password

- Your TAN number

Good to know

You will set your username and password in the online form. After you have completed the form, you will need to verify your identity. One to two days after you have successfully validated your identity, you will receive an online banking activation letter. The instructions in this letter will help you set up your photoTAN. You will need photoTAN set up to log into your online banking account (as a second verification method) and confirm bank transfers.

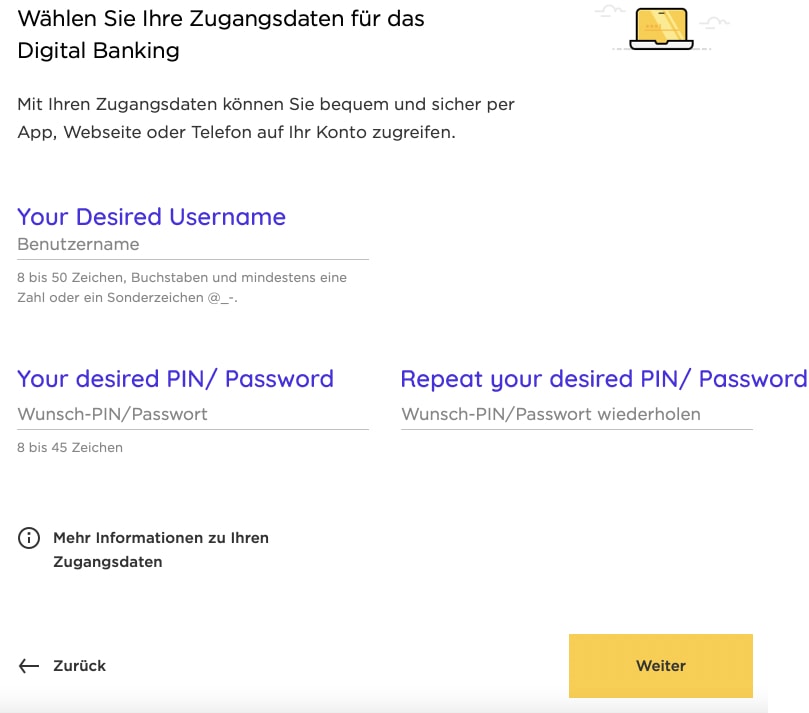

1.2.1 Fill out Your login data

Benutzername: Your desired username. Make sure that your username follows the required criteria:

- 8-50 characters, letters, and at least one number or special character

- Permissible characters are letters (upper and lower case are not distinguished), numbers, and special characters @ _ – .

- Not permitted: umlauts (ä, ö, ü), spaces, letter ß, or any other letter marks (e.g.: î, ó)

- Use of the same character a maximum of 2 times in a row

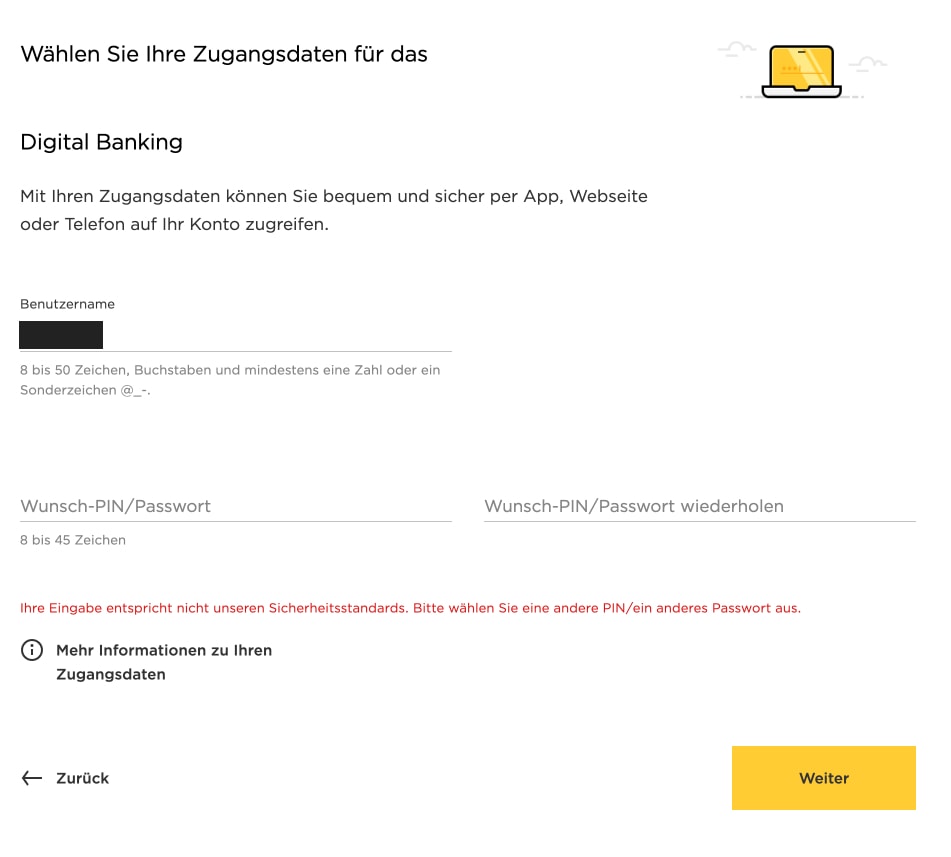

Wunsch-PIN/Passwort: Your desired PIN/ Password. Make sure your PIN/Password follows the required criteria:

- 8 – 45 characters, letters, and at least one number or special character

- Permissible characters are letters (upper and/or lower case), numbers and the special characters # + ~ ! ” $ % & / ( ) = ? \ { } ] [ @ > < . : , ; – _ |

- Not permitted: umlauts (ä, ö, ü), spaces, letter ß, or any other letter marks (e.g.: î, ó)

Wunsch-PIN/Passwort wiederholen: Repeat your desired PIN/ Password

Simple Germany’s Hot Tip

Keep your username and pin/password stored in a safe place because you will need it for step 3 to activate your online banking. I use 1Password to help me generate a secure password, keep it safe. The cool thing is that I don’t have to memorize it or be worried that I am going to lose it.

A password manager that simplifies and secures your digital life. You only need to remember one password to access your secure data.

- 30-day free trial

- Easy to set up

- Use 1Password on all your devices

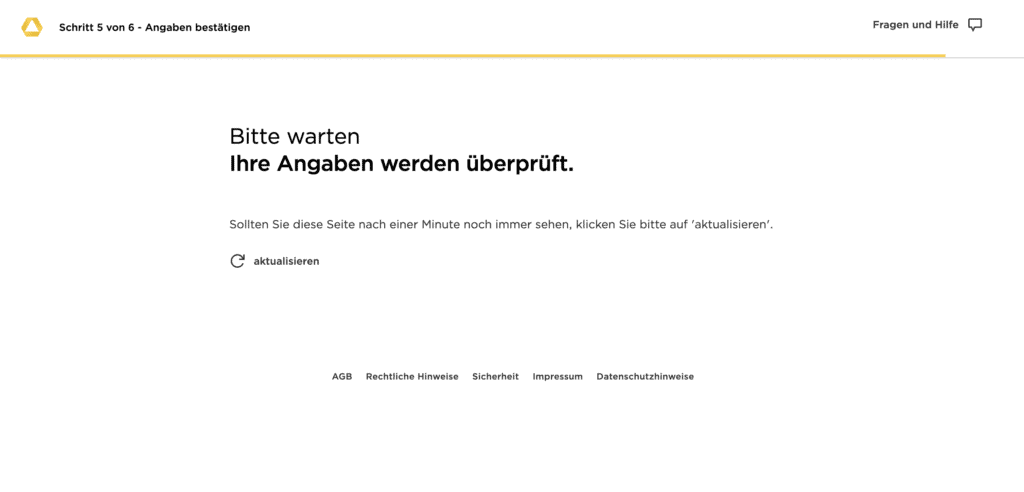

Wait for your information to be checked. You will see the screen below for a few seconds.

If an input field in the form is not valid, you will see an error message with what went wrong so you can update the value.

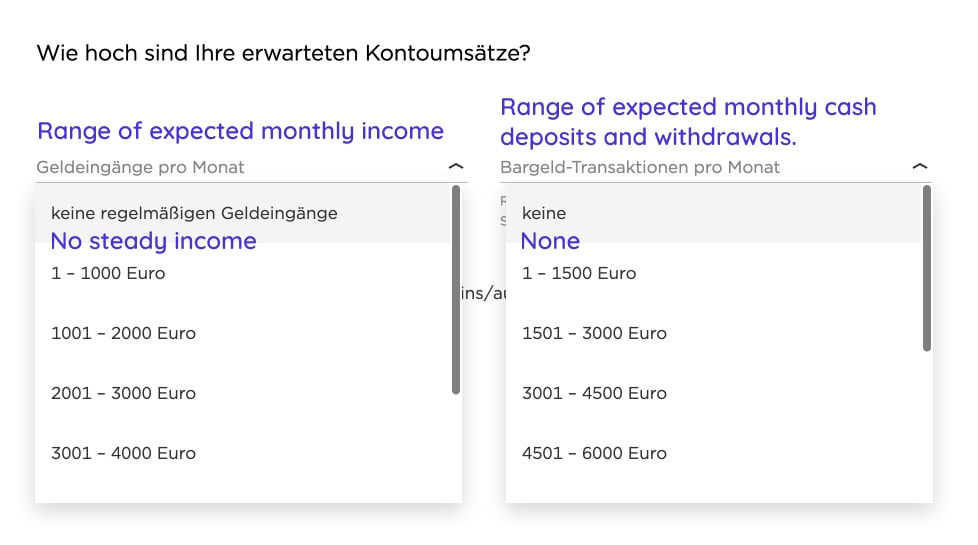

1.2.2 Fill out how you will use the account

Geldeingänge pro Monat: Range of expected monthly income.

Keine regelmäßigen Geldeingänge: No steady income.

Bargeld-Transaktionen pro Monat: Range of expected monthly cash deposits and withdrawals.

keine: none

Überweisungen ins Ausland: If you expect to receive or send money abroad, make sure to tick this box and add the countries.

Be aware that Commerzbank might have very high fees for international bank transfers. If you need to send money back home or do any other type of international transaction, consider opening an account with Wise. Wise offers very low fees for sending and receiving money from abroad.

1.2.3 Mastercard Debit Card (Optional)

The online form you are filling out is for a Commerzbank checking account (Girokonto), including a free Commerzbank girocard and a free virtual debit card.

A girocard is a direct debit card that allows you to withdraw money from ATMs and pay for services in Germany in person. We have written a detailed explanation of the difference between a girocard and a credit card in Germany.

You can use the virtual debit card with Apple Pay or Google Pay. However, it is just a virtual card, which means that it does not have a CVC number on it, and therefore, it is not accepted for paying for services online.

This section of the form asks you if you would like an additional Mastercard debit card, which you could use to make payments online. There is a catch, though. If you order this Mastercard, you will pay an additional 3,50 euros every month.

Online services like Amazon, Netflix, and Zalando allow you to enter alternative payment methods like:

- PayPal: If you have a PayPal account, you can easily link your bank account as a payment method and use PayPal to pay for services online.

- SEPA: You can easily connect your German bank account and use it to pay for services online.

I don’t think the monthly 3,50 euros is worth the benefits, especially since Germany has great free credit cards to choose from, which you can use to pay online.

Read Our Related Guide

Best Free Credit Card In Germany [The Ultimate English Guide]

1.2.4 Securities Account (Optional)

Choose if you would like to open a securities account to invest in ETFs and trade in the stock market.

If you are unsure right now whether you want a securities account with Commerzbank or not, no worries. You can always skip this step now and come back to our guide below, at a later time.

Read Our Related Guide

1.2.5 Savings Account (Optional)

Choose if you would like to open a savings account to receive a variable interest rate of currently 2,25% for the first 12 months on money you want to ‘park’ with Commerzbank. Their savings account is called Topzinskonto Plus.

Again, if you are unsure at this time, you can skip this step and come back to it later. For more research, you can also read our guide below.

Read Our Related Guide

1.3 Terms and Conditions

Remember, you can use Chrome as a browser and their translation feature to read the page in your desired language. Right-click on the page and click on ‘Translate to English’ or any other language you prefer.

1.3.1 Send Account Details per E-mail (Optional)

Tick this box if you would like to receive the conditions and further information for your account, including the cancellation policy and the application for opening an account, per e-mail.

1.3.2 Accept Terms and Conditions

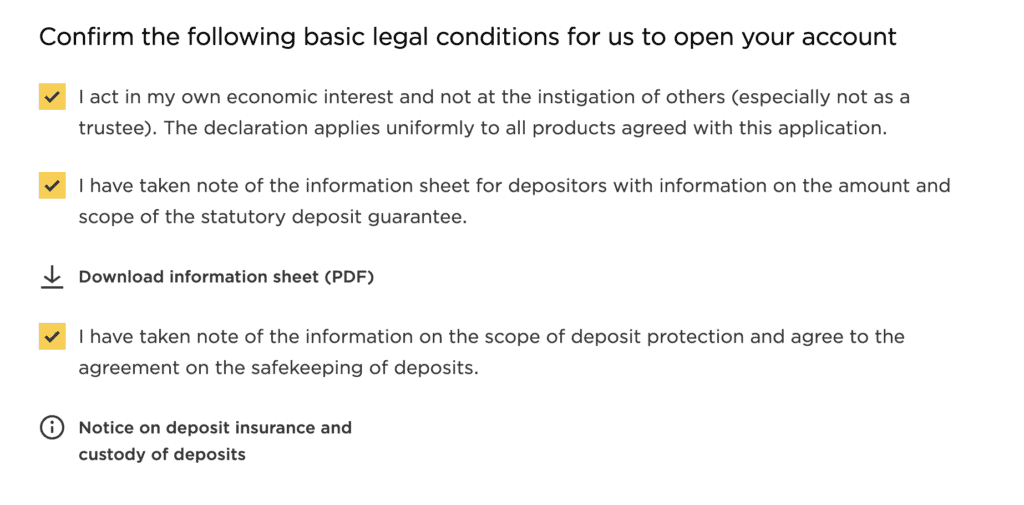

You have to accept all three conditions to continue with the registration process.

1.3.3 Consent for the use of your data (Optional)

As of writing this guide, Commerzbank offers a 50 euros monetary bonus when you open your checking account.

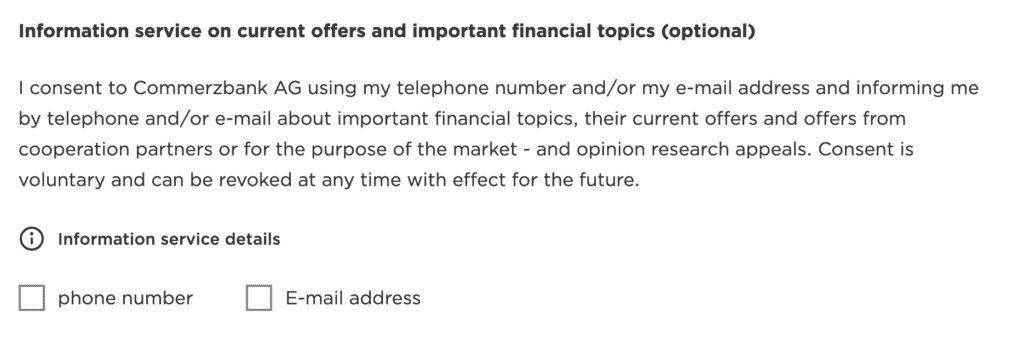

One of the conditions to qualify for the starter bonus is to accept Commerzbank’s request to receive promotions through e-mail and phone.

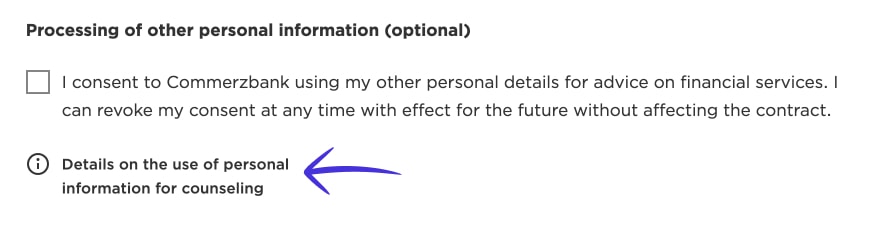

Decide if you want to allow Commerzbank to use some of your data, like marital status and monthly net income (amongst others), for advice on financial services. You can always click on the details link for more information on the data they will collect.

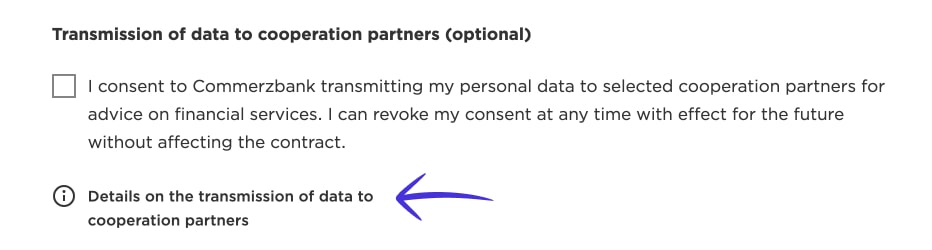

Decide if you want Commerzbank to use some of your data like marital status and monthly net income (amongst others) to select cooperation partners for advice on financial services. You can always click on the details link for more information on the data they will collect.

1.4 Confirm your data

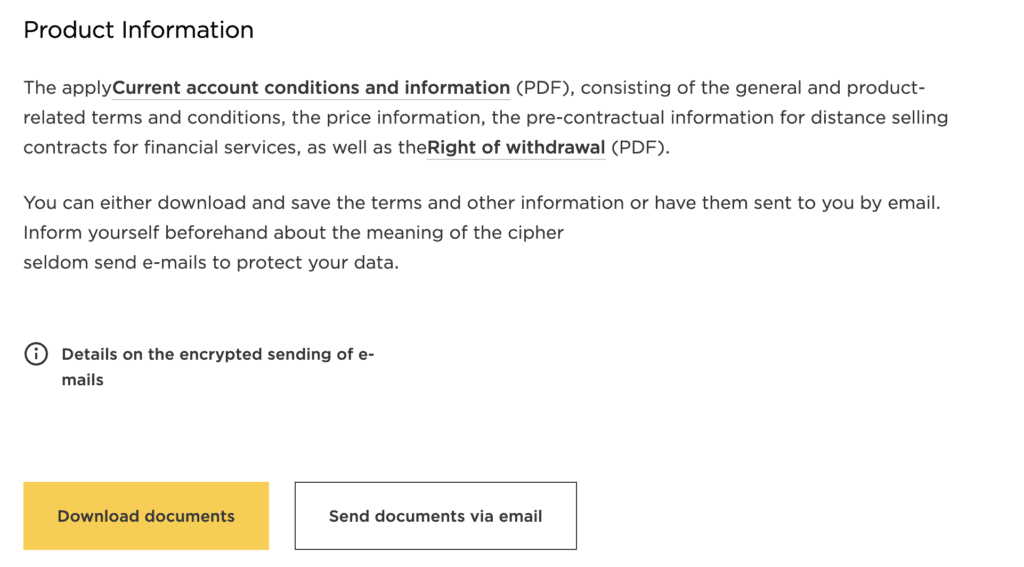

You need to download your bank account’s terms and conditions (in German) or have them sent by e-mail. If you don’t do this, you won’t be able to continue to the next step.

Double-check your data and if you need to edit anything, click on “Angaben ändern.”

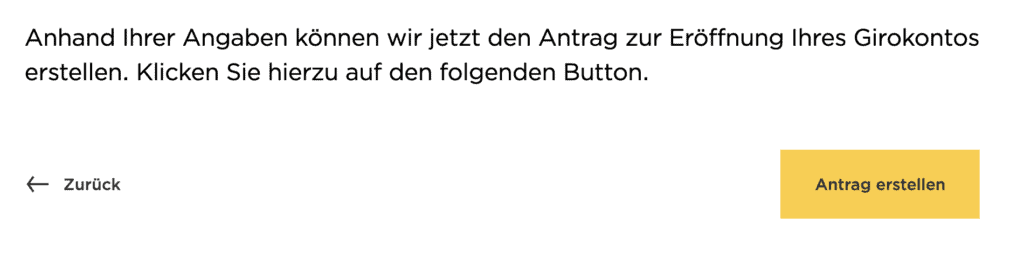

If everything looks good, click on the button that says “Antrag erstellen.“

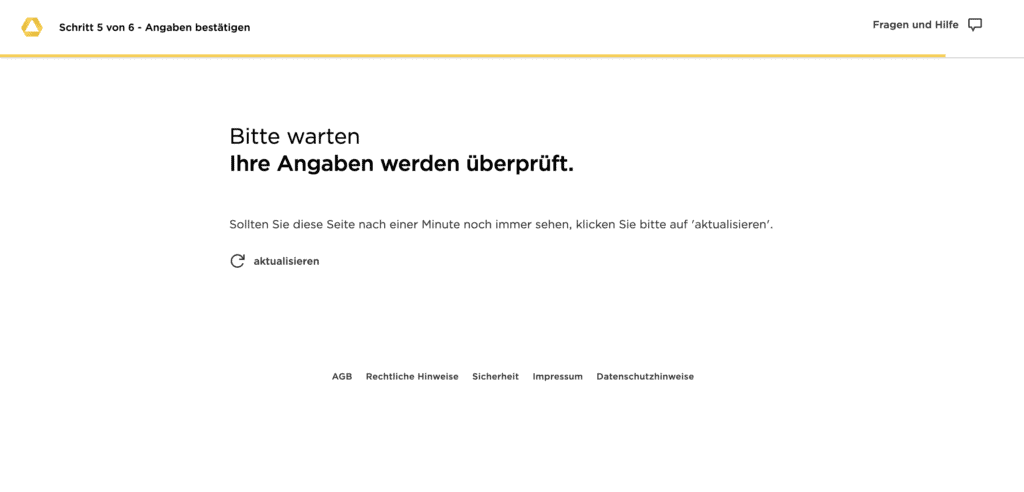

You need to wait a few seconds for the form to be submitted.

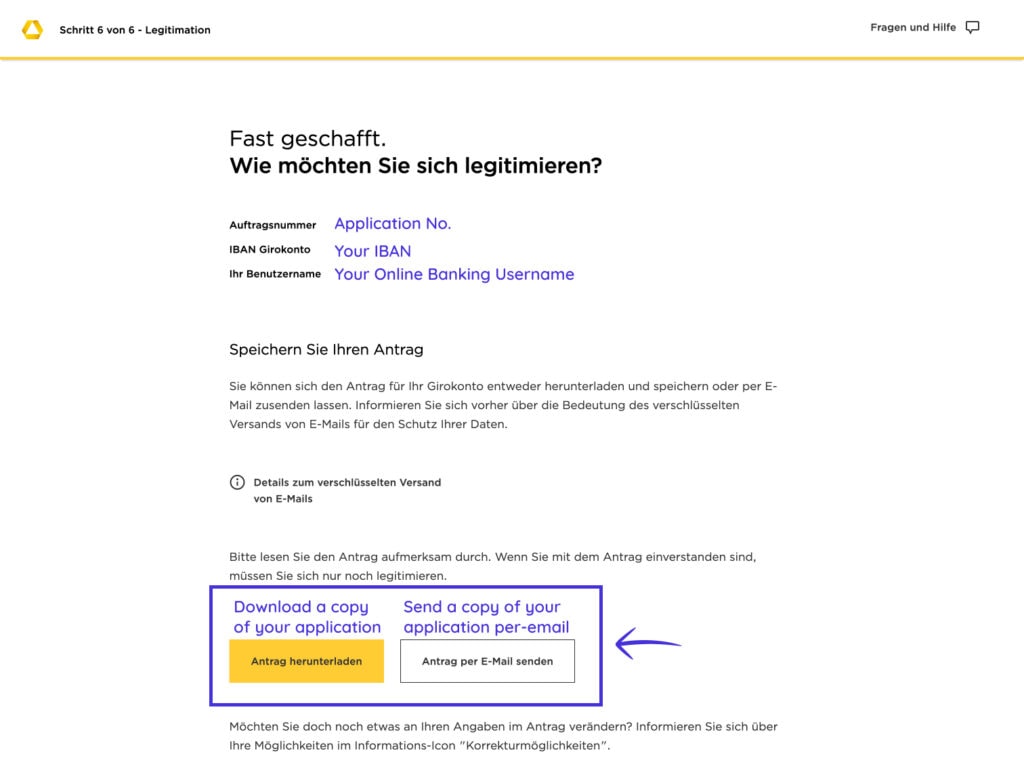

1.5 Get A Copy Of Your Application

The last screen of the online form shows your application number, IBAN, and online banking username. Make sure to download a copy of your application or to get it sent by e-mail.

2. Verify your identity

After completing the online form, you will have 90 days to verify your identity. If you are an EU or EEA citizen, you can choose to get verified through a service called videoIDENT. This service requires you to download an app on your phone and have a video call with an agent from videoIDENT. This agent will ask you several questions, including showing your ID. Due to legal reasons, the videoIDENT process is just available for EU or EEA citizens. Once the agent has verified your identity, they will forward the information to Commerzbank.

If you are a non-EU or non-EEA citizen, you can choose one of the other two ways to get verified:

- Post office: You can go through the verification process at any post office in Germany. You don’t need to make an appointment; you just need to wait for your turn and tell the clerk that you would like to get verified for Commerzbank. Keep in mind that this is the slowest way to get verified. The post office will gather your data and then send it to Commerzbank for them to confirm it again.

- Commerzbank branch office: This is the quickest way to get verified. You don’t need an appointment. You just need to wait in line at Commerzbank, and when your turn is up, tell the clerk that you would like to get your identity verified. The documents you will need to bring are:

- Your Meldebescheinigung

- Your passport or ID

- Your residence permit (in some cases): it seems there is no hard rule for this one. We have contacted Commerzbank with different nationalities and sometimes they say the residence permit is required, and sometimes they say it is not. So it’s up to you to try to open an account with Commerzbank before getting your residence permit.

After you have verified your identity, your account is officially activated.

Congratulations, you have a Commerzbank checking account in Germany! 🥳

At this point, you can share your IBAN with your employer to receive your salary or deposit money into your bank account by going to a clerk at a Commerzbank branch.

Just bear in mind that you won’t have access to online banking until you complete the next step.

3. Activate your online banking

After you have successfully verified your identity, Commerzbank will send out a letter with instructions on how to activate your online banking. This letter takes 3-4 business days to arrive at the address you provided in step 1.1.2.

To activate your online banking, you will need:

- The username and password you set up on step 1.2.1

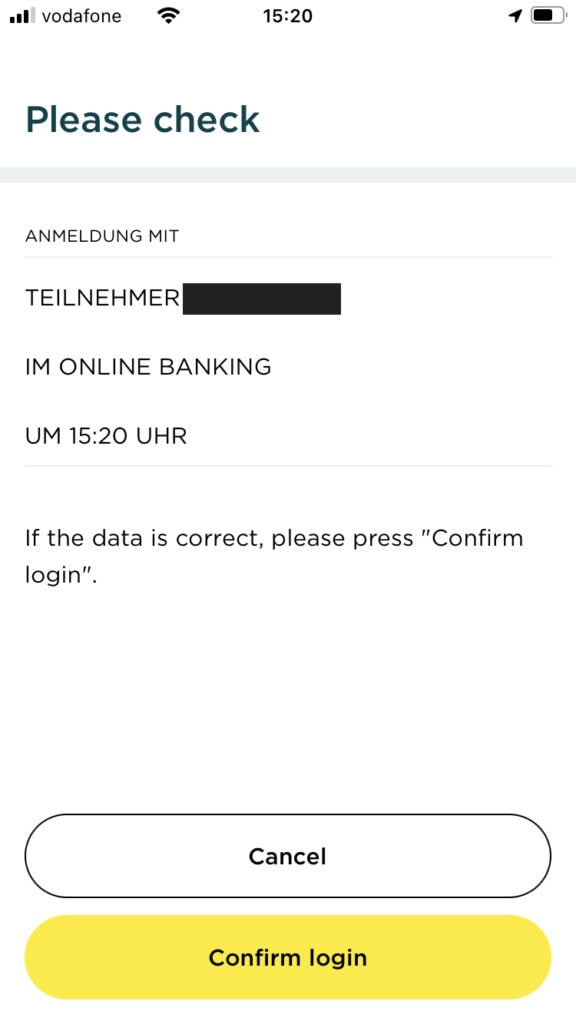

- Download the photoTAN app from either the Apple or Google Play store

The photoTAN process is a security feature Commerzbank has. Every time you want to log into your online banking account or pay for services online, you will be required to authorize the transaction on your phone. So make sure that you have enabled notifications for this app. The process is very hassle-free and adds a layer of security to your online banking.

Important Note

Only after you have successfully activated your online banking will you be able to check your account balance online and to make online transfers.

4. Get your girocard PIN number

The next letter you should be expecting in the mail is your girocard PIN. Remember to keep this number safe because you will need it to use your girocard to make cash withdrawals or pay services in person.

5. Get your girocard

The last letter you should receive is the one containing your girocard. Make sure to add your signature to the back of your card.

How to open a joint account

Commerzbank offers a joint account that you can open with your spouse, partner, or even a friend.

You fill out the online application with the data of both account holders. Both account holders will then receive an email with a link to a consent form you both need to sign. Afterwards, you must both identify yourself via Video-Ident or Post-Ident.

Contacting customer service

Commerzbank offers customer service in English. However, the way to reach it is a bit tricky. I contacted Commerzbank, and they have confirmed that they currently don’t have a direct line to support in English or their voice messages in English.

So the way to speak to an English agent is:

- Dial their general customer service phone number +49 69 580008000.

- You will hear a German voice recording asking you some questions. If you don’t understand a single word of what the recording says, try to answer ‘Nein’ to every question you hear. After some questions, you will hear the magical words “Ich verbinde Sie mit einem Mitarbeiter” (I will connect you to an agent).

- You will need to press 1 if you are okay for the call to be recorded or press 2 if you don’t want the call to be recorded.

- Once you have a customer service agent on the line, you can ask if they speak English. The majority of times I have called, the agent replied with a cheerful “Yes, how may I help you?”. However, if the agent does not feel comfortable speaking English, they will inform you in English that they will transfer you to a colleague who can better handle your inquiries.

With the Google translate feature mentioned in this guide, you can always go to Commerzbank’s help articles. You will find answers to general questions there.

Conclusion

Opening a bank account with a traditional German bank like Commerzbank is great if you are looking for a branch bank where you can talk to people in person or make cash deposits.

Although reaching customer service in English is sometimes a struggle, Commerzbank provides online banking and their apps in English, which ease the complications compared to other branch banks that are only available in German.

My wife has been a happy Commerzbank customer for years! She loves the trustworthiness of the bank and their great customer service.

Good luck with opening your bank account with Commerzbank! 🍀